Answered step by step

Verified Expert Solution

Question

1 Approved Answer

check figure for consolidated b/s is 3865 200 On December 31, 2021, Bull Corporation purchased 30 percent of the stock of Winkle at book value.

check figure for consolidated b/s is 3865

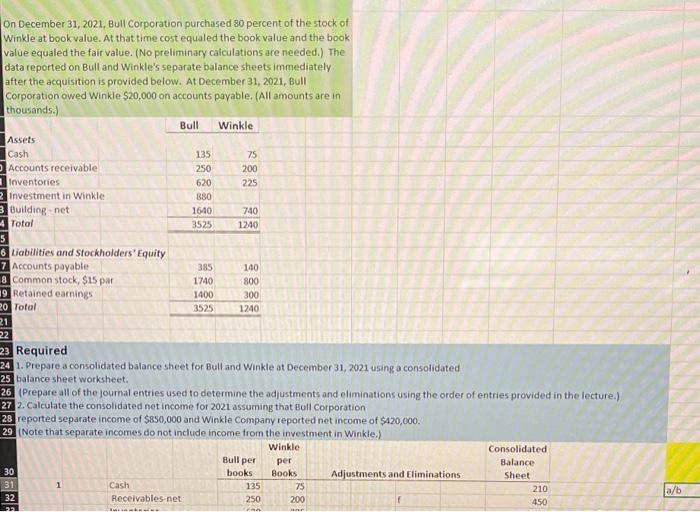

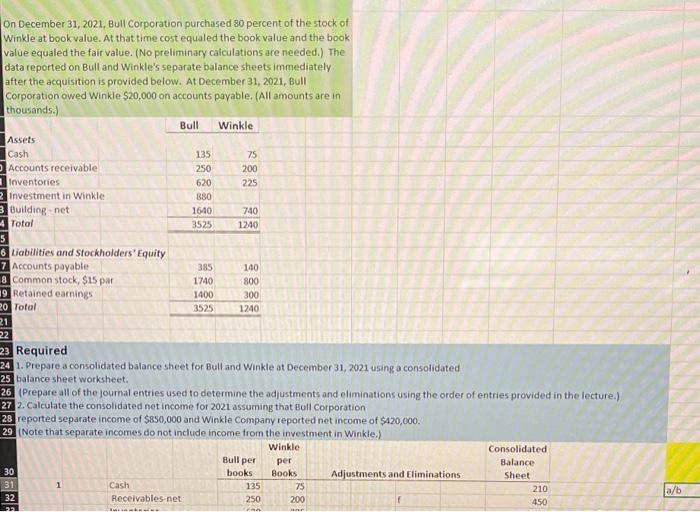

200 On December 31, 2021, Bull Corporation purchased 30 percent of the stock of Winkle at book value. At that time cost equaled the book value and the book value equaled the fair value. (No preliminary calculations are needed.) The data reported on Bull and Winkle's separate balance sheets immediately after the acquisition is provided below. At December 31, 2021, Bull corporation owed Winkle $20,000 on accounts payable. (All amounts are in thousands.) Bull Winkle Assets Cash 135 75 Accounts receivable 250 Inventories 620 225 investment in Winkle 380 3 Building.net 1640 740 4 Total 3525 1240 5 6 Liabilities and Stockholders' Equity 7 Accounts payable 385 140 8 Common stock, $15 par 1740 800 19 Retained earnings 1400 300 20 Total 3525 1240 21 22 223 Required 24 1. Prepare a consolidated balance sheet for Bull and Winkle at December 31, 2021 using a consolidated 25 balance sheet worksheet. 26 Prepare all of the journal entries used to determine the adjustments and eliminations using the order of entries provided in the lecture.) 27 2. Calculate the consolidated net income for 2021 assuming that Bull Corporation 28 reported separate income of $850,000 and Winkle Company reported net income of $420,000. 29 Note that separate incomes do not include income from the investment in Winkle.) Winkle Consolidated per Balance 30 books Books Adjustments and Eliminations Sheet 31 Cash 135 75 210 Receivables.net 250 200 450 Bull per 1 a/b 32

Step by Step Solution

There are 3 Steps involved in it

Step: 1

Get Instant Access to Expert-Tailored Solutions

See step-by-step solutions with expert insights and AI powered tools for academic success

Step: 2

Step: 3

Ace Your Homework with AI

Get the answers you need in no time with our AI-driven, step-by-step assistance

Get Started