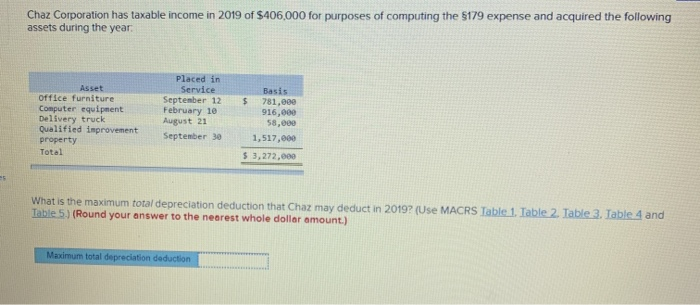

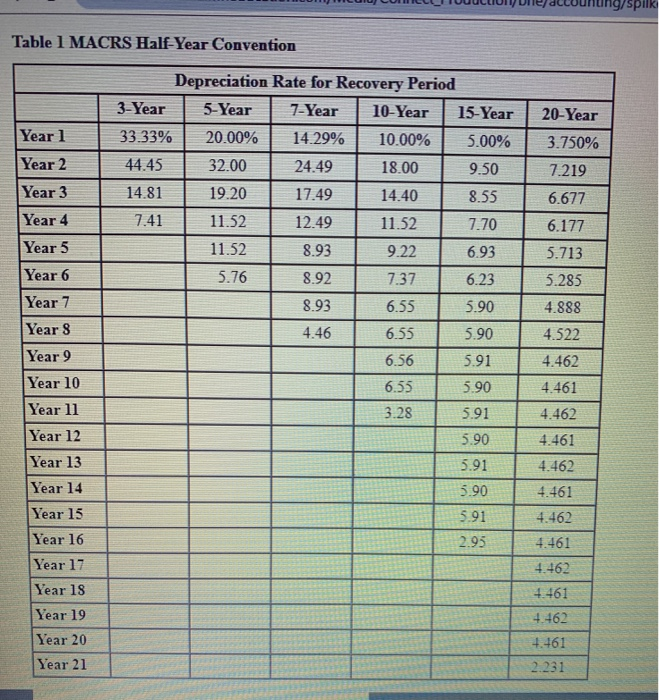

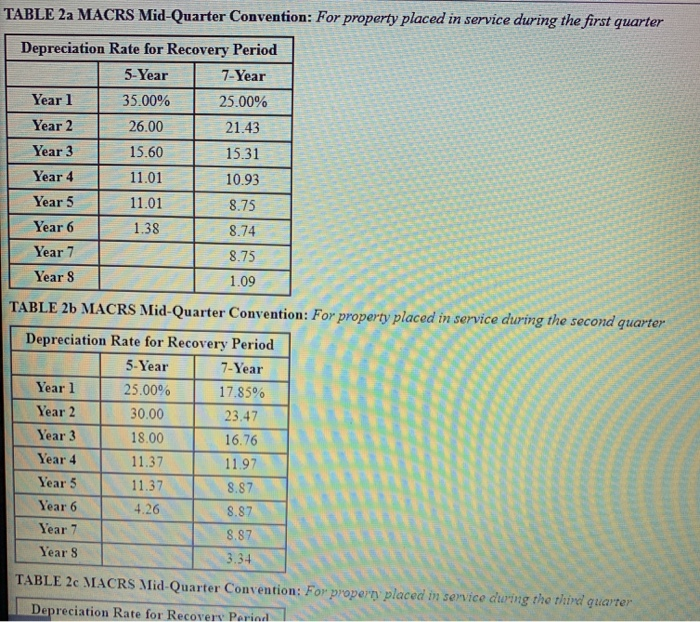

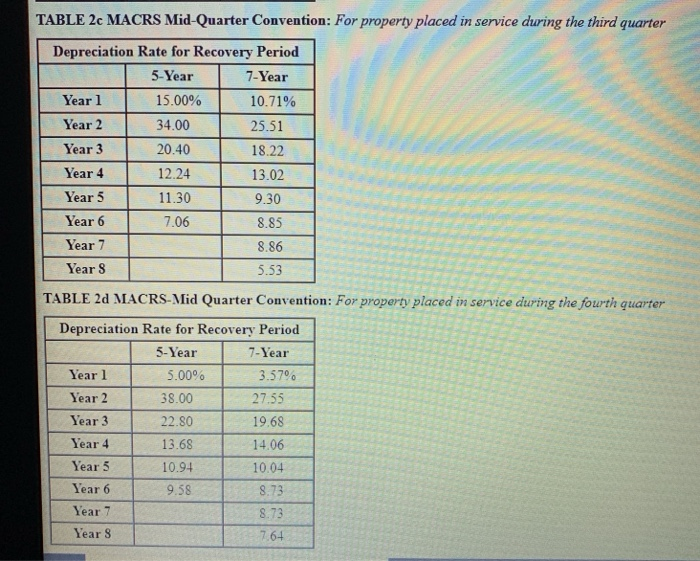

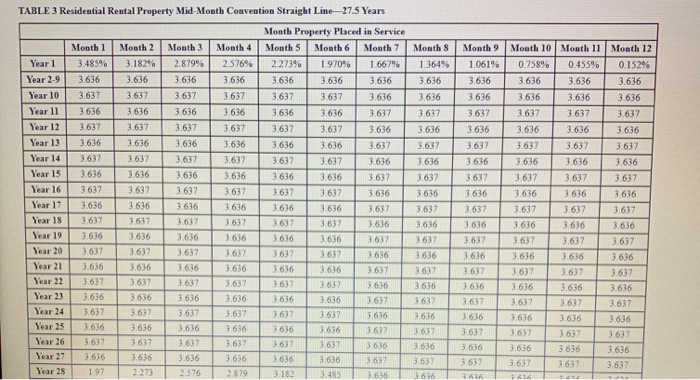

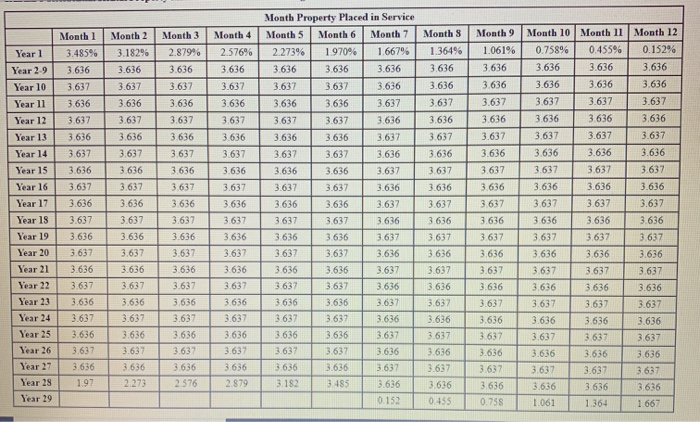

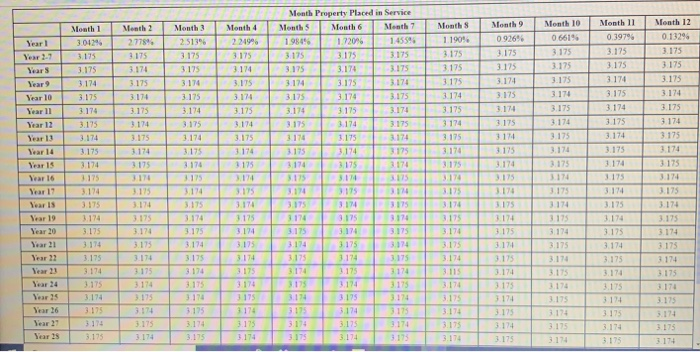

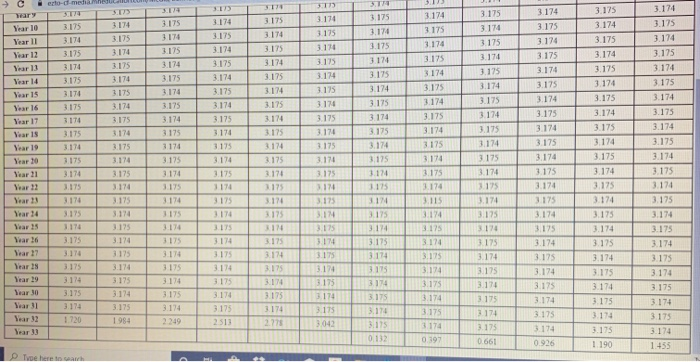

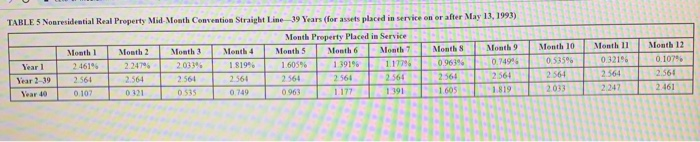

Chaz Corporation has taxable income in 2019 of $406,000 for purposes of computing the $179 expense and acquired the following assets during the year. Basis placed in Service September 12 February 10 August 21 Asset Office furniture Computer equipment Delivery truck Qualified improvement property Total $ 781,000 916,000 58.000 September 30 1,517,00 $ 3,272, What is the maximum total depreciation deduction that Chaz may deduct in 2019? (Use MACRS Table 1. Table 2. Table 3. Table 4 and Table 5.) (Round your answer to the nearest whole dollar amount.) Maximum total depreciation deduction LUIU LULUI IUUUUUUUH ACCOUNY) Spik Table 1 MACRS Half-Year Convention Year 1 Year 2 Year 3 Year 4 Year 5 Year 6 Year 7 Year 8 Year 9 Year 10 Year 11 Year 12 Year 13 Year 14 Year 15 Year 16 Year 17 Year 18 Year 19 Year 20 Year 21 Depreciation Rate for Recovery Period 3-Year 5-Year 7-Year 10-Year 15-Year | 20-Year 33.33% 20,00% 14.29% | 10.00% 5.00% | 3.750% 44.45 32.00 24.49 18.00 9.50 7.219 14.81 19.20 17.49 14.40 18.55 6.677 7.41 11.52 12.49 11.52 7.70 6.177 11.52 8.93 9.22 6.93 5.713 5.76 | 8.92 7.376.23 5.285 8.93 6.55 5.90 4.888 4.46 6.55 5.90 4.522 1 6.56 5.91 4.462 | 6.55 5.90 4.461 13.285.91 4.462 5.90 4.461 5 .91 4.462 5.90 4.461 