Question

Chatham Automotive purchased new electric forklifts to move steel automobile parts two years ago. They cost $70,000 each, including the charging stand. In practice, it

Chatham Automotive purchased new electric forklifts to move steel automobile parts two years ago. They cost $70,000 each, including the charging stand. In practice, it was found that they did not hold a charge as long as claimed by the manufacturer, so operating costs are very high. As a result, their current salvage value is about $ 11,000. Chatham is considering replacing them with propane models. New propane forklifts cost $ 58,000 each. After one year, they have a salvage value of $ 40,000and thereafter decline in value at a declining-balance depreciation rate of 20 percent, as does the electric model from this time on. The MARR is 7 percent. Operating costs for the electric model will be $ 20,000 this year, rising by 11 percent per year. Operating costs for the propane model will initially be $ 12,000 over the first year, rising by 11 percent per year. Should Chatham Automotive replace the forklifts now?

Chatham Automotive ( should or should not) replace the forklifts now since the minimum total EAC for the electric forklifts is $ enter your response here, which is(lower or higher) than $ enter your response here, the minimum total EAC for the propane forklifts.

(Round to the nearest dollar as needed.)

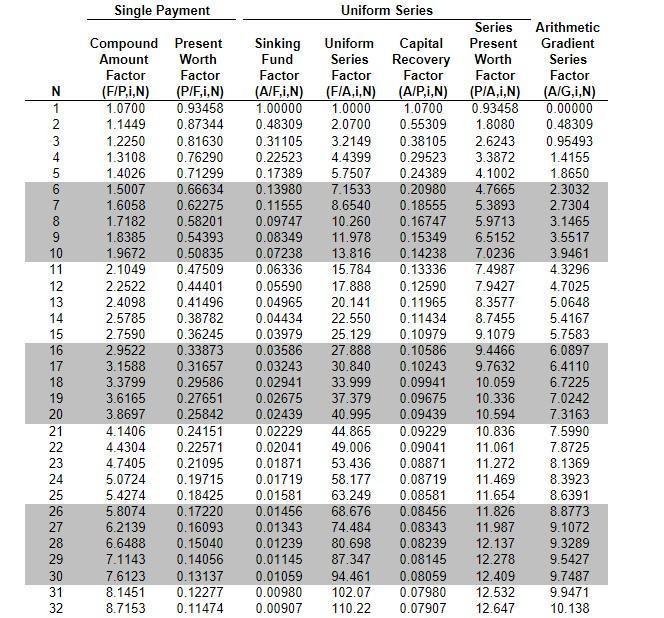

View the table of compound interest factors for discrete compounding periods when i=7%.

N 1 23456789 2: 10 11 12 13 14 15 567 16 17 18 19 20 21 22 23 24 25 26 WW N N N N 27 28 29 30 31 32 Single Payment Compound Present Amount Worth Factor (F/P,i,N) 1.0700 1.1449 Sinking Fund Factor Factor (P/F,i,N) (A/F,i,N) (F/A,i,N) 0.93458 1.00000 1.0000 0.87344 0.48309 2.0700 Uniform Series Uniform Capital Series Recovery Factor Factor 3.2149 0.38105 1.2250 0.81630 0.31105 1.3108 0.76290 0.22523 4.4399 0.29523 1.4026 0.71299 0.17389 5.7507 0.24389 1.5007 0.66634 1.6058 0.62275 1.7182 0.58201 0.09747 1.8385 1.9672 2.1049 2.7590 2.9522 3.1588 3.3799 0.29586 3.6165 0.27651 3.8697 0.25842 4.1406 0.24151 4.4304 0.22571 4.7405 0.13980 0.11555 8.6540 0.18555 10.260 0.16747 0.54393 0.08349 11.978 0.15349 0.50835 0.07238 13.816 0.06336 15.784 0.47509 0.33873 0.31657 Factor (A/P,i,N) (P/A,I,N) 1.0700 0.93458 0.55309 1.8080 2.6243 3.3872 4.1002 4.7665 5.3893 7.1533 0.20980 2.2522 0.44401 2.4098 0.41496 0.04965 2.5785 0.38782 0.04434 0.36245 0.03979 25.129 0.03586 27.888 0.03243 30.840 0.10243 0.02941 0.21095 5.0724 0.19715 Series Arithmetic Present Gradient Worth Series 5.9713 6.5152 0.14238 7.0236 0.13336 7.4987 0.05590 17.888 0.12590 20.141 0.11965 22.550 0.11434 8.7455 0.10979 9.1079 0.10586 9.4466 9.7632 10.059 0.02675 37.379 0.02439 40.995 0.02229 44.865 0.02041 49.006 0.01871 53.436 0.01719 58.177 5.4274 0.18425 0.01581 63.249 0.08581 5.8074 0.17220 0.01456 68.676 0.08456 6.2139 0.16093 0.01343 74.484 0.08343 6.6488 0.15040 0.01239 80.698 0.08239 87.347 0.08145 7.1143 0.14056 0.01145 7.6123 0.13137 0.01059 94.461 0.08059 0.07980 8.1451 0.12277 0.00980 102.07 8.7153 0.11474 0.00907 110.22 0.07907 7.9427 8.3577 33.999 0.09941 0.09675 10.336 0.09439 10.594 0.09229 10.836 0.09041 11.061 0.08871 11.272 0.08719 11.469 11.654 11.826 11.987 12.137 12.278 12.409 12.532 12.647 Factor (A/G,I,N) 0.00000 0.48309 0.95493 1.4155 1.8650 2.3032 2.7304 3.1465 3.5517 3.9461 4.3296 4.7025 5.0648 5.4167 5.7583 6.0897 6.4110 6.7225 7.0242 7.3163 7.5990 7.8725 8.1369 8.3923 8.6391 8.8773 9.1072 9.3289 9.5427 9.7487 9.9471 10.138

Step by Step Solution

3.47 Rating (150 Votes )

There are 3 Steps involved in it

Step: 1

We understand from the statement that Defender is the electric forklift and Challenger is the propane forklift Let us compare the EAC of two and then ...

Get Instant Access to Expert-Tailored Solutions

See step-by-step solutions with expert insights and AI powered tools for academic success

Step: 2

Step: 3

Ace Your Homework with AI

Get the answers you need in no time with our AI-driven, step-by-step assistance

Get Started