Answered step by step

Verified Expert Solution

Question

1 Approved Answer

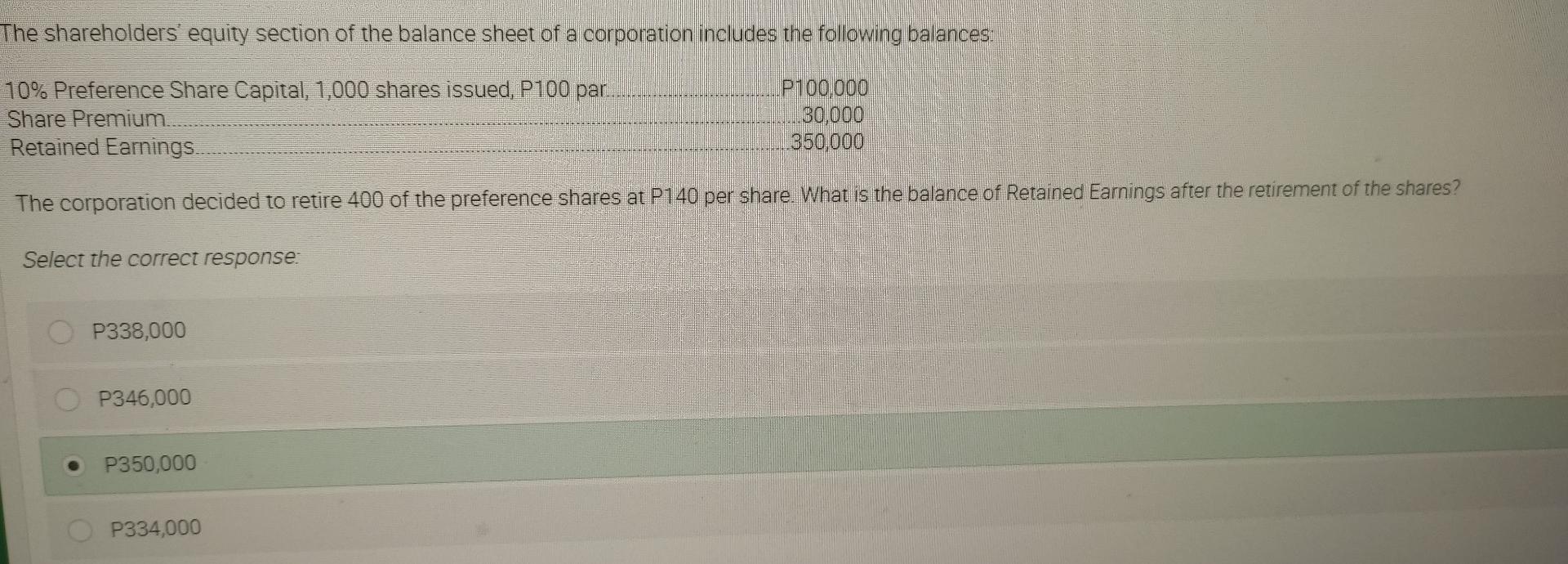

check again please!!! The shareholders' equity section of the balance sheet of a corporation includes the following balances: 10% Preference Share Capital, 1,000 shares issued,

check again please!!!

