Answered step by step

Verified Expert Solution

Question

1 Approved Answer

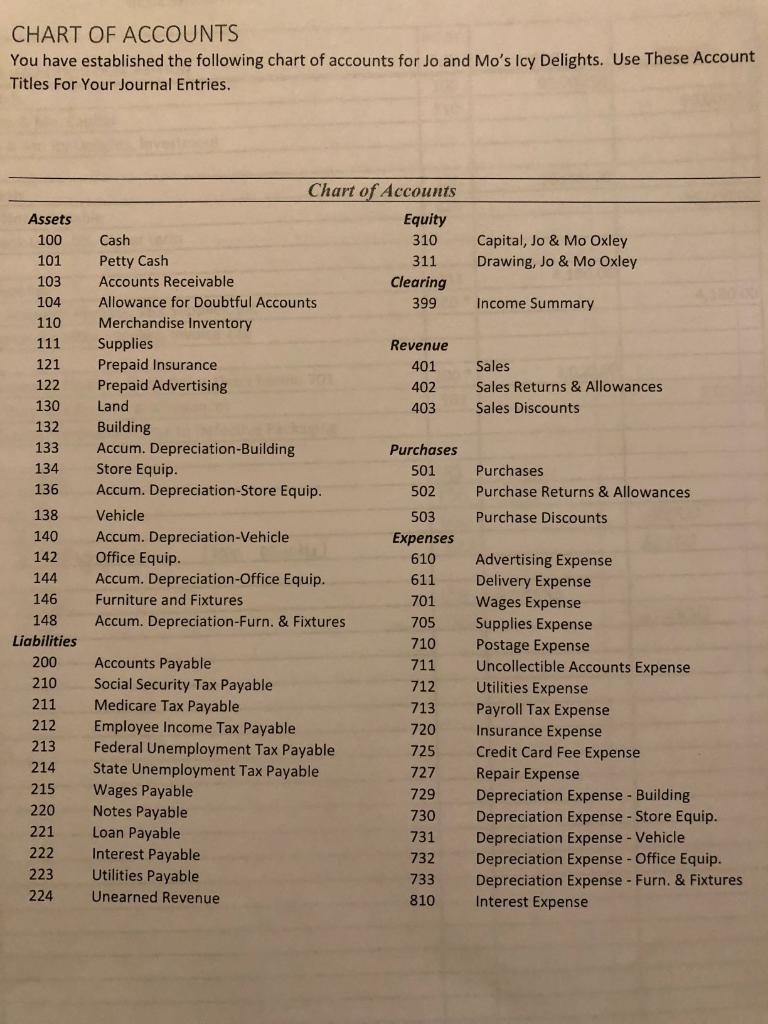

Each transaction needs to be placed in a Journal (General, Cash Payments, Cash Receipts, Purchases, or Sales). After recording transactions in the proper journal, the

Each transaction needs to be placed in a Journal (General, Cash Payments, Cash Receipts, Purchases, or Sales). After recording transactions in the proper journal, the transactions also need to be recorded into ledgers (General ledger, Accounts receivable subsidiary ledger, or Accounts Payable subsidiary ledger).