1591 4.462 2.95 4.461 4.462 4.461 4.462 4 .461 TABLE 2a MACRS Mid-Quarter Convention: For property placed in service during the first quarter Depreciation Rate for Recovery Period S 5 -Year 7-Year Year 1 3 5.00% 25.00% Year 2 26.00 21.43 Year 3 15.60 15.31 1 Year 4 11.01 10.93 Year 5 11.01 8.75 Year 6 1.38 8 .74 Year 7 8.75 Year 8 1.09 quan TABLE 26 MACRS Mid-Quarter Convention: For property placed in service during the second quarter Depreciation Rate for Recovery Period 5-Year 7-Year Year 1 25.00% 17.85% Year 2 30.00 23.47 Year 3 18.00 16.76 Year 4 11.37 11.97 Year 5 11.37 8.87 Year 6 4.2 8.87 Year 7 8.87 Years 3.34 TABLE 2 MACRS Mid-Quarter Convention: For property placed in service during the third quarter Depreciation Rate for Recovery Period ... TABLE 2c MACRS Mid-Quarter Convention: For property placed in service during the third quarter Depreciation Rate for Recovery Period 5-Year 7-Year Yearl 15.00% | 10.71% Year 2 34.00 25.51 Year 3 20.40 18.22 Year 4 12.24 13.02 T Year 5 11.30 9.30 Year 6 7.06 8.85 Year 7 8.86 Year 8 5 .53 TABLE 20 MACRS- Mid Quarter Convention: For property placed in service during the fourth quarter Depreciation Rate for Recovery Period 5-Year 7-Year Yearl 5.00% 3.57% Year 2 3 8.00 27.55 Year 3 22.80 L 19.68 Year 4 13.68 14.06 Year 5 10.94 10.04 Year 6 9.58 8.73 Year 7 8.73 Years 7.64 TABLE 3 Residential Rental Property Mid-Month Convention Straight Line-27.5 Years Month Weath 12 Month 1 Month 2 3.48596 3.1826 3.636 3.636 Month 3 28799 Month 4 2.576% Month Property Placed in Service Month 3 Month 6 Month 7 2273%) 1970% 1.667% 3.636 3.636 3.636 Month 9 Month 