Answered step by step

Verified Expert Solution

Question

1 Approved Answer

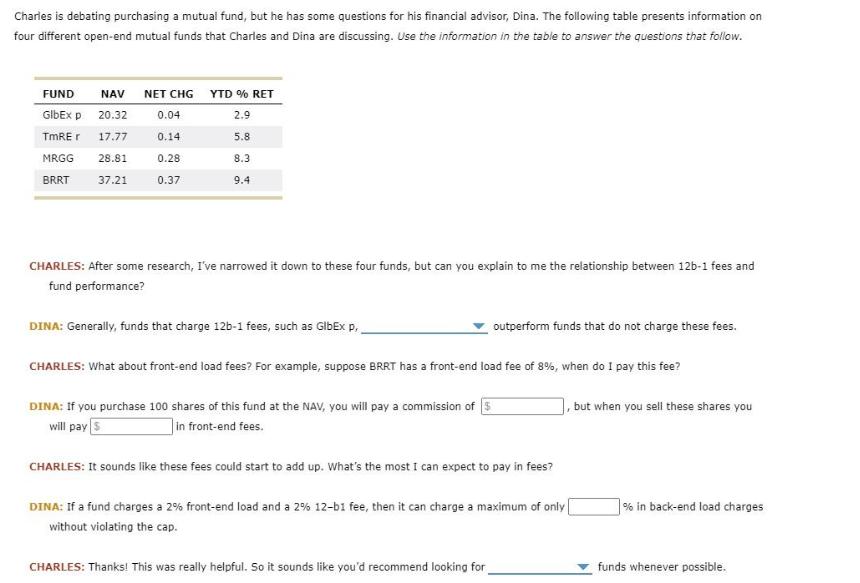

Charles is debating purchasing a mutual fund, but he has some questions for his financial advisor, Dina. The following table presents information on four

Charles is debating purchasing a mutual fund, but he has some questions for his financial advisor, Dina. The following table presents information on four different open-end mutual funds that Charles and Dina are discussing. Use the information in the table to answer the questions that follow. FUND GlbEx p TMRE r NAV NET CHG YTD % RET 20.32 2.9 17.77 5.8 8.3 9.4 MRGG 28.81 BRRT 37.21 0.04 0.14 0.28 0.37 CHARLES: After some research, I've narrowed it down to these four funds, but can you explain to me the relationship between 12b-1 fees and fund performance? DINA: Generally, funds that charge 12b-1 fees, such as GlbEx p,, outperform funds that do not charge these fees. CHARLES: What about front-end load fees? For example, suppose BRRT has a front-end load fee of 8%, when do I pay this fee? DINA: If you purchase 100 shares of this fund at the NAV, you will pay a commission of S will pay S in front-end fees. CHARLES: It sounds like these fees could start to add up. What's the most I can expect to pay in fees? DINA: If a fund charges a 2% front-end load and a 2% 12-b1 fee, then it can charge a maximum of only without violating the cap. CHARLES: Thanks! This was really helpful. So it sounds like you'd recommend looking for but when you sell these shares you % in back-end load charges funds whenever possible.

Step by Step Solution

★★★★★

3.57 Rating (154 Votes )

There are 3 Steps involved in it

Step: 1

1 Relationship between 12b1 Fees and Fund Performance DINA Generally funds that charge 12b1 fees such as GlbEx p outperform funds that do not charge these fees Explanation The statement implies that f...

Get Instant Access to Expert-Tailored Solutions

See step-by-step solutions with expert insights and AI powered tools for academic success

Step: 2

Step: 3

Ace Your Homework with AI

Get the answers you need in no time with our AI-driven, step-by-step assistance

Get Started