Answered step by step

Verified Expert Solution

Question

1 Approved Answer

Charles Harley seeks your advice for the 2017/18 income year in respect of the transactions below: Investment Property Family residence Jewellery Oil Painting Sailing

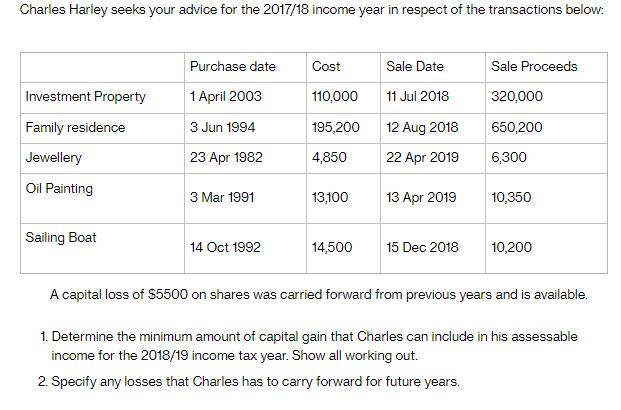

Charles Harley seeks your advice for the 2017/18 income year in respect of the transactions below: Investment Property Family residence Jewellery Oil Painting Sailing Boat Purchase date 1 April 2003 3 Jun 1994 23 Apr 1982 3 Mar 1991 14 Oct 1992 Cost 110,000 195,200 4,850 13,100 14,500 Sale Date 11 Jul 2018 12 Aug 2018 22 Apr 2019 13 Apr 2019 15 Dec 2018 Sale Proceeds 320,000 650,200 6,300 10,350 10,200 A capital loss of $5500 on shares was carried forward from previous years and is available. 1. Determine the minimum amount of capital gain that Charles can include in his assessable income for the 2018/19 income tax year. Show all working out. 2. Specify any losses that Charles has to carry forward for future years.

Step by Step Solution

★★★★★

3.42 Rating (177 Votes )

There are 3 Steps involved in it

Step: 1

1 Capital GainsLosses Calculation Investment Property Purchase Date 1 April 2003 Cost 110000 Sale Da...

Get Instant Access to Expert-Tailored Solutions

See step-by-step solutions with expert insights and AI powered tools for academic success

Step: 2

Step: 3

Ace Your Homework with AI

Get the answers you need in no time with our AI-driven, step-by-step assistance

Get Started