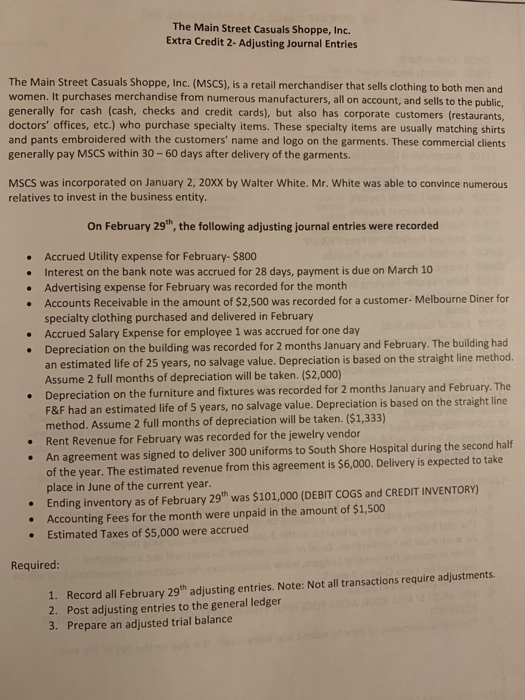

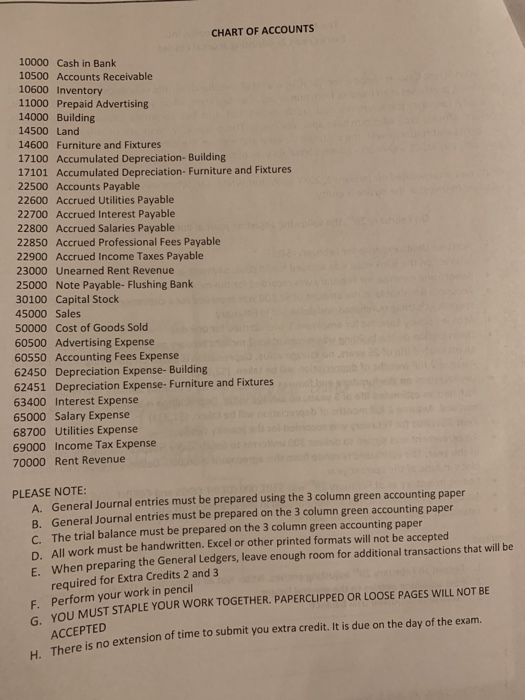

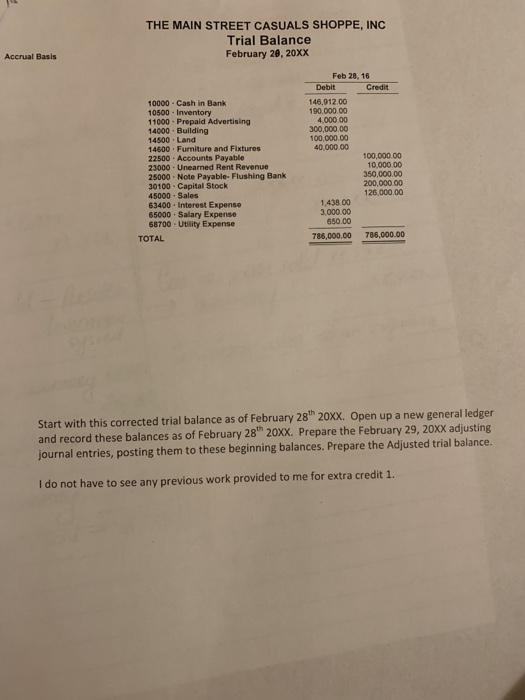

CHART OF ACCOUNTS 10000 Cash in Bank 10500 Accounts Receivable 10600 Inventory 11000 Prepaid Advertising 14000 Building 14500 Land 14600 Furniture and Fixtures 17100 Accumulated Depreciation- Building 17101 Accumulated Depreciation Furniture and Fixtures 22500 Accounts Payable 22600 Accrued Utilities Payable 22700 Accrued Interest Payable 22800 Accrued Salaries Payable 22850 Accrued Professional Fees Payable 22900 Accrued Income Taxes Payable 23000 Unearned Rent Revenue 25000 Note Payable- Flushing Bank 30100 Capital Stock 45000 Sales 50000 Cost of Goods Sold 60500 Advertising Expense 60550 Accounting Fees Expense 62450 Depreciation Expense-Building 62451 Depreciation Expense- Furniture and Fixtures 63400 Interest Expense 65000 Salary Expense 68700 Utilities Expense 69000 Income Tax Expense 70000 Rent Revenue PLEASE NOTE: A. General Journal entries must be prepared using the 3 column green accounting paper B. General Journal entries must be prepared on the 3 column green accounting paper C. The trial balance must be prepared on the 3 column green accounting paper D. All work must be handwritten. Excel or other printed formats will not be accepted E. When preparing the General Ledgers, leave enough room for additional transactions that will be required for Extra Credits 2 and 3 F. Perform your work in pencil G. YOU U MUST STAPLE YOUR WORTOGETHER. PAPERCLIPPED OR LOOSE PAGES WILL NOT BE tension of time to submit you extra credit. It is due on the day of the exam. ACCEPTED THE MAIN STREET CASUALS SHOPPE, INC Trial Balance February 20, 20xX 0 Accrual Basis Feb 28, 16 Debit Credit 10000 Cash in Bank 10500- Inventory 11000 Prepaid Advertising 14000 Building 14500 Land 14600 Furniture and Fixtures 22500 Accounts Payable 23000 Unearned Rent Revenue 146,912.00 190,000.00 4,000.00 300,000.00 100,000.00 40,000.00 100,000.00 10,000.00 350,000.00 200,000.00 126,000.00 25000 Note Payable- Flushing Bank 30100 Capital Stock 45000 Sales 63400 Interest Expense 65000 Salary Expense 68700 Utility Expense 1-438 00 126.000 3,000.00 650.00 TOTAL 786,000.00 786,000.00 Start with this corrected trial balance as of February 28th 20xx. Open up a new general ledger and record these balances as of February 28h 20Xx. Prepare the February 29, 20XX adjusting journal entries, posting them to these beginning balances. Prepare the Adjusted trial balance. I do not have to see any previous work provided to me for extra credit 1