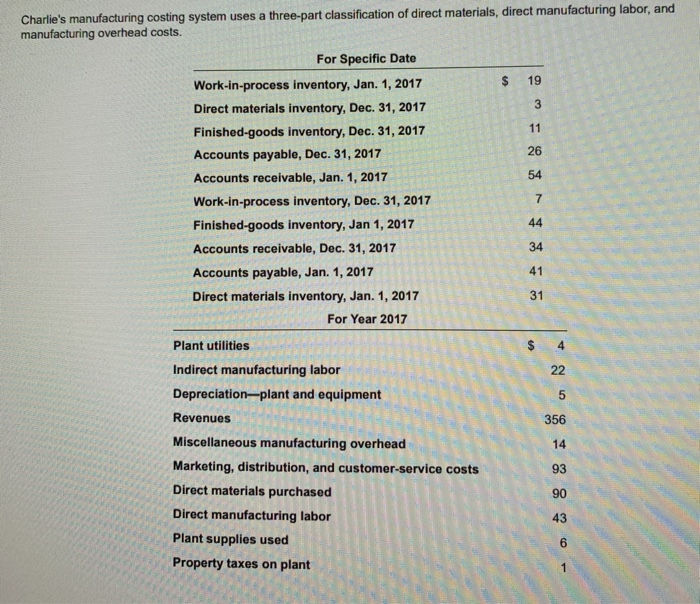

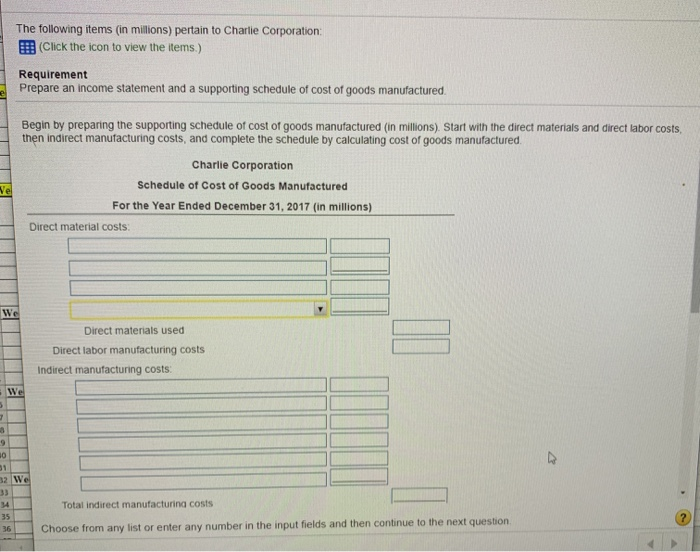

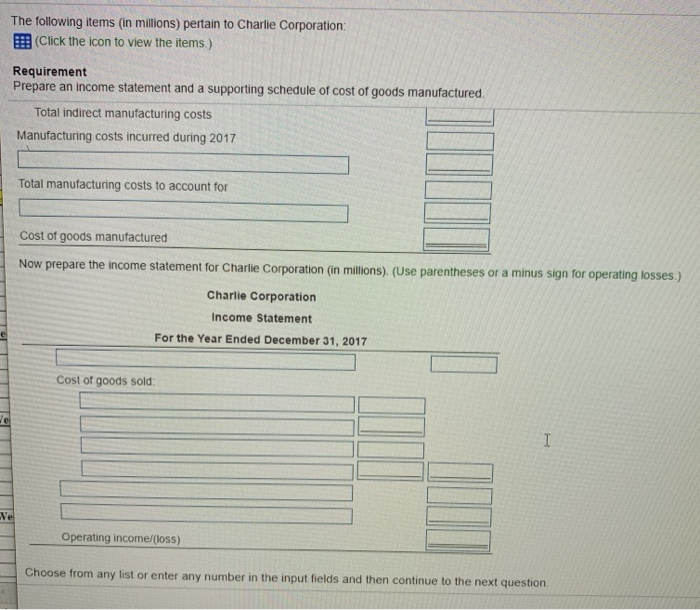

Charlie's manufacturing costing system uses a three-part classification of direct materials, direct manufacturing labor, and manufacturing overhead costs. $ 19 3 11 26 54 For Specific Date Work-in-process inventory, Jan. 1, 2017 Direct materials inventory, Dec. 31, 2017 Finished-goods inventory, Dec. 31, 2017 Accounts payable, Dec. 31, 2017 Accounts receivable, Jan. 1, 2017 Work-in-process inventory, Dec. 31, 2017 Finished-goods inventory, Jan 1, 2017 Accounts receivable, Dec. 31, 2017 Accounts payable, Jan. 1, 2017 Direct materials inventory, Jan. 1, 2017 For Year 2017 7 44 34 41 31 $ 4 Plant utilities Indirect manufacturing labor Depreciation-plant and equipment 22 5 Revenues 356 14 93 90 Miscellaneous manufacturing overhead Marketing, distribution, and customer-service costs Direct materials purchased Direct manufacturing labor Plant supplies used Property taxes on plant 43 6 The following items (in millions) pertain to Charlie Corporation: (Click the icon to view the items.) Requirement Prepare an income statement and a supporting schedule of cost of goods manufactured Begin by preparing the supporting schedule of cost of goods manufactured (in millions). Start with the direct materials and direct labor costs, then indirect manufacturing costs, and complete the schedule by calculating cost of goods manufactured. Charlie Corporation Schedule of Cost of Goods Manufactured For the Year Ended December 31, 2017 (in millions) Direct material costs Ve We Direct materials used Direct labor manufacturing costs Indirect manufacturing costs: We 5 20 32 We Total indirect manufacturing costs 34 35 36 Choose from any list or enter any number in the input fields and then continue to the next question The following items in millions) pertain to Charlie Corporation: (Click the icon to view the items) Requirement Prepare an income statement and a supporting schedule of cost of goods manufactured Total indirect manufacturing costs Manufacturing costs incurred during 2017 Total manufacturing costs to account for Cost of goods manufactured Now prepare the income statement for Charlie Corporation (in Millions). (Use parentheses or a minus sign for operating losses.) Charlie Corporation Income Statement For the Year Ended December 31, 2017 Cost of goods sold le I Ne Operating income/(loss) Choose from any list or enter any number in the input fields and then continue to the next