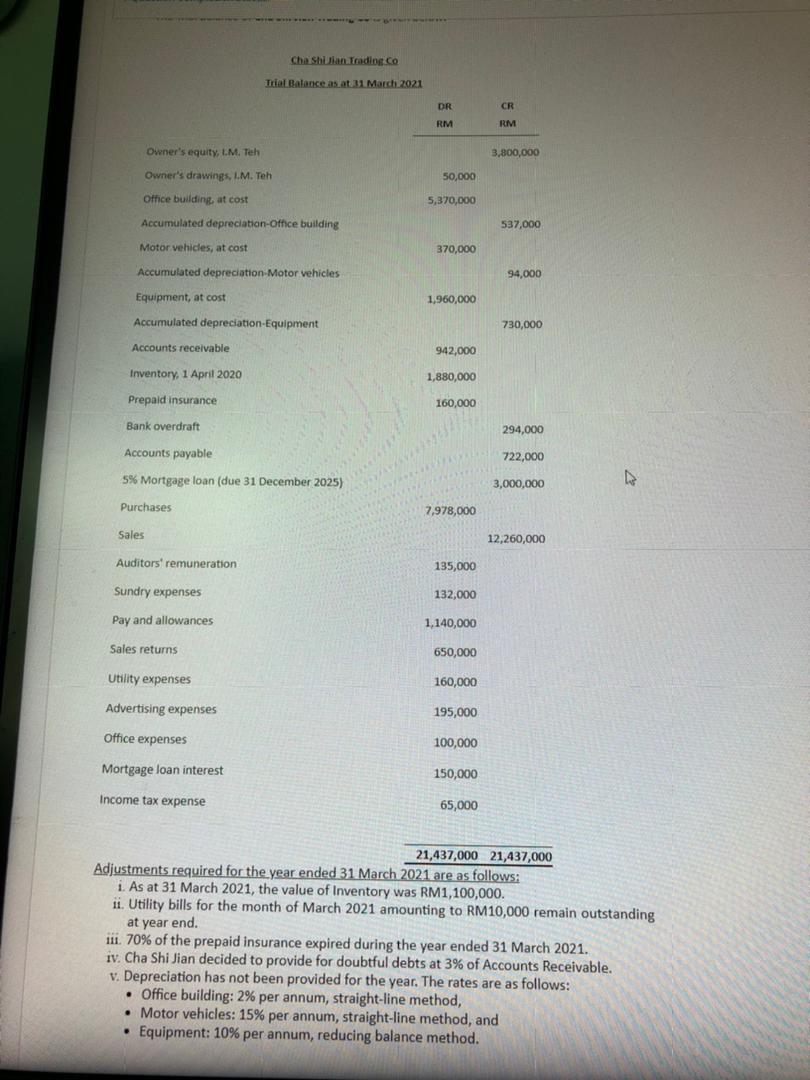

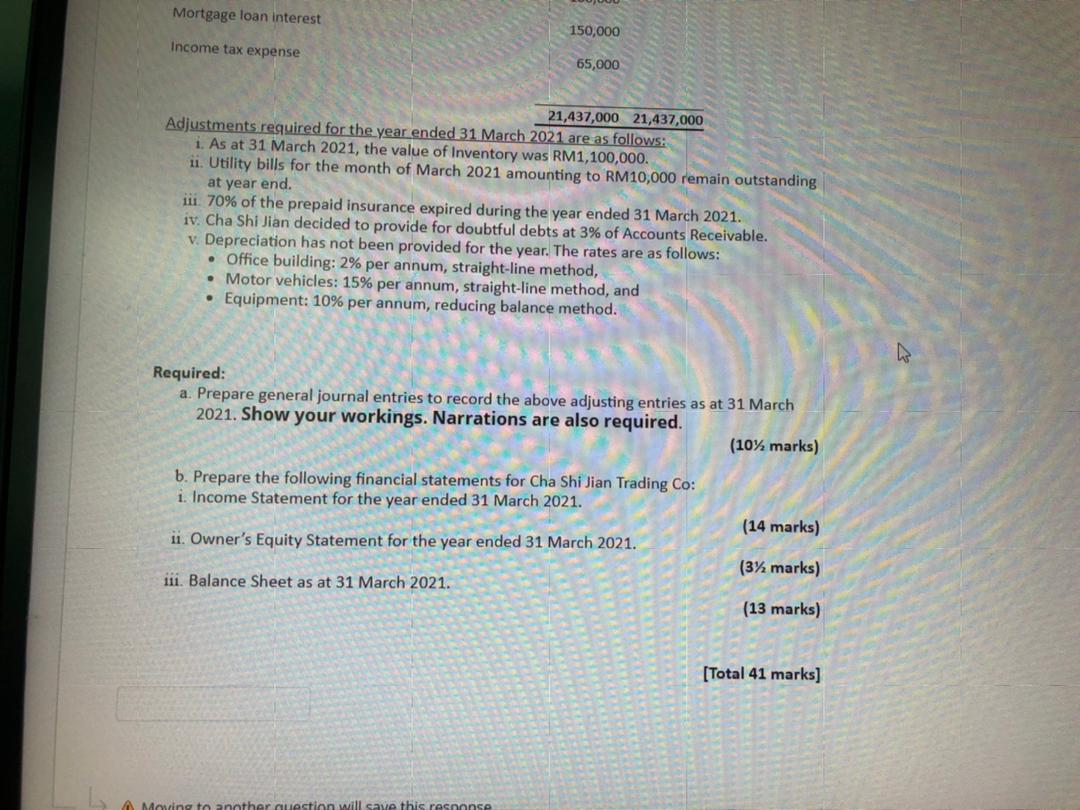

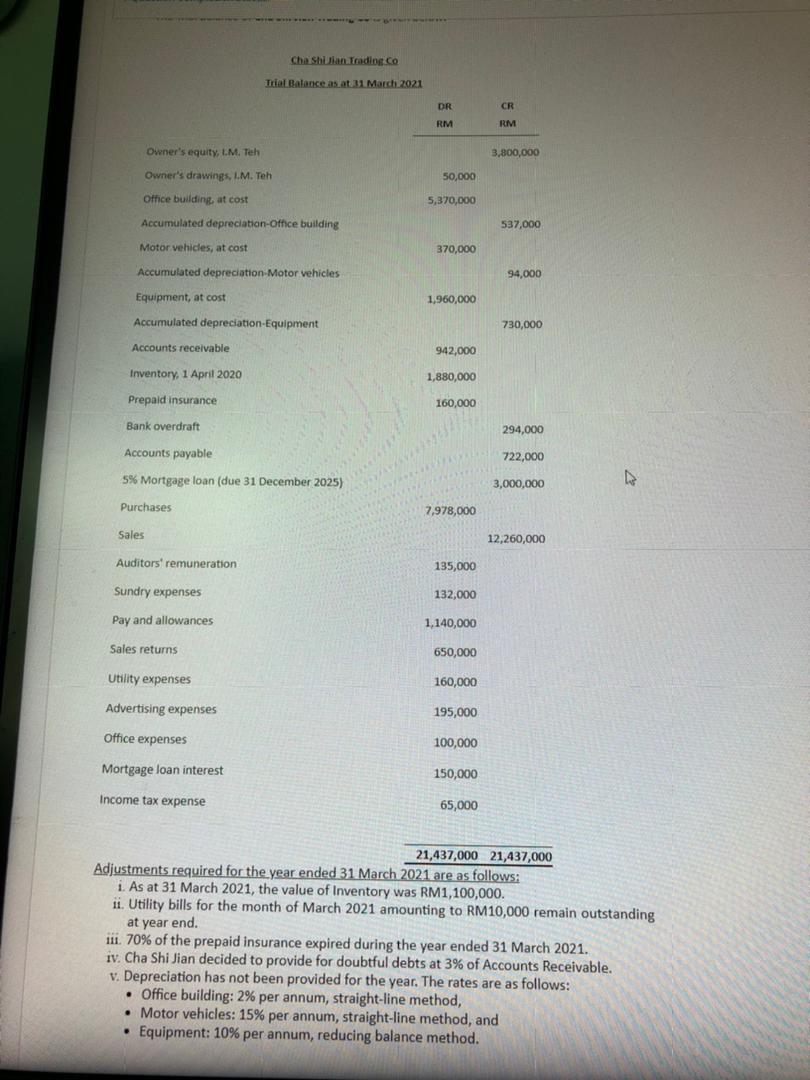

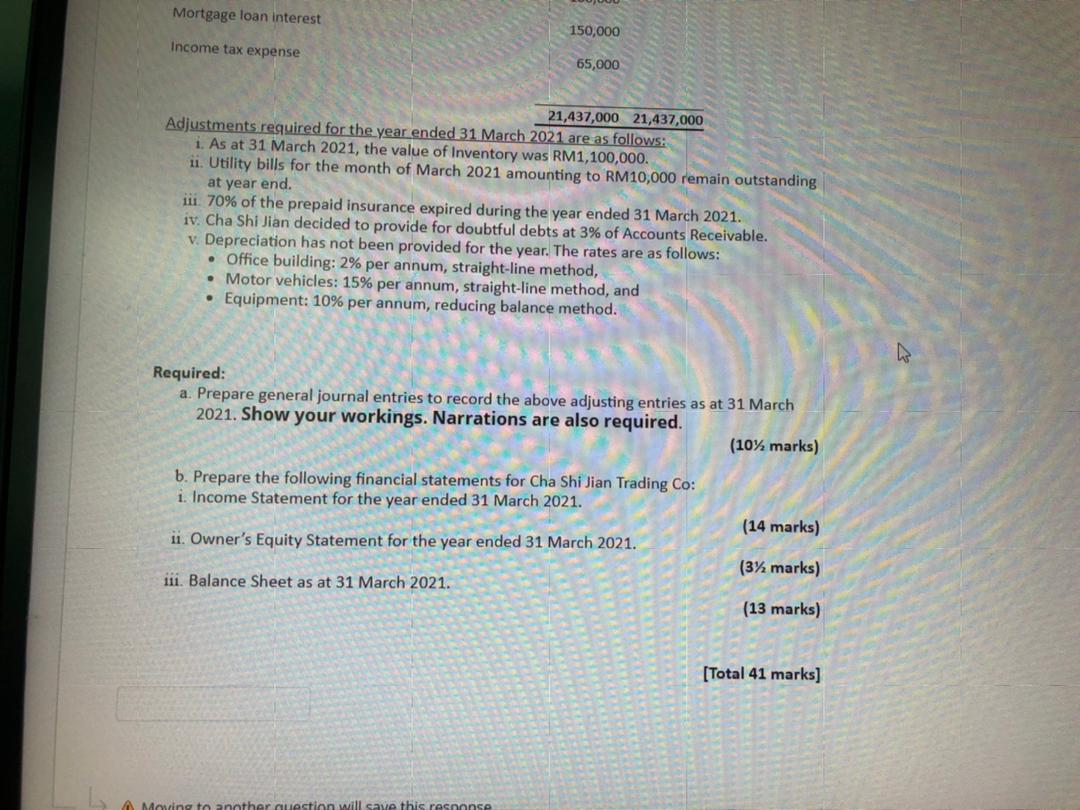

Che shuian Trading CO Trial Balance as at 31 Matchi 2021 DR CR RM RM Owner's equity, I.M. Teh 3,800,000 Owner's drawings, I.M. Teh 50,000 5,370,000 Office building, at cost Accumulated depreciation office building 537,000 Motor vehicles, at cost 370,000 Accumulated depreciation-Motor vehicles 94,000 Equipment, at cost 1,960,000 Accumulated depreciation Equipment 730,000 Accounts receivable 942,000 Inventory, 1 April 2020 1,880,000 Prepaid insurance 160,000 Bank overdraft 294,000 Accounts payable 722,000 5% Mortgage loan (due 31 December 2025) 3,000,000 Purchases 7,978,000 Sales 12,260,000 Auditors' remuneration 135,000 Sundry expenses 132,000 Pay and allowances 1,140,000 Sales returns 650,000 Utility expenses 160,000 Advertising expenses 195,000 Office expenses 100,000 Mortgage