Question

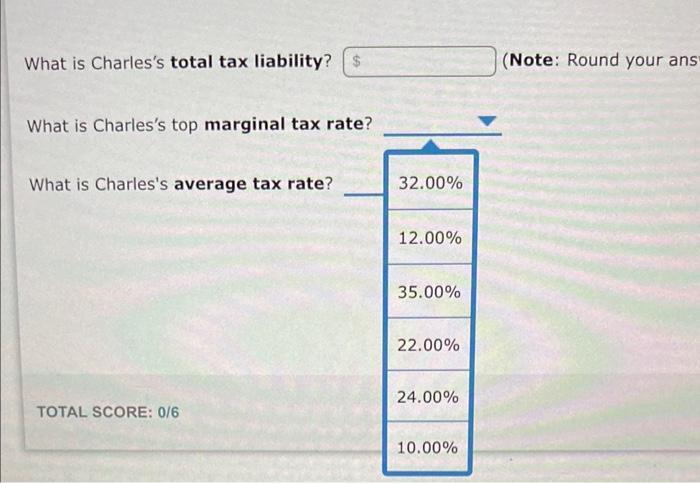

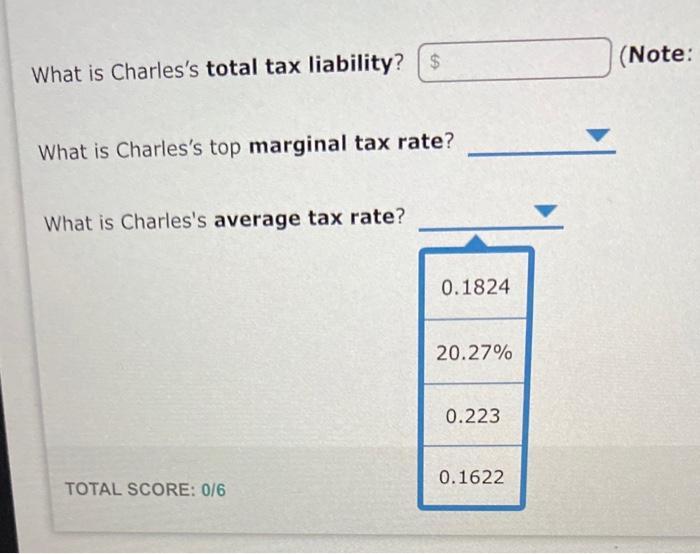

Charles is a young professional with a taxable income of $153,000 as an advertising account executive. What is Charless total tax liability?(Note: Round your answer

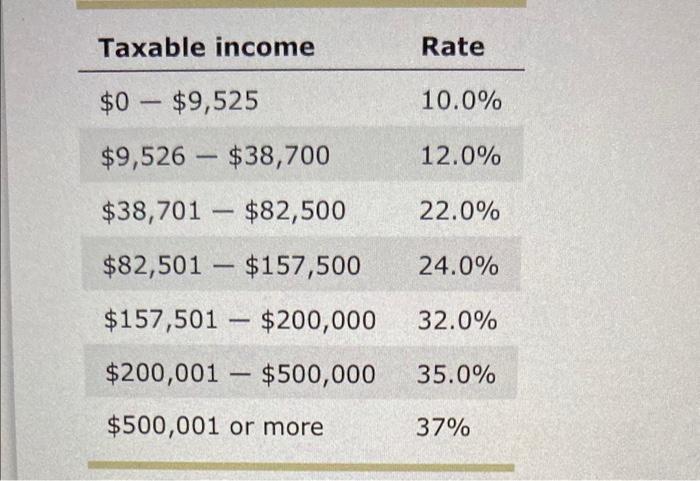

Taxable income $0 $9,525 - $9,526 $38,700 $38,701 $82,500 $82,501 $157,500 $157,501 $200,000 $200,001 $500,000 $500,001 or more 1 - - - - Rate 10.0% 12.0% 22.0% 24.0% 32.0% 35.0% 37%

Step by Step Solution

3.37 Rating (156 Votes )

There are 3 Steps involved in it

Step: 1

General Guidance The answer provided below has been developed in a clear step by step manner St...

Get Instant Access to Expert-Tailored Solutions

See step-by-step solutions with expert insights and AI powered tools for academic success

Step: 2

Step: 3

Ace Your Homework with AI

Get the answers you need in no time with our AI-driven, step-by-step assistance

Get StartedRecommended Textbook for

Financial Accounting

Authors: Walter Harrison, Charles Horngren, William Thomas, Wendy Tietz

11th edition

978-0134065830, 134065832, 134127625, 978-0134127620

Students also viewed these Accounting questions

Question

Answered: 1 week ago

Question

Answered: 1 week ago

Question

Answered: 1 week ago

Question

Answered: 1 week ago

Question

Answered: 1 week ago

Question

Answered: 1 week ago

Question

Answered: 1 week ago

Question

Answered: 1 week ago

Question

Answered: 1 week ago

Question

Answered: 1 week ago

Question

Answered: 1 week ago

Question

Answered: 1 week ago

Question

Answered: 1 week ago

Question

Answered: 1 week ago

Question

Answered: 1 week ago

Question

Answered: 1 week ago

Question

Answered: 1 week ago

Question

Answered: 1 week ago

Question

Answered: 1 week ago

Question

Answered: 1 week ago

Question

Answered: 1 week ago

Question

Answered: 1 week ago

View Answer in SolutionInn App