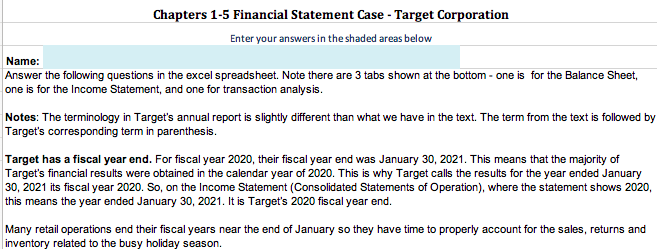

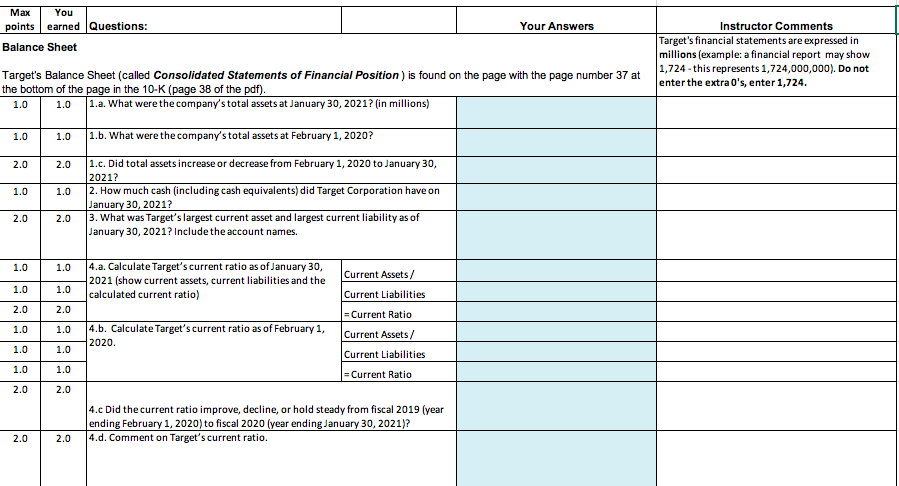

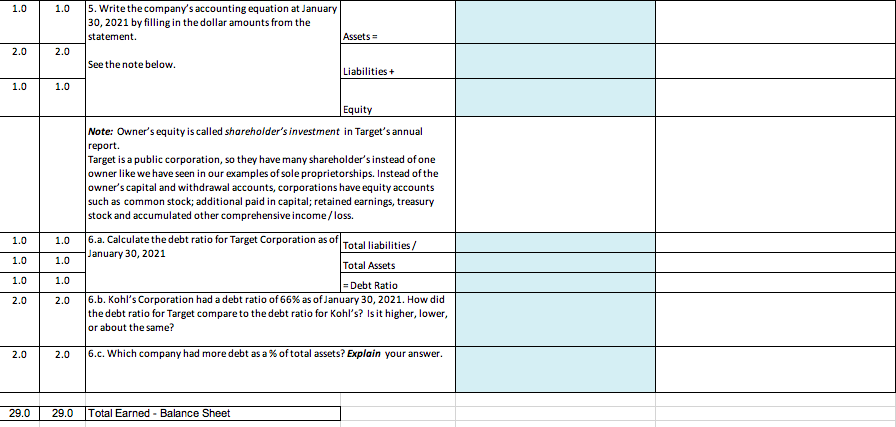

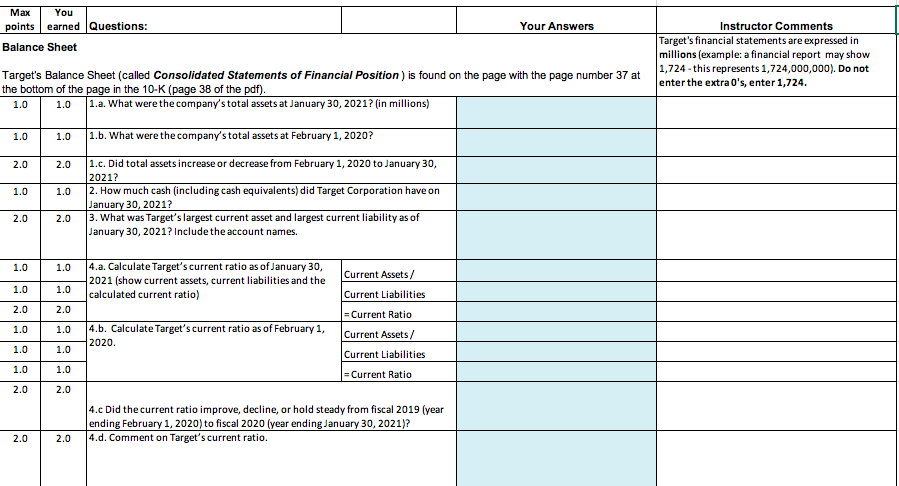

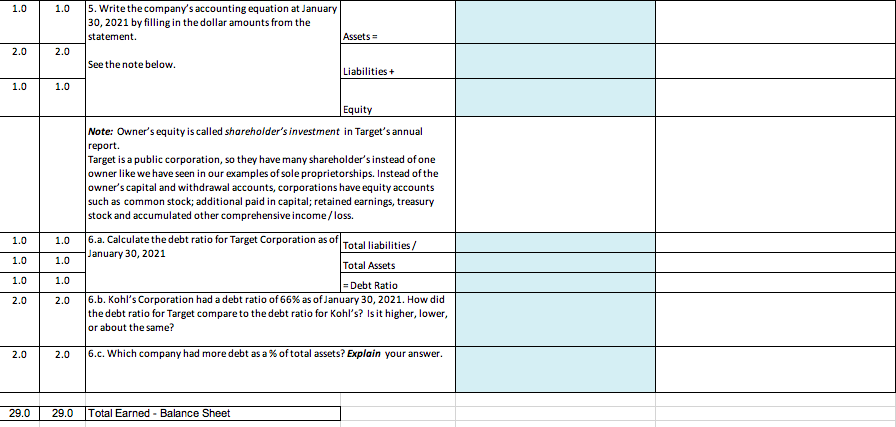

Chapters 1-5 Financial Statement Case - Target Corporation Enter your answers in the shaded areas below Name: Answer the following questions in the excel spreadsheet. Note there are 3 tabs shown at the bottom - one is for the Balance Sheet, one is for the Income Statement, and one for transaction analysis. Notes: The terminology in Target's annual report is slightly different than what we have in the text. The term from the text is followed by Target's corresponding term in parenthesis. Target has a fiscal year end. For fiscal year 2020, their fiscal year end was January 30, 2021. This means that the majority of Target's financial results were obtained in the calendar year of 2020. This is why Target calls the results for the year ended January 30, 2021 its fiscal year 2020. So, on the Income Statement (Consolidated Statements of Operation), where the statement shows 2020, this means the year ended January 30, 2021. It is Target's 2020 fiscal year end. Many retail operations end their fiscal years near the end of January so they have time to properly account for the sales, returns and inventory related to the busy holiday season. You Your Answers Max points earned Questions: Balance Sheet Instructor Comments Target's financial statements are expressed in millions (example: a financial report may show 1,724 - this represents 1,724,000,000). Do not enter the extra 0's, enter 1,724. Target's Balance Sheet (called Consolidated Statements of Financial Position) is found on the page with the page number 37 at the bottom of the page in the 10-K (page 38 of the pdf). 1.0 1.a. What were the company's total assets at January 30, 2021? (in millions) 1.0 1.0 1.0 1.b. What were the company's total assets at February 1, 2020? 2.0 2.0 1.0 1.0 1.c. Did total assets increase or decrease from February 1, 2020 to January 30, 2021? 2. How much cash (including cash equivalents) did Target Corporation have on January 30, 2021? 3. What was Target's largest current asset and largest current liability as of January 30, 2021? Include the account names. 2.0 2.0 1.0 1.0 14.a. Calculate Target's current ratio as of January 30, 2021 (show current assets, current liabilities and the calculated current ratio) 1.0 1.0 2.0 2.0 1.0 1.0 4.b. Calculate Target's current ratio as of February 1, 2020 Current Assets/ Current Liabilities = Current Ratio Current Assets/ Current Liabilities = Current Ratio 1.0 1.0 1.0 1.0 2.0 2.0 4. Did the current ratio improve, decline, or hold steady from fiscal 2019 (year ending February 1, 2020) to fiscal 2020 (year ending January 30, 2021)? 