loan interest 150,000 Income tax expense 65,000 21,437,000 21,437,000 Adjustments required for the year ended 31 March 2021 are as follows: i. As at 31 March 2021, the value of Inventory was RM1,100,000. ii. Utility bills for the month of March 2021 amounting to RM10,000 remain outstanding at year end. 11. 70% of the prepaid insurance expired during the year ended 31 March 2021. iv. Cha Shi Jian decided to provide for doubtful debts at 3% of Accounts Receivable. v. Depreciation has not been provided for the year. The rates are as follows: Office building: 2% per annum, straight-line method, Motor vehicles: 15% per annum, straight-line method, and Equipment: 10% per annum, reducing balance method. Mortgage loan interest 150,000 Income tax expense 65,000 21,437,000 21,437,000 Adjustments required for the year ended 31 March 2021 are as follows: i. As at 31 March 2021, the value of Inventory was RM1,100,000. ii. Utility bills for the month of March 2021 amounting to RM10,000 remain outstanding at year end. iii. 70% of the prepaid insurance expired during the year ended 31 March 2021. iv. Cha Shi Jian decided to provide for doubtful debts at 3% of Accounts Receivable. v. Depreciation has not been provided for the year. The rates are as follows: Office building: 2% per annum, straight-line method, Motor vehicles: 15% per annum, straight-line method, and Equipment: 10% per annum, reducing balance method. Required: a. Prepare general journal entries to record the above adjusting entries as at 31 March 2021. Show your workings. Narrations are also required. (10% marks) b. Prepare the following financial statements for Cha Shi Jian Trading Co: i. Income Statement for the year ended 31 March 2021. (14 marks) ii. Owner's Equity Statement for the year ended 31 March 2021. (3% marks) iii. Balance Sheet as at 31 March 2021. (13 marks) [Total 41 marks) Mosing to another question will save this response