10 Month 10619 0.75896 1 369 Year 2.9 3.636 3636 3636 3636 3.637 3.637 3.637 3637 3637 13636 1636 3.636 3636 Year 11 3636 3636 3.636 3636 3637 3637 3.636 3.637 3616 3637 3637 13616 3637 1616 3636 3.636 3.636 3636 3636 3.636 3636 3636 1637 3637 3.637 1637 3636 1616 1616 3.636 3.636 3636 3.636 3.636 3.636 3636 3.637 3.637 3.637 3.637 3.637 3.637 3.637 3636 3636 3636 3636 3.636 Year 17 1636 3.636 3.636 3.636 3637 3637 3.637 3.637 3.637 Year IS 3637 3637 1637 1.617 1617 3.636 3.636 3636 1616 3.636 Year 19 3636 3636 3.636 1616 3.636 3.636 3617 3617 3637 3.637 3.637 Year 203.637 3.637 1637 1617 1616 1616 3616 3 636 Year 21 3.63636363636 1616 3616 1616 3.616 3637 1617 1637 3637 1617 Year 22 637 3637 3617 3637 3636 1615 1616 3636 3.636 3636 Year 23 3.6363.636 3.636 3636 3616 3.636 1617 363716173617 3.637 3637 Year 24 3.637 3637 3 .637 3637 3637 3637 1616 016363636363636 3636 Year 25 | 36363636363636363636 36373637 3.637 3.637 1534 3631 Year 26 361 3637 3687 617 3637 3.637 3636 3.636 3.636363636363636 Year 37 3.6363636363636363636363636373537363 3.637 3 637 3.637 Year 2 1 97 2273 376 879 12 343536363616 Sche Month 2 Month 3 Month 4 3.182% 2.879% 2.576% Month 1 3.485% 3.636 3.637 Month Property Placed in Service Month 5 Month 6 Month 7 2.273% 1970% 1.667% 3.636 1 3 .636 3.636 Month 3 1.364% 3.636 3.636 Month 9 Month 10 Month 1 Month 12 1.061% 0.758% 0.455% 0.152% 3.636 3.636 3.636 3.636 3.636 3.636 3.636 3.636 3.636 3.636 3.636 ear 10 3.637 3.637 36373.637 3.637 3.636 Year 1l 3.636 3636 3637 3.637 3.637 3.637 3.637 3.637 Year 12 3.637 3637 3.637 3636 3636 3.636 3636 3636 3.636 Year 13 3636 3.636 