4.d. Comment on Target's current ratio. 2.0 2.0 1.0 1.0 5. Write the company's accounting equation at January 30, 2021 by filling in the dollar amounts from the statement. Assets = 2.0 2.0 See the note below. Liabilities + 1.0 1.0 Equity Note: Owner's equity is called shareholder's investment in Target's annual report. Target is a public corporation, so they have many shareholder's instead of one owner like we have seen in our examples of sole proprietorships. Instead of the owner's capital and withdrawal accounts, corporations have equity accounts such as common stock; additional paid in capital; retained earnings, treasury stock and accumulated other comprehensive income/loss. 6.a. Calculate the debt ratio for Target Corporation as of Total liabilities/ January 30, 2021 Total Assets = Debt Ratio 6.b. Kohl's Corporation had a debt ratio of 66% as of January 30, 2021. How did the debt ratio for Target compare to the debt ratio for Kohl's? Is it higher, lower, or about the same? 1.0 1.0 1.0 1.0 1.0 1.0 2.0 2.0 2.0 2.0 6.c. Which company had more debt as a % of total assets? Explain your answer. 29.0 29.0 Total Earned - Balance Sheet Chapters 1-5 Financial Statement Case - Target Corporation Enter your answers in the shaded areas below Name: Answer the following questions in the excel spreadsheet. Note there are 3 tabs shown at the bottom - one is for the Balance Sheet, one is for the Income Statement, and one for transaction analysis. Notes: The terminology in Target's annual report is slightly different than what we have in the text. The term from the text is followed by Target's corresponding term in parenthesis. Target has a fiscal year end. For fiscal year 2020, their fiscal year end was January 30, 2021. This means that the majority of Target's financial results were obtained in the calendar year of 2020. This is why Target calls the results for the year ended January 30, 2021 its fiscal year 2020. So, on the Income Statement (Consolidated Statements of Operation), where the statement shows 2020, this means the year ended January 30, 2021. It is Target's 2020 fiscal year end. Many retail operations end their fiscal years near the end of January so they have time to properly account for the sales, returns and inventory related to the busy holiday season. You Your Answers Max points