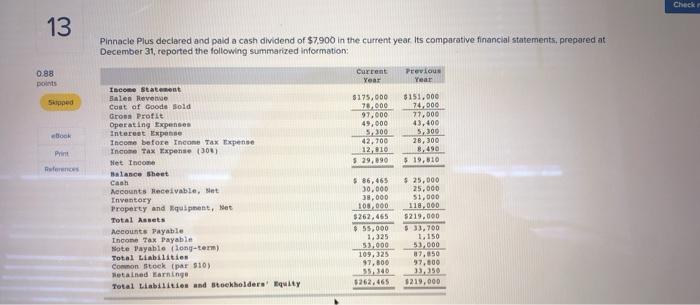

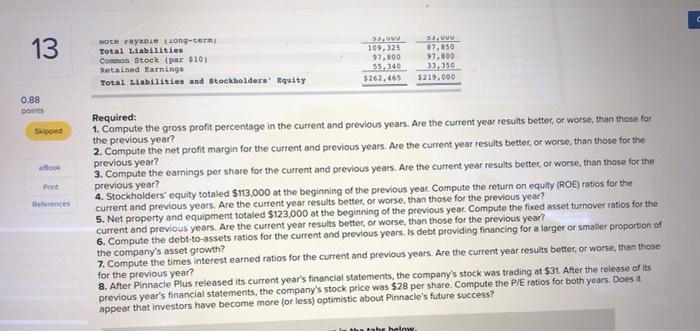

Check 13 Pinnacle Plus declared and paid a cash dividend of $7.900 in the current year its comparative financial statements, prepared at December 31, reported the following summarized information: 0.88 Current Year Previous Year Sipped $175,000 70.000 97,000 49,000 5.300 42,700 12,010 5 29,90 5151.000 74.000 77.000 43,400 5,300 28,300 8,490 $ 19,810 Book Print forno Income statement Balen Revenge Cast of Goode sold Gronn Profit Operating Expenses Interest Expense Income before Income Tax Expense Income Tax Expense (301) Net Income Balance Sheet Cat Accounts Receivable, et Inventory Property and quipment, Met Total Assets Accounts Payable Income Tax Payable Note Payable (long-term) Total Liabilities Common stock (par 310) Retained Earringe Total Liabilities and stockholders' Equity 5 86, 465 30,000 38,000 100.000 $262,465 $ 55,000 1.325 53,000 109,325 97,800 55.340 $262,465 $ 25,000 25,000 51.000 118,000 5219.000 $ 33,700 1.150 53,000 87.650 97.000 3320 1219.000 13 wote wayable long-term Total Liabilities Common Stock (par 510) Retained Earnings Total Liabilities and Stockholders Iquity VO 109.325 97,200 55,340 $262,465 33 87,850 97,800 33, 350 $219.000 0.88 points Skipped Bo Print References Required: 1. Compute the gross profit percentage in the current and previous years. Are the current year results better, or worse than those for 2. Compute the net profit margin for the current and previous years. Are the current year results better, or worse, than those for the previous year? 3. Compute the earnings per share for the current and previous years. Are the current year results better, or worse than those for the previous year? 4. Stockholders' equity totaled $113,000 at the beginning of the previous year Compute the return on equity (ROE) ratios for the current and previous years. Are the current year results better, or worse than those for the previous year? 5. Net property and equipment totaled $123,000 at the beginning of the previous year. Compute the fixed asset turnover ratios for the current and previous years. Are the current year results better, or worse than those for the previous year? 6. Compute the debt-to-assets ratios for the current and previous years. Is debt providing financing for a larger or smaller proportion of the company's asset growth? 7. Compute the times interest earned ratios for the current and previous years. Are the current year results better, or worse than those for the previous year? 8. After Pinnacle Plus released its current year's financial statements, the company's stock was trading at $31. After the release of its previous year's financial statements, the company's stock price was $28 per share. Compute the P/E ratios for both years. Does it appear that investors have become more or less) optimistic about Pinnacle's future success? tahu below