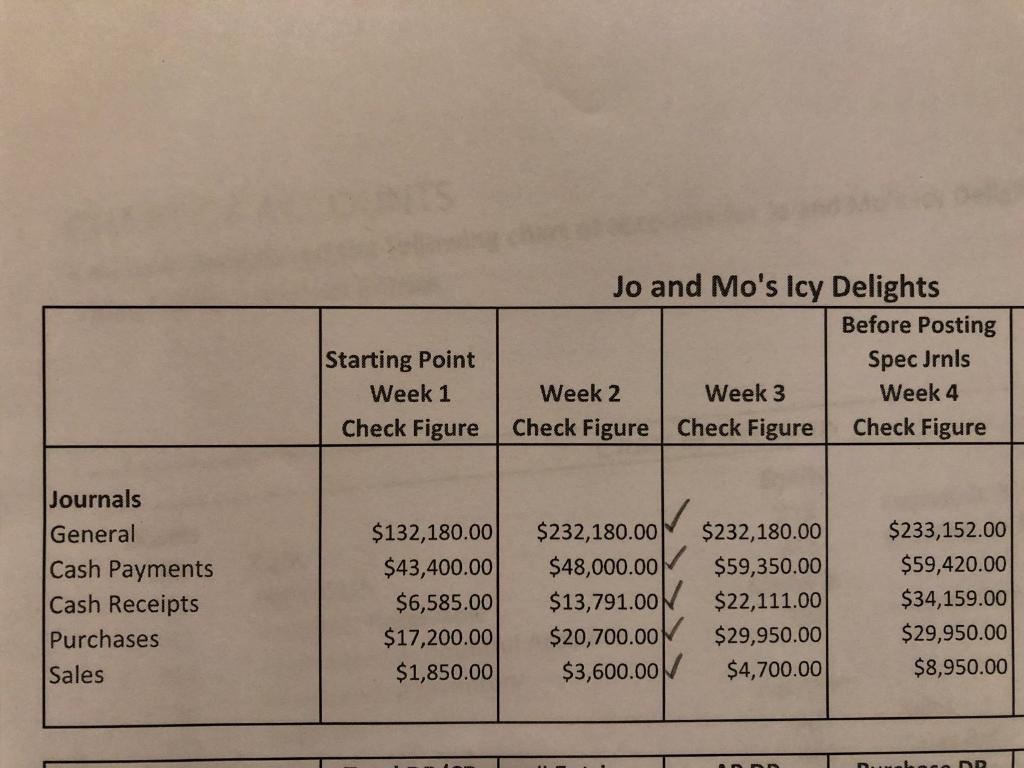

I have attached the check figures Week 4 to compare to end balances from Week 3.

Address each transaction in the order that the transactions are presented. Do not skip around.

- Read the transaction, entirely.

- Analyze the transaction (account, journal, etc.)

- Record the transaction/entry into the appropriate journal.

- Post entry into the General Ledger, where applicable.

- Post entry into the Subsidiary Ledger, where applicable.

- Move to the next transaction.

- After the final transaction, ensure that your numbers match the Check Figures (Instruction manual).

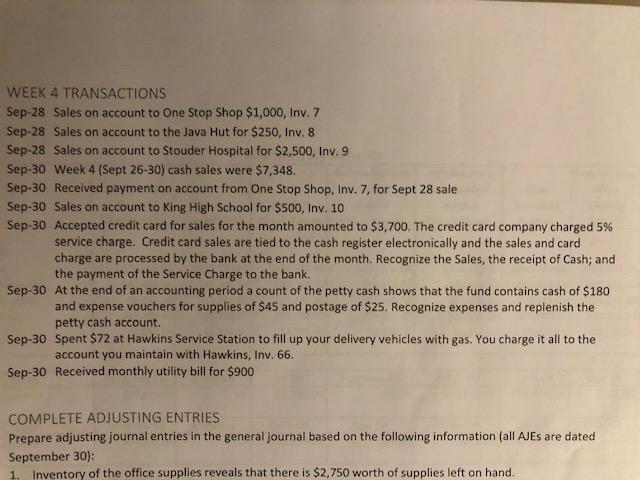

WEEK 4 TRANSACTIONS Sep-28 Sales on account to One Stop Shop $1,000, Inv. 7 Sep-28 Sales on account to the Java Hut for $250, Inv. 8 Sep-28 Sales on account to Stouder Hospital for $2,500, Inv. 9 Sep-30 Week 4 (Sept 26-30) cash sales were $7,348. Sep-30. Received payment on account from One Stop Shop, Inv. 7, for Sept 28 sale Sep-30 Sales on account to King High School for $500, Inv. 10 Sep-30 Accepted credit card for sales for the month amounted to $3,700. The credit card company charged 5% service charge. Credit card sales are tied to the cash register electronically and the sales and card charge are processed by the bank at the end of the month. Recognize the Sales, the receipt of Cash; and the payment of the Service Charge to the bank. Sep-30 At the end of an accounting period a count of the petty cash shows that the fund contains cash of $180 and expense vouchers for supplies of $45 and postage of $25. Recognize expenses and replenish the petty cash account. Sep-30 Spent $72 at Hawkins Service Station to fill up your delivery vehicles with gas. You charge it all to the account you maintain with Hawkins, Inv. 66. Sep-30 Received monthly utility bill for $900 COMPLETE ADJUSTING ENTRIES Prepare adjusting journal entries in the general journal based September 30): 1. Inventory of the office supplies reveals that there is $2,750 worth of supplies left on hand. the following information (all AJES are dated

Step by Step Solution

★★★★★

3.39 Rating (168 Votes )

There are 3 Steps involved in it

Step: 1

Jo Mos Icy Delights 1 Journal entries for the transaction of Week 3 of September Date Account Titles ...

Get Instant Access to Expert-Tailored Solutions

See step-by-step solutions with expert insights and AI powered tools for academic success

Step: 2

Step: 3

Ace Your Homework with AI

Get the answers you need in no time with our AI-driven, step-by-step assistance

Get Started