Answered step by step

Verified Expert Solution

Question

1 Approved Answer

In 2020, X Corporation contributed 100 shares of Y corporation stock to a qualified charity. The FMV of the stock was $100,000 and adjusted

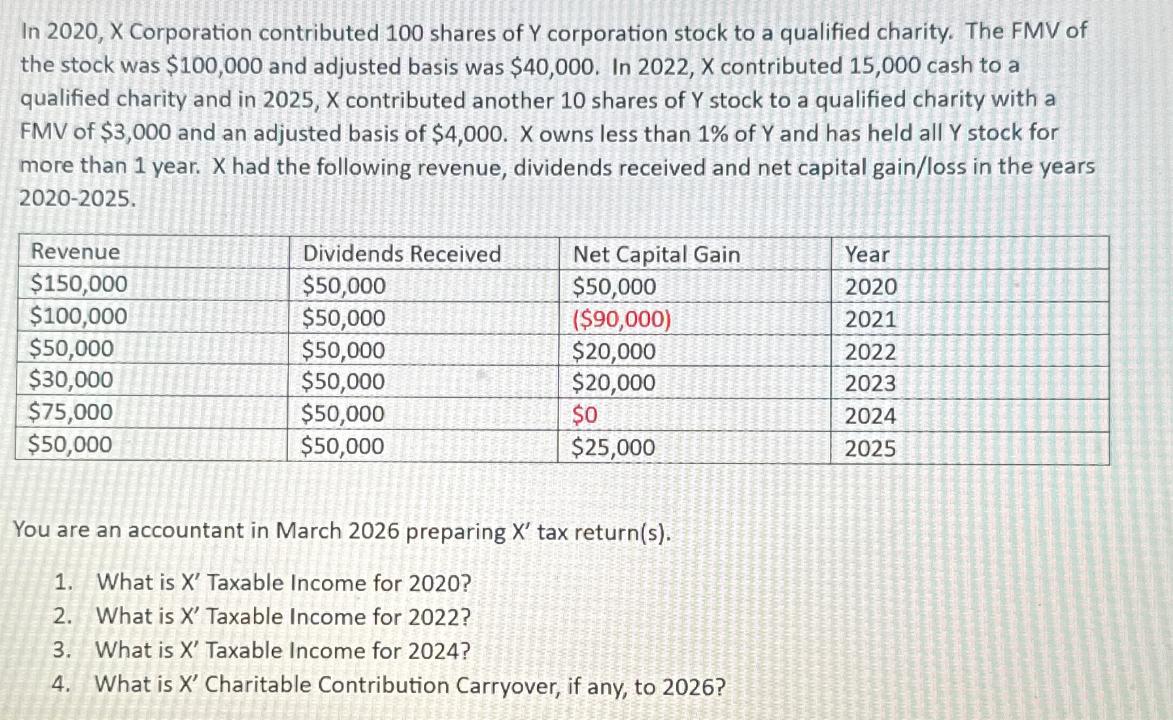

In 2020, X Corporation contributed 100 shares of Y corporation stock to a qualified charity. The FMV of the stock was $100,000 and adjusted basis was $40,000. In 2022, X contributed 15,000 cash to a qualified charity and in 2025, X contributed another 10 shares of Y stock to a qualified charity with a FMV of $3,000 and an adjusted basis of $4,000. X owns less than 1% of Y and has held all Y stock for more than 1 year. X had the following revenue, dividends received and net capital gain/loss in the years 2020-2025. Revenue Dividends Received Net Capital Gain Year $150,000 $50,000 $50,000 2020 $100,000 $50,000 ($90,000) 2021 $50,000 $50,000 $20,000 2022 $30,000 $50,000 $20,000 2023 $75,000 $50,000 $0 2024 $50,000 $50,000 $25,000 2025 You are an accountant in March 2026 preparing X' tax return(s). 1. What is X' Taxable Income for 2020? 2. What is X' Taxable Income for 2022? 3. What is X' Taxable Income for 2024? 4. What is X' Charitable Contribution Carryover, if any, to 2026?

Step by Step Solution

There are 3 Steps involved in it

Step: 1

Answer X Corporations Taxable Income and Charitable Deductions Heres a breakdown of X Corporations t...

Get Instant Access to Expert-Tailored Solutions

See step-by-step solutions with expert insights and AI powered tools for academic success

Step: 2

Step: 3

Ace Your Homework with AI

Get the answers you need in no time with our AI-driven, step-by-step assistance

Get Started