Answered step by step

Verified Expert Solution

Question

1 Approved Answer

Chas McCormick started a corporation McCormick Co. on Jan. 1, 2023. Chas starts his business by investing $100,000 of his own money by purchasing

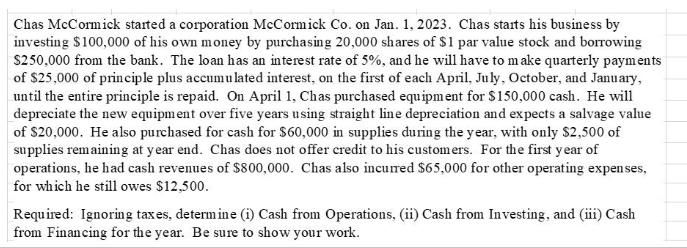

Chas McCormick started a corporation McCormick Co. on Jan. 1, 2023. Chas starts his business by investing $100,000 of his own money by purchasing 20,000 shares of $1 par value stock and borrowing $250,000 from the bank. The loan has an interest rate of 5%, and he will have to make quarterly payments of $25,000 of principle plus accumulated interest, on the first of each April, July, October, and January, until the entire principle is repaid. On April 1, Chas purchased equipment for $150,000 cash. He will depreciate the new equipment over five years using straight line depreciation and expects a salvage value of $20,000. He also purchased for cash for $60,000 in supplies during the year, with only $2,500 of supplies remaining at year end. Chas does not offer credit to his customers. For the first year of operations, he had cash revenues of $800,000. Chas also incurred $65,000 for other operating expenses, for which he still owes $12,500. Required: Ignoring taxes, determine (1) Cash from Operations, (ii) Cash from Investing, and (iii) Cash from Financing for the year. Be sure to show your work.

Step by Step Solution

★★★★★

3.33 Rating (153 Votes )

There are 3 Steps involved in it

Step: 1

Lets break down the cash flows for McCormick Co for the first year of operations i Cash from Operati...

Get Instant Access to Expert-Tailored Solutions

See step-by-step solutions with expert insights and AI powered tools for academic success

Step: 2

Step: 3

Ace Your Homework with AI

Get the answers you need in no time with our AI-driven, step-by-step assistance

Get Started