3.637 3.637 3.637 3.637 3.637 Year 14 3.637 3.637 3.636 3.636 3.636 3.637 | 3.637 3.636 3.637 3.636 3.637 3.636 3.637 3.636 3.636 3.636 3.636 3.636 3.636 3637 3.637 | 3.637 3636 3.6363 .636 3.636 3.637 3.637 3.637 3.6373 3.636 3.636 3.636 3.636 3.637 3.637 3 .637 | 3.637 3.636 3.6363.6363.636 3.637 3.637 3637 3.637 3.636 3.636 3636 3.636 3.6373.637 3637 3637 3.636 3.636 3.637 3.637 3.637 3.636 3.637 3.636 | 3.637 3.637 .636 3.636 3.637 1 3.637 3.636 3.636 3.6373.637 3.636 3.636 3.637 3.637 3.636 3.636 3.637 3637 3.636 3636 Year 153.636 Year 163.637 Year 17 3.636 Year 183.637 Year 19 3.636 Year 203.637 Year 21 3.636 Year 22 3637 3636 3.636 3.637 3.636 3.637 3.636 3.637 3.636 1637 3.636 3.637 3.637 3.637 3.636 3.636 3.636 3.636 3636 3635 LE9 3637 29 909 3636 1616 3.636 3.637 3.636 3.637 3.636 3636 3636 3.636 3.637 3.637 3.637 Year 23 Year 24 3637 3.637 3632 3637 3636 3.636 3.636 3.636 3.636 3636 3617 Year 2 3.636 3.636 3.636 3637 3637 3.637 3637 3.637 Year 26 3637 3.636 3.636 3636 Year 3636 3637 Year 28 197 3.636 3.637 3.636 1.061 3.637 3.636 0.758 3.636 3.637 3 636 1 364 3636 3.636 0.455 Year 29 1667 Monthlo Month 11 Month 12 01329 3175 3.175 Month 1 3.0424 317 3.175 3.174 3 .175 3 .174 3.175 Year 1 Year 2.7 Years Year 9 Year 10 Yearll Var 12 3 3 175 Month Property Placed in Service Mouth Month Meath 195891720% 1455% 317 3.175 3175 315 3.174 175 3.114 3.175 174 3.175 3.174 3.175 316 317 3178 315 3174 17 Meath 2 2778% 318 3.174 175 3174 315 317 Month 3 Month 4 231392209 317 317 3 175 3 174 .174 3.175 3.175 3.114 3.114 3.175 315 3.114 Month $ Month 9 Month 9 1190% 11175 .175L .175 3.175 