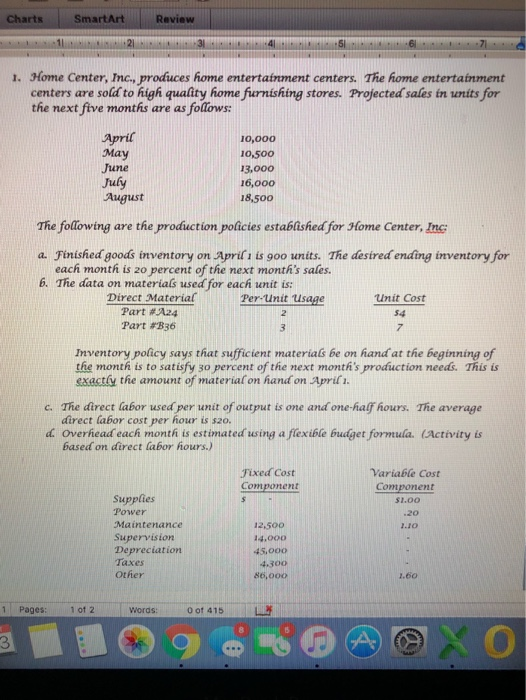

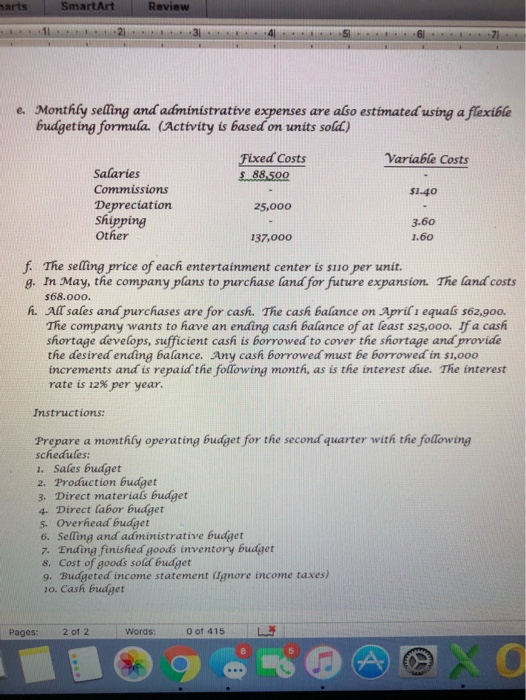

Charts SmartArt Review 1. Home Center, Inc., produces home entertainment centers. The home entertainment centers are sold to high quality home furnishing stores. Projected sales in units for the next five months are as follows: April May June July August 10,000 10,500 13,000 16,000 18,500 The following are the production policies established for Home Center, Inc a. Finished goods inventory on April 1 is goo units. The desired ending inventory for each month is 20 percent of the next month's sales. 6. The data on materials used for each unit is: Direct Material Per-Unit Usage Unit Cost Part #A24 54 Part #B36 Inventory policy says that sufficient materials be on hand at the beginning of the month is to satisfy 30 percent of the next month's production needs. This is exactly the amount of material on hand on April. c. The direct labor used per unit of output is one and one-half hours. The average direct labor cost per hour is $20. d. Overhead each month is estimated using a flexible budget formula. (Activity is based on direct labor hours.) Fixed Cost Component Variable Cost Component $1.00 Supplies Power Maintenance Supervision Depreciation Taxes Other 12,500 14.000 45,000 4.300 86,000 1 Pages: 1 of 2 Words: 0 of 415 harts SmartArt Review 1121314 . Monthly selling and administrative expenses are also estimated using a flexible budgeting formula. (Activity is based on units sold) Variable costs Fixed Costs $ 88,500 $1.40 Salaries Commissions Depreciation Shipping Other 25,000 3.60 1.60 137,000 f. The selling price of each entertainment center is suo per unit. g. In May, the company plans to purchase land for future expansion. The land costs $68.000. h. All sales and purchases are for cash. The cash balance on April 1 equals 562,900. The company wants to have an ending cash balance of at least 525,000. If a cash shortage develops, sufficient cash is borrowed to cover the shortage and provide the desired ending balance. Any cash borrowed must be borrowed in $1,000 increments and is repaid the following month, as is the interest due. The interest rate is 12% per year. Instructions: Prepare a monthly operating budget for the second quarter with the following schedules: 1. Sales budget 2. Production budget 3. Direct materials budget 4. Direct labor budget 5. Overhead budget 6. Selling and administrative budget 7. Ending finished goods inventory budget 8. Cost of goods sold budget 9. Budgeted income statement (Ignore income taxes) 10. Cash budget Pages: 2 of 2 Words: 0 of 415