earned Questions: Balance Sheet Instructor Comments Target's financial statements are expressed in millions (example: a financial report may show 1,724 - this represents 1,724,000,000). Do not enter the extra 0's, enter 1,724. Target's Balance Sheet (called Consolidated Statements of Financial Position) is found on the page with the page number 37 at the bottom of the page in the 10-K (page 38 of the pdf). 1.0 1.a. What were the company's total assets at January 30, 2021? (in millions) 1.0 1.0 1.0 1.b. What were the company's total assets at February 1, 2020? 2.0 2.0 1.0 1.0 1.c. Did total assets increase or decrease from February 1, 2020 to January 30, 2021? 2. How much cash (including cash equivalents) did Target Corporation have on January 30, 2021? 3. What was Target's largest current asset and largest current liability as of January 30, 2021? Include the account names. 2.0 2.0 1.0 1.0 14.a. Calculate Target's current ratio as of January 30, 2021 (show current assets, current liabilities and the calculated current ratio) 1.0 1.0 2.0 2.0 1.0 1.0 4.b. Calculate Target's current ratio as of February 1, 2020 Current Assets/ Current Liabilities = Current Ratio Current Assets/ Current Liabilities = Current Ratio 1.0 1.0 1.0 1.0 2.0 2.0 4. Did the current ratio improve, decline, or hold steady from fiscal 2019 (year ending February 1, 2020) to fiscal 2020 (year ending January 30, 2021)? 4.d. Comment on Target's current ratio. 2.0 2.0 1.0 1.0 5. Write the company's accounting equation at January 30, 2021 by filling in the dollar amounts from the statement. Assets = 2.0 2.0 See the note below. Liabilities + 1.0 1.0 Equity Note: Owner's equity is called shareholder's investment in Target's annual report. Target is a public corporation, so they have many shareholder's instead of one owner like we have seen in our examples of sole proprietorships. Instead of the owner's capital and withdrawal accounts, corporations have equity accounts such as common stock; additional paid in capital; retained earnings, treasury stock and accumulated other comprehensive income/loss. 6.a. Calculate the debt ratio for Target Corporation as of Total liabilities/ January 30, 2021 Total Assets = Debt Ratio 6.b. Kohl's Corporation had a debt ratio of 66% as of January 30, 2021. How did the debt ratio for Target compare to the debt ratio for Kohl's? Is it higher, lower, or about the same? 1.0 1.0 1.0 1.0 1.0 1.0 2.0 2.0 2.0 2.0 6.c. Which company had more debt as a % of total assets? Explain your answer. 29.0 29.0 Total Earned - Balance Sheet