Question

Charlotte Read is a portfolio manager for an Asset Management Company and she has to deal with two clients, John Murat and Rebecca Davis, both

Charlotte Read is a portfolio manager for an Asset Management Company and she has to deal with two clients, John Murat and Rebecca Davis, both wanting to review their investment objectives. Currently, John and Rebecca hold a well-diversified portfolio of risky assets. However,

a. John Murat wants a higher expected return for his portfolio. In the context of the Capital Market Line, what Charlotte Read should do to achieve the John Murat's objective?

b. Rebecca Davis wants a lower risk exposure for her portfolio, without engaging in further borrowing or lending to do so. What Charlotte Read should do to achieve the Rebecca Davis's objective?

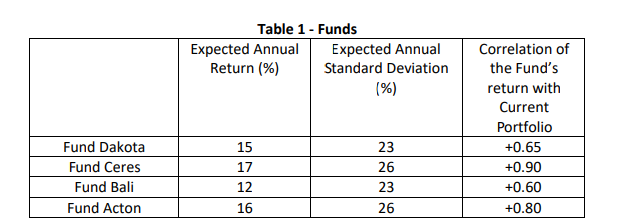

c. Charlotte Read is also responsible for managing the $3 million portfolio of another client: Gray Norton. Short-term bonds, small stocks and large stocks compose this portfolio. The annual expected return of the portfolio is 14% and the annual standard deviation is 24%. Gray Norton tells Charlotte Read that he would like to invest an additional $1 million in an index fund that best complements his current portfolio in terms of expected returns and volatility. Which of the four Funds, illustrated in Table 1, should Charlotte recommend to Gray as the investment that combined with the current portfolio of assets will be able to provide a portfolio with higher expected return and lower risk? Explain your answer fully

d. What should it be the correlation coefficient between the return of the recommended Fund (in c) and the Current portfolio of Gray Norton if Gray, instead, requires Charlotte to construct a risk-free portfolio with them? Find the weights of this riskfree portfolio and show the formula you use to find those weights

Table 1 - Funds Expected Annual Return (%) Expected Annual Standard Deviation (%) Correlation of the Fund's return with Current Portfolio Fund Dakota 15 23 +0.65 Fund Ceres 17 26 +0.90 Fund Bali 12 23 +0.60 Fund Acton 16 26 +0.80

Step by Step Solution

3.43 Rating (153 Votes )

There are 3 Steps involved in it

Step: 1

a To achieve John Murats objective of a higher expected return for his portfolio within the context of the Capital Market Line CML Charlotte Read shou...

Get Instant Access to Expert-Tailored Solutions

See step-by-step solutions with expert insights and AI powered tools for academic success

Step: 2

Step: 3

Ace Your Homework with AI

Get the answers you need in no time with our AI-driven, step-by-step assistance

Get Started