Answered step by step

Verified Expert Solution

Question

1 Approved Answer

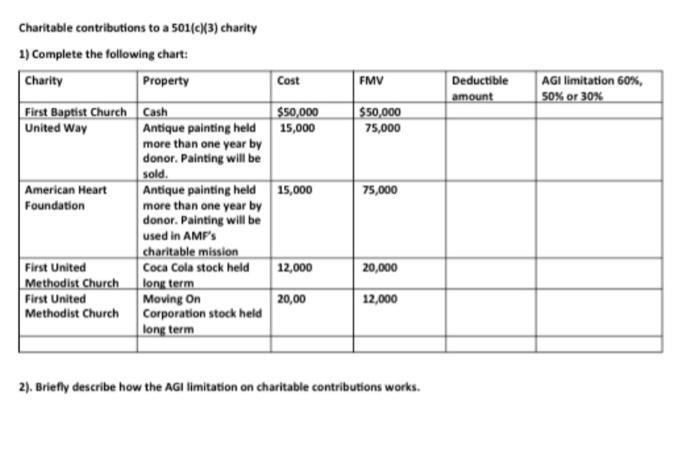

Charitable contributions to a 501(c)(3) charity 1) Complete the following chart: Charity Property First Baptist Church United Way American Heart Foundation First United Methodist

Charitable contributions to a 501(c)(3) charity 1) Complete the following chart: Charity Property First Baptist Church United Way American Heart Foundation First United Methodist Church First United Methodist Church Cash Antique painting held more than one year by donor. Painting will be sold. Antique painting held 15,000 more than one year by donor. Painting will be used in AMF's charitable mission Coca Cola stock held long term Cost $50,000 15,000 Moving On Corporation stock held long term 12,000 20,00 FMV $50,000 75,000 75,000 20,000 12,000 2). Briefly describe how the AGI limitation on charitable contributions works. Deductible amount AGI limitation 60%, 50% or 30% Charitable contributions to a 501(c)(3) charity 1) Complete the following chart: Charity Property First Baptist Church United Way American Heart Foundation First United Methodist Church First United Methodist Church Cash Antique painting held more than one year by donor. Painting will be sold. Antique painting held 15,000 more than one year by donor. Painting will be used in AMF's charitable mission Coca Cola stock held long term Cost $50,000 15,000 Moving On Corporation stock held long term 12,000 20,00 FMV $50,000 75,000 75,000 20,000 12,000 2). Briefly describe how the AGI limitation on charitable contributions works. Deductible amount AGI limitation 60%, 50% or 30%

Step by Step Solution

★★★★★

3.46 Rating (156 Votes )

There are 3 Steps involved in it

Step: 1

1 The Complete table is Charity Property Cost FMV Deductable amount AGI limitations 60 50 or 30 First Baptist Church Cash 50000 50000 50000 50 United way Antique painting held more than one year by do...

Get Instant Access to Expert-Tailored Solutions

See step-by-step solutions with expert insights and AI powered tools for academic success

Step: 2

Step: 3

Ace Your Homework with AI

Get the answers you need in no time with our AI-driven, step-by-step assistance

Get Started