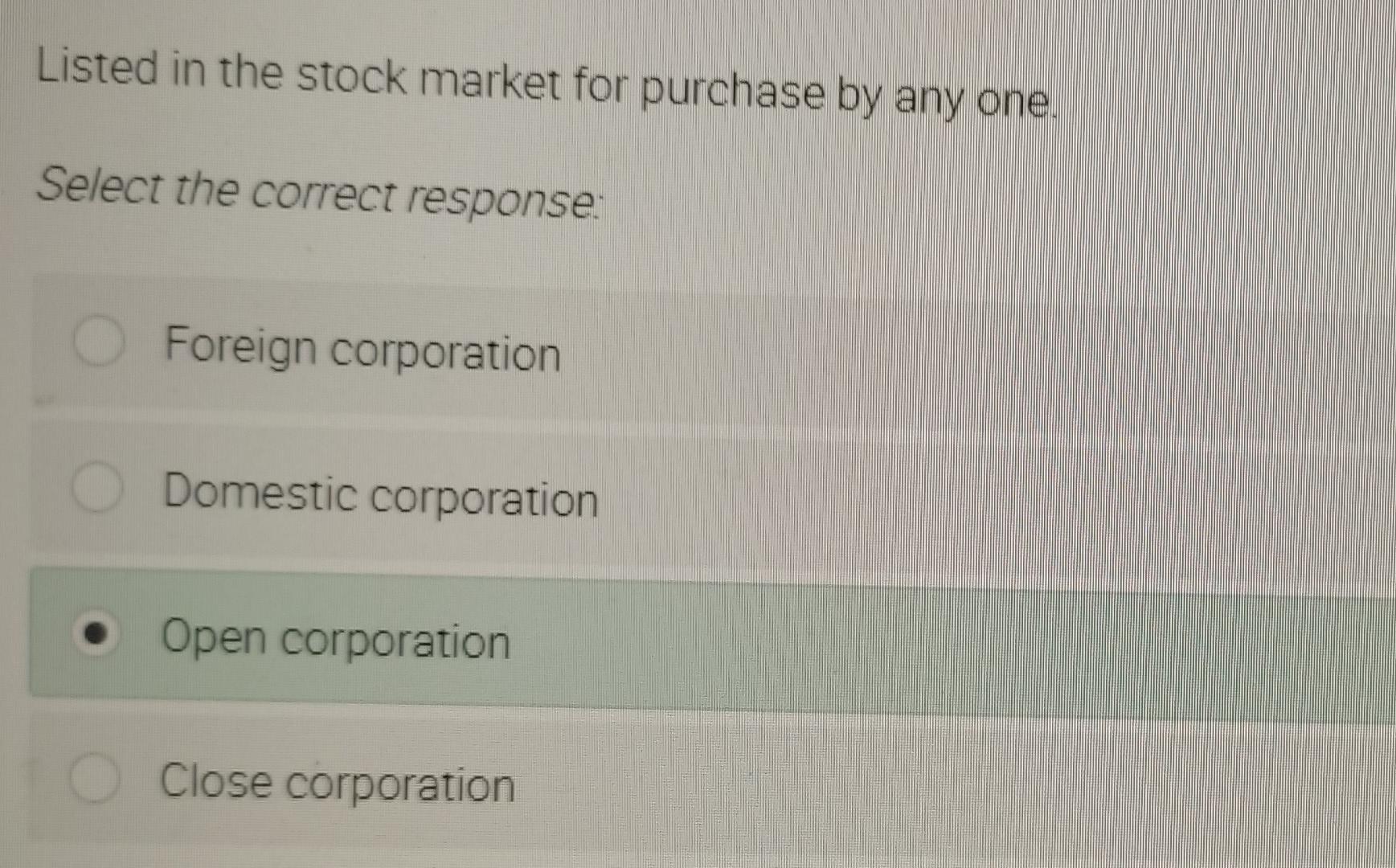

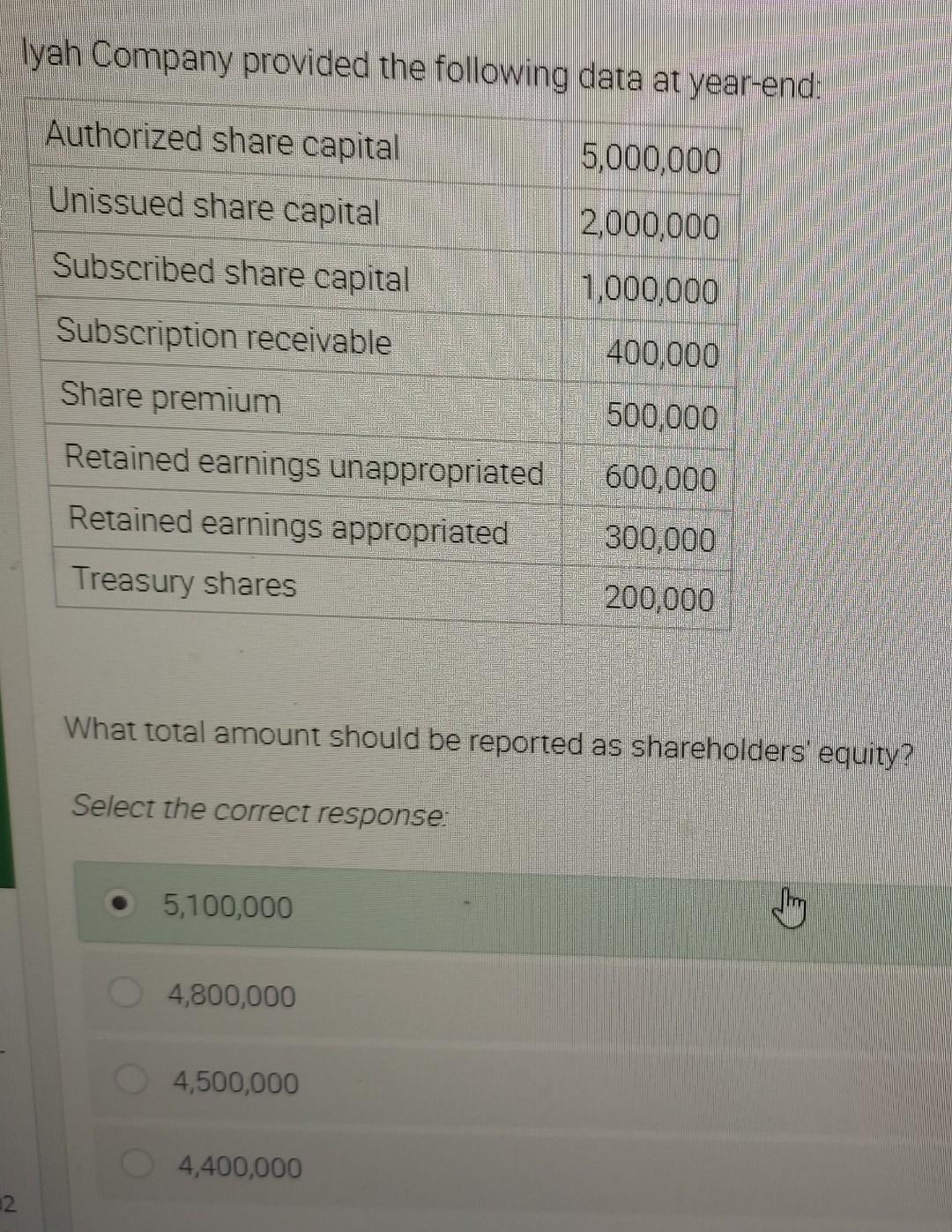

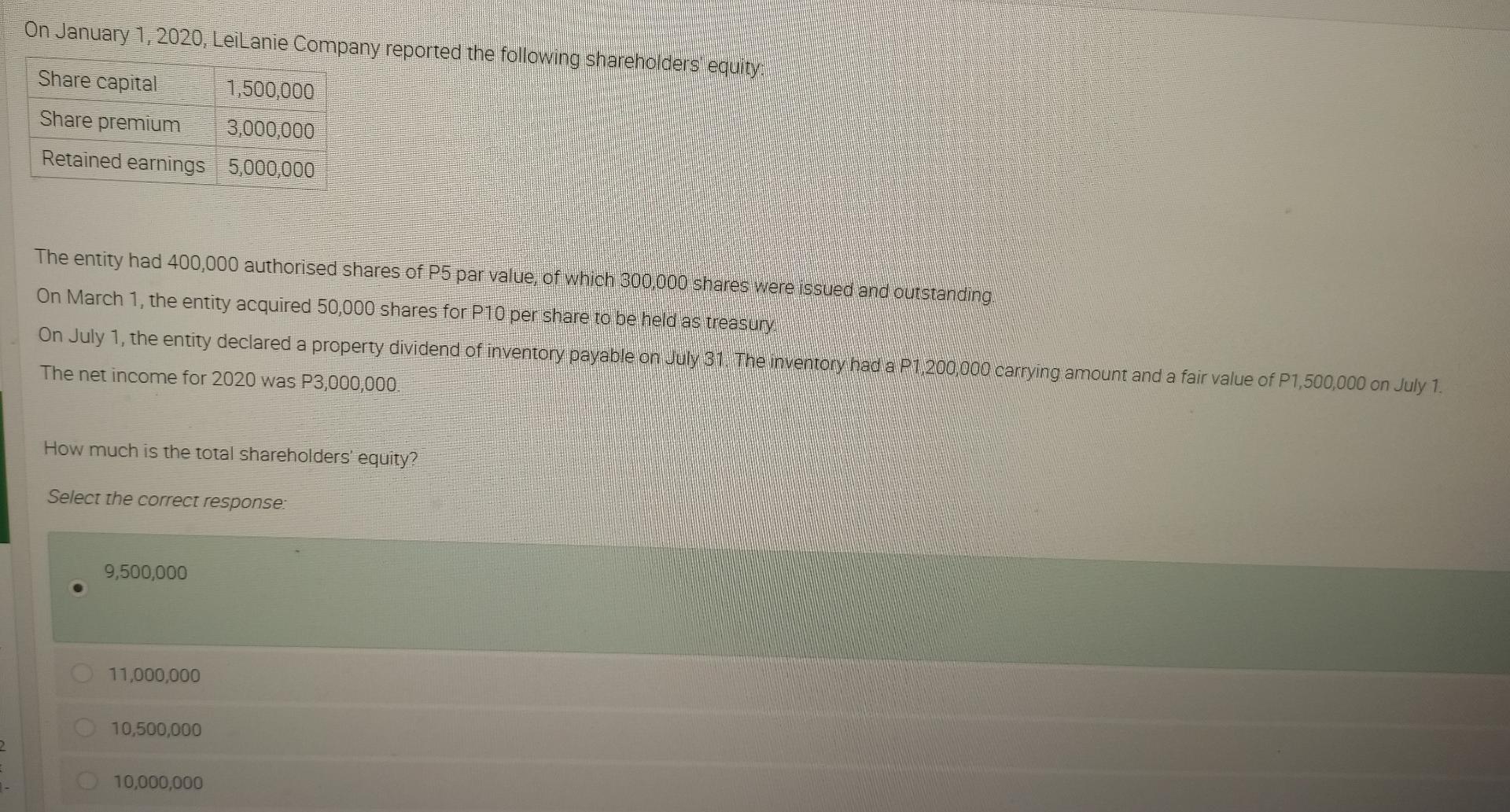

The shareholders' equity section of the balance sheet of a corporation includes the following balances: 10% Preference Share Capital, 1,000 shares issued, P100 par. Share Premium Retained Earnings. P100,000 30,000 350,000 The corporation decided to retire 400 of the preference shares at P140 per share. What is the balance of Retained Earnings after the retirement of the shares? Select the correct response: P338,000 P346,000 P350,000 P334,000 Listed in the stock market for purchase by any one Select the correct response Foreign corporation Domestic corporation Open corporation Close corporation Iyah