175 3.174 174 3.175 3.175 3174 174 175 3 3 174 3175 3.174 3.175 3175 3.174 3 3175 3.175 1174 1175 3175 3.174 3175 3.174 175 176 175 3 174 175 1174 11 Vear 16 Year 1 174 175 175 174 17 175 1175 3 174 3.114 3.175 175 1114 3174 319 315 316 3.116 317 31751 3173 3175 317 318 175 174 11 31753 174 175 3175 3 174 3175 Year? EEEEEEEEEEEE 175 114 1131 Vear 2331743151317 3174 31151 Vers 175 3.14 3.175 314 3.174 3.175 174 Year 103.175 1174 3175 1175 3174 3175 317 3175 3175 3174 3175 3 174 175 1.174 3.174 3.175 3124 Year 12 3175 1175 3.174 3.175 3.174 3174 3.175 3.174 3.175 3.174 3.174317 + 175 + 3075317431 TIM 175 Dear Ser 31743.175 t 31753 174 3175 174 1175 3 174 3 174 3.175 3.174 3175 1174 3.174 3174 3 174 117 3175 3175 3 174 3.175 31 3.174 3.175 3.174 1175 3175 1174 3.175 3 174 11 1175 317 3175 3.174 175 3174 1175 1174 3 174 3175 3174 117 3.175 3175 3 174 3.175 114 313 317 3.17631753.1743.175 1173.1708153174 175 1.174 1175 1115 1174 1174 1175 112 3175 3174 3175 3174 3125 Tears 3.14 3174 175 3.174 1174 -3.175 3.17 3114 3174 3175 1175 3 174 3115 17 bear 30 3 175 SLI 311 3175 3194 3124 2249 1175 11 3174 3175 312 175 1190 155 TABLE 5 Nonresidential Real Property Mid Mouth Convention Straight line 39 Years (for assets placed in service en or after May 13, 1993) Mouth Property Placed in Service Month Month 3 Month 3 Month 4 Month 3 Month 6 Month Months 1 Month 9 Year 1 2 .4619 2.2476 2.033% 18194 1605% 13919 1 17 0.963. 0.7499 Year 2 39 2.561 2.564 2561 2.564 2561 2561 2564 1 561 Year 40 0 107 0121 0515 0 149 0.963 1177 1191 1819 Month 10 0.535% 564 2013 Month 0.32196 2564 247 Month 12 0.107 2561 2461