Answered step by step

Verified Expert Solution

Question

1 Approved Answer

Chauncey corporation began business on June 30th, 2016. At the time, it issued 20,000 shares of $50 par value, 6%, cumulative preferred stock in 90,000

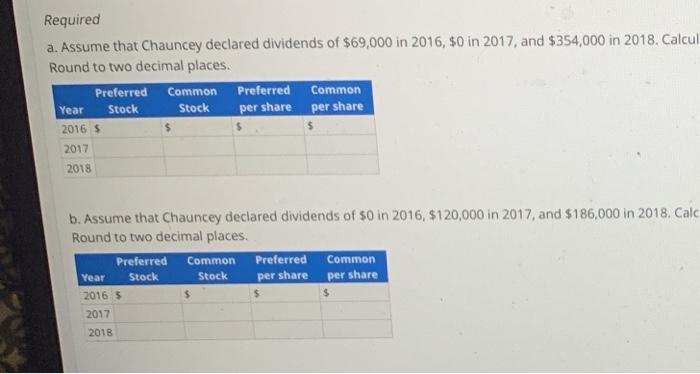

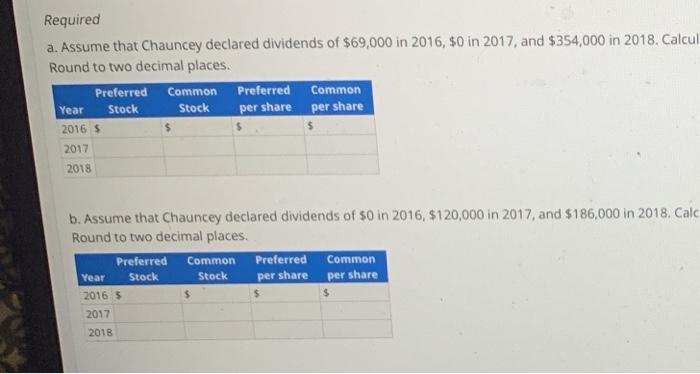

Chauncey corporation began business on June 30th, 2016. At the time, it issued 20,000 shares of $50 par value, 6%, cumulative preferred stock in 90,000 shares of $10 par value common stock. Through the end of 2018, there had been no change in the number of preferred and common shares outstanding. A. Assume what Chauncey declare dividends of $69,000 in 2016, $0 in 2017, and $354,000 in 2018. Calculate the total dividends and the dividends per share paid to each class of stock in 2016, 2017, and 2018. Round to two decimal places. B. Assume that Chauncey declared dividends of $0 in 2016, $120,000 in 2017, and $186,000 in 2018. Calculate the total dividends dividends per share paid to each class of stock in 2016, 2017, and 2018. Round to two decimal places

Dividend Distribution Chauncey Corporation began toets on June 30 2016. AUG, 20.000 ures of 50 per un percent, omave preferred stock 9.000 se 10 par value common stock Through the end of 2016 there had been change in the number of pared and common sig 1. Aume that any deared vidends 200 2016. 30 2017 and 5354000 in 2018 Coculate the sotaloudend and the dividend per share paid to each oss of stock in 2016, 2017, and 2018 Round to become The chance de 2.000 2017. . cand te studs per we paid to estaba of cock in 2016, 2017 and 2014 Required a. Assume that Chauncey declared dividends of $69,000 in 2016, $0 in 2017, and $354,000 in 2018. Calcul Round to two decimal places. Preferred Preferred Common Stock per share per share Common Stock Year 2016 $ 2017 2018 b. Assume that Chauncey declared dividends of so in 2016, $120,000 in 2017, and $186,000 in 2018. Calc Round to two decimal places. Preferred Common Preferred Common Year Stock Stock per share per share 2016 5 $ $ 2017 2018

Step by Step Solution

There are 3 Steps involved in it

Step: 1

Get Instant Access to Expert-Tailored Solutions

See step-by-step solutions with expert insights and AI powered tools for academic success

Step: 2

Step: 3

Ace Your Homework with AI

Get the answers you need in no time with our AI-driven, step-by-step assistance

Get Started