Company provided the following data at year-end: Authorized share capital 5,000,000 Unissued share capital 2.000.000 Subscribed share capital 1,000,000 Subscription receivable 400,000 500,000 Share premium Retained earnings unappropriated Retained earnings appropriated Treasury shares 600,000 300,000 200,000 What total amount should be reported as shareholders' equity? Select the correct response 5,100,000 4 4,800,000 4,500,000 4,400,000 2 On January 1, 2020, Leilanie Company reported the following shareholders equity Share capital 1,500,000 Share premium 3,000,000 Retained earnings 5,000,000 The entity had 400,000 authorised shares of P5 par value, of which 300,000 shares were issued and outstanding On March 1, the entity acquired 50,000 shares for P10 per share to be held as treasury On July 1, the entity declared a property dividend of inventory payable on July 31. The inventory had a P1,200,000 carrying amount and a fair value of P1,500,000 on July 1. The net income for 2020 was P3,000,000. How much is the total shareholders' equity? Select the correct response 9,500,000 11,000,000 10,500,000 2 10,000,000Step by Step Solution

There are 3 Steps involved in it

Step: 1

Get Instant Access to Expert-Tailored Solutions

See step-by-step solutions with expert insights and AI powered tools for academic success

Step: 2

Step: 3

Ace Your Homework with AI

Get the answers you need in no time with our AI-driven, step-by-step assistance

Get Started