Answered step by step

Verified Expert Solution

Question

1 Approved Answer

ChatGPT how to find E... !!! EBITDA Multi... coursehero.com ... G + MERCURY ATHLETIC FOOTWEAR TN Exhibit 5 Completed DCF Valuation of Mercury ($

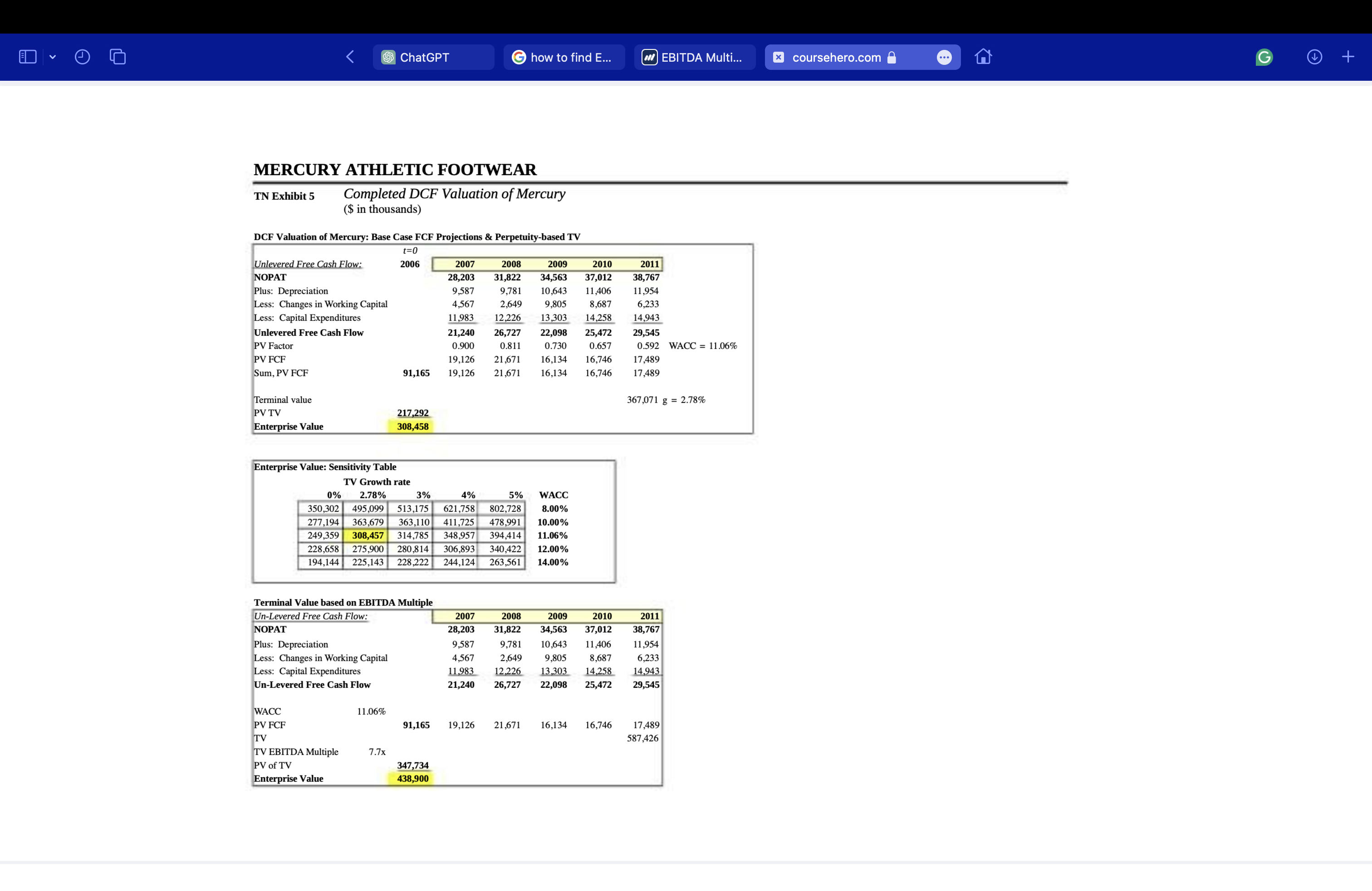

ChatGPT how to find E... !!! EBITDA Multi... coursehero.com ... G + MERCURY ATHLETIC FOOTWEAR TN Exhibit 5 Completed DCF Valuation of Mercury ($ in thousands) DCF Valuation of Mercury: Base Case FCF Projections & Perpetuity-based TV Unlevered Free Cash Flow: NOPAT t=0 2006 Plus: Depreciation 2007 2008 28,203 31,822 9,587 2009 2010 34,563 37,012 Less: Changes in Working Capital 4,567 Less: Capital Expenditures 11,983 9,781 10,643 11,406 2,649 9,805 12,226 13,303 2011 38,767 11,954 8,687 14,258 6,233 Unlevered Free Cash Flow PV Factor PV FCF Sum, PV FCF 91,165 21,240 26,727 22,098 25,472 0.900 0.811 0.730 0.657 19,126 21,671 16,746 19,126 21,671 14,943 29,545 0.592 WACC = 11.06% 16,134 17,489 16,134 16,746 17,489 Terminal value 367,071 g = 2.78% PV TV Enterprise Value 217,292 308,458 Enterprise Value: Sensitivity Table TV Growth rate 0% 350,302 2.78% 3% 4% 495,099 513,175 621,758 802,728 277,194 363,679 363,110 411,725 478,991 249,359 308,457 314,785 348,957 394,414 11.06% 228,658 275,900 280,814 306,893 340,422 12.00% 194,144 225,143 228,222 244,124 263,561 14.00% 5% WACC 8.00% 10.00% Terminal Value based on EBITDA Multiple Un-Levered Free Cash Flow: NOPAT Plus: Depreciation 2007 28,203 31,822 34,563 9,587 2008 2009 2010 37,012 2011 38,767 9,781 10,643 11,406 11,954 Less: Changes in Working Capital 4,567 2,649 9,805 8,687 6,233 Less: Capital Expenditures Un-Levered Free Cash Flow 11.983 21,240 12,226 26,727 13,303 14,258 14,943 22,098 25,472 29,545 WACC 11.06% PV FCF 91,165 19,126 21,671 16,134 16,746 TV 17,489 587,426 TV EBITDA Multiple 7.7x PV of TV Enterprise Value 347,734 438,900

Step by Step Solution

There are 3 Steps involved in it

Step: 1

Get Instant Access to Expert-Tailored Solutions

See step-by-step solutions with expert insights and AI powered tools for academic success

Step: 2

Step: 3

Ace Your Homework with AI

Get the answers you need in no time with our AI-driven, step-by-step assistance

Get Started