Question

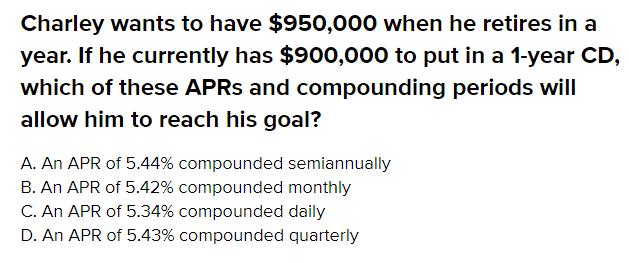

Charley wants to have $950,000 when he retires in a year. If he currently has $900,000 to put in a 1-year CD, which of

Charley wants to have $950,000 when he retires in a year. If he currently has $900,000 to put in a 1-year CD, which of these APRS and compounding periods will allow him to reach his goal? A. An APR of 5.44% compounded semiannually B. An APR of 5.42% compounded monthly C. An APR of 5.34% compounded daily D. An APR of 5.43% compounded quarterly Charley wants to have $950,000 when he retires in a year. If he currently has $900,000 to put in a 1-year CD, which of these APRS and compounding periods will allow him to reach his goal? A. An APR of 5.44% compounded semiannually B. An APR of 5.42% compounded monthly C. An APR of 5.34% compounded daily D. An APR of 5.43% compounded quarterly

Step by Step Solution

3.41 Rating (164 Votes )

There are 3 Steps involved in it

Step: 1

To determine which APR and compounding period will allow Charley to reach his retirement goal of 950...

Get Instant Access to Expert-Tailored Solutions

See step-by-step solutions with expert insights and AI powered tools for academic success

Step: 2

Step: 3

Ace Your Homework with AI

Get the answers you need in no time with our AI-driven, step-by-step assistance

Get StartedRecommended Textbook for

Human Resource Management

Authors: Derek Torrington, Laura Hall, Stephen Taylor, Carol Atkinson

11th Edition

1292261641, 978-1292261645

Students also viewed these Finance questions

Question

Answered: 1 week ago

Question

Answered: 1 week ago

Question

Answered: 1 week ago

Question

Answered: 1 week ago

Question

Answered: 1 week ago

Question

Answered: 1 week ago

Question

Answered: 1 week ago

Question

Answered: 1 week ago

Question

Answered: 1 week ago

Question

Answered: 1 week ago

Question

Answered: 1 week ago

Question

Answered: 1 week ago

Question

Answered: 1 week ago

Question

Answered: 1 week ago

Question

Answered: 1 week ago

Question

Answered: 1 week ago

Question

Answered: 1 week ago

Question

Answered: 1 week ago

Question

Answered: 1 week ago

Question

Answered: 1 week ago

Question

Answered: 1 week ago

View Answer in SolutionInn App