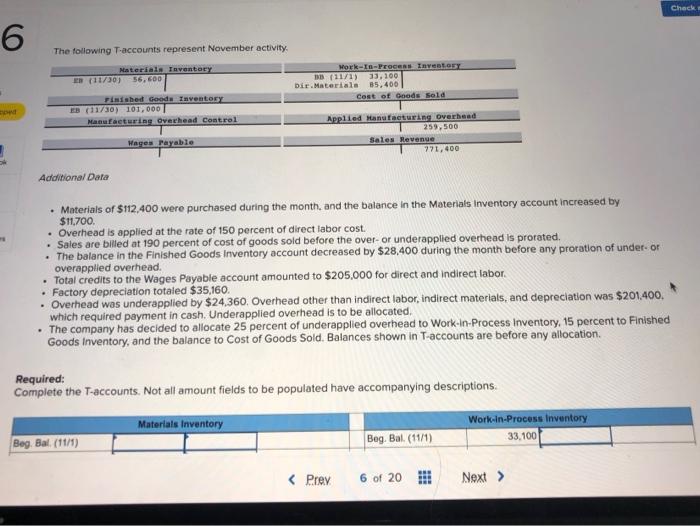

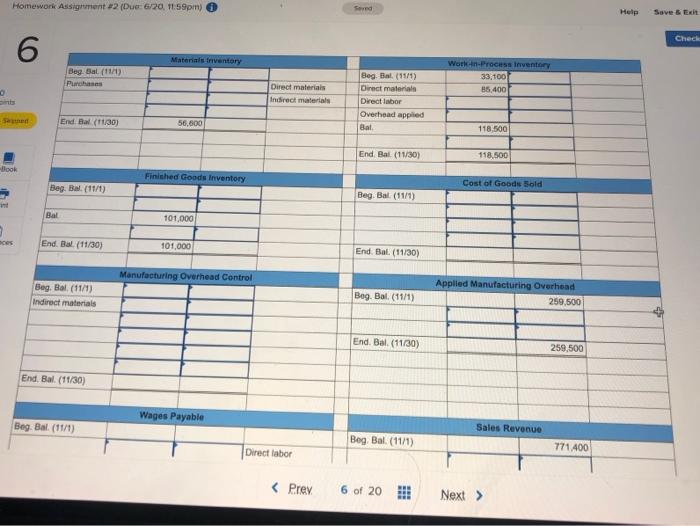

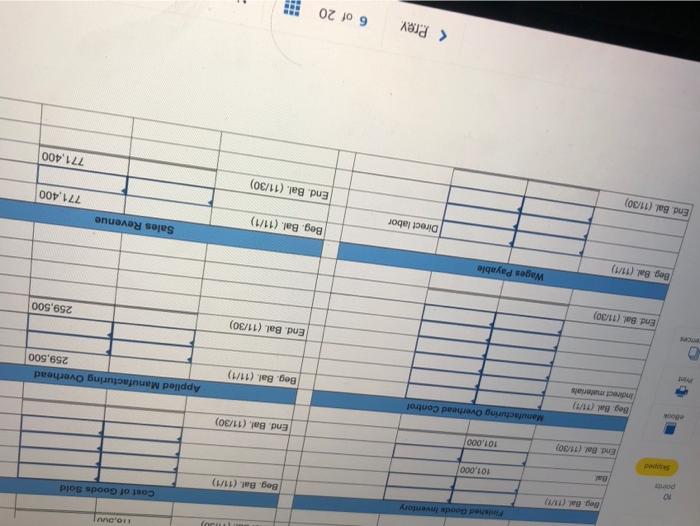

Check 6 The following T-accounts represent November activity, Materiale Taventory EN (11730 56,600 Hork.PEOCER Inventos 18 (1171) 33,100 Dir. Materiala 85,400 cost of Goods Sold . Finished Goods Inventos EB (1170) 101,000 Manufacturing Overhead Control Applied Manufacturing overhead 259,500 Sales Revenge 771,400 Wages Payable Tayable Additional Data $11.700. Materials of $112,400 were purchased during the month and the balance in the Materials Inventory account increased by Overhead is applied at the rate of 150 percent of direct labor cost. Sales are billed at 190 percent of cost of goods sold before the over- or underapplied overhead is prorated, The balance in the Finished Goods Inventory account decreased by $28,400 during the month before any proration of under of Total credits to the Wages Payable account amounted to $205,000 for direct and indirect labor. Overhead was underapplied by $24.360, Overhead other than indirect labor, indirect materials, and depreciation was $201.400, The company has decided to allocate 25 percent of underapplied overhead to Work-In-Process Inventory, 15 percent to Finished Goods Inventory, and the balance to Cost of Goods Sold. Balances shown in T-accounts are before any allocation Required: Complete the T-accounts. Not all amount fields to be populated have accompanying descriptions Materials inventory Work-in-Process Inventory 33,100 Beg Bal (11/1) Beg. Bal. (11/1) Homework Assignent #2 (Due: 6/20. 11.59pm) Seved Help Save & EX Check 6 Materials inventory Beg. Bal (11/0) Purchase Work in Process Inventory 33,100 85 400 Beg. Bat. (171) Direct materials Direct materials Indirect materials 0 Direct labor End Bal (1/30) 56.600 Overhead applied Bal 118.500 End. Bat. (11/30) 118.500 -Book Finished Goods Inventory Cost of Goods Sold Beg. Bal (11/1) Beg Bal (11/1) Bal 101.000 nes End. Bal (11/30) 101.000 End. Bat. (11/30) Manufacturing Overhead Control Seg. Bal (11/1) Indirect materials Bog. Bal (11/1) Applied Manufacturing Overhead 259.500 End. Bal. (11/30) 259,500 End, Bal (11/30) Wages Payable Beg. Bal (11/1) Sales Revenue Beg Bal (11/1) Direct labor 771400 110,00 ashed Geode inventory Begal/ 10 PO Beg. Bat. (11/1) Coat of Goods Sald 101.000 End Bal 1.30 101.000 End. Bal (11/30) Manufacturing Overhead Control Beg Bal (1/1) Indirect materiale Beg. Bal (11/1) Applied Manufacturing Overhead 259,500 End. Bal (11/30) End Bal (11/30) 259,500 Beg. Bal. (11/1) Wages Payable Direct labor Beg. Bal. (11/1) Sales Revenue End. Bat. (11/30) 771,400 End. Bal. (11/30) 771.400