Answered step by step

Verified Expert Solution

Question

1 Approved Answer

Charles and Heather are married and will file a joint return. Heather is a U.S. citizen with a valid Social Security number. Charles is

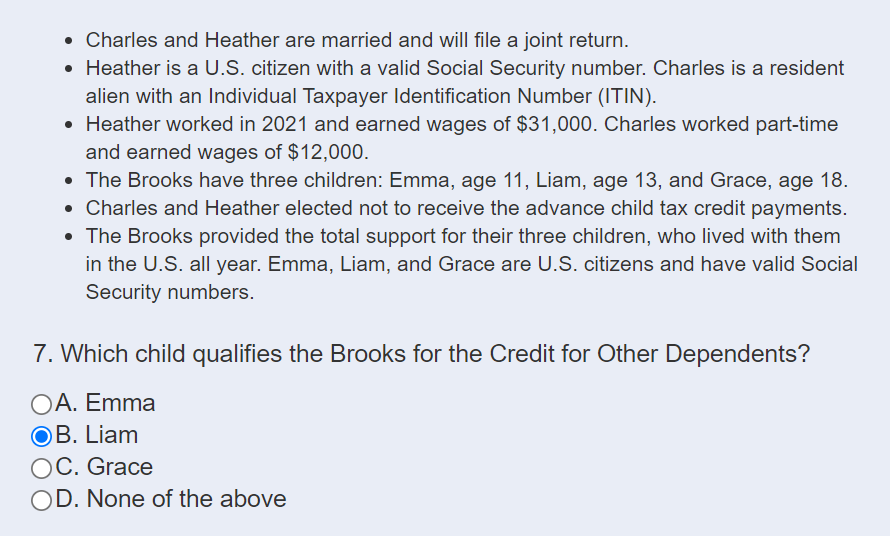

Charles and Heather are married and will file a joint return. Heather is a U.S. citizen with a valid Social Security number. Charles is a resident alien with an Individual Taxpayer Identification Number (ITIN). Heather worked in 2021 and earned wages of $31,000. Charles worked part-time and earned wages of $12,000. The Brooks have three children: Emma, age 11, Liam, age 13, and Grace, age 18. Charles and Heather elected not to receive the advance child tax credit payments. The Brooks provided the total support for their three children, who lived with them in the U.S. all year. Emma, Liam, and Grace are U.S. citizens and have valid Social Security numbers. 7. Which child qualifies the Brooks for the Credit for Other Dependents? OA. Emma OB. Liam OC. Grace OD. None of the above

Step by Step Solution

★★★★★

3.37 Rating (153 Votes )

There are 3 Steps involved in it

Step: 1

CGrace option c is correct Explanation Taxpayers with dependents ...

Get Instant Access to Expert-Tailored Solutions

See step-by-step solutions with expert insights and AI powered tools for academic success

Step: 2

Step: 3

Ace Your Homework with AI

Get the answers you need in no time with our AI-driven, step-by-step assistance

Get Started