Answered step by step

Verified Expert Solution

Question

1 Approved Answer

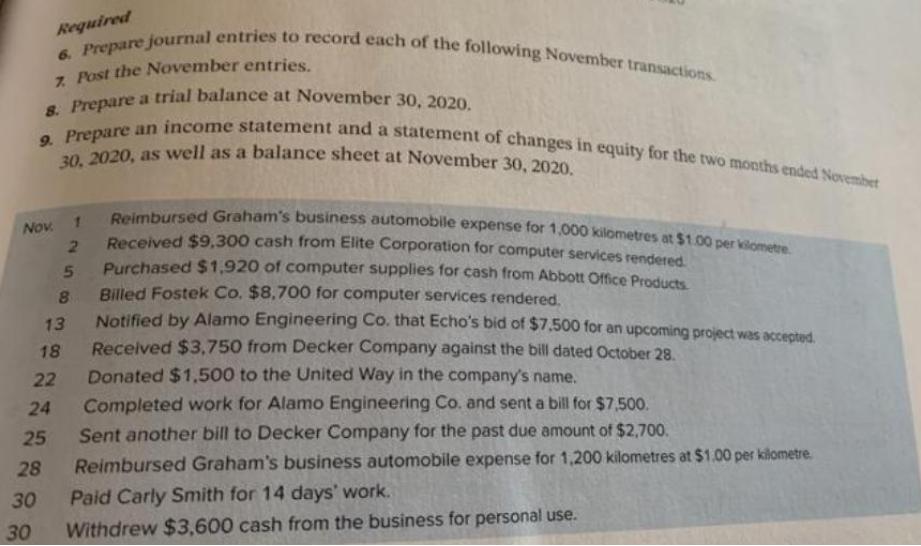

Required 6. Prepare journal entries to record each of the following November transactions. 7. Post the November entries. 8. Prepare a trial balance at

Required 6. Prepare journal entries to record each of the following November transactions. 7. Post the November entries. 8. Prepare a trial balance at November 30, 2020. Nov. 1 Reimbursed Graham's business automobile expense for 1,000 kilometres at $1.00 per kilometre. Received $9,300 cash from Elite Corporation for computer services rendered Purchased $1,920 of computer supplies for cash from Abbott Office Products Billed Fostek Co. $8,700 for computer services rendered. Notified by Alamo Engineering Co. that Echo's bid of $7.500 for an upcoming project was accepted. Received $3,750 from Decker Company against the bill dated October 28. Donated $1,500 to the United Way in the company's name. Completed work for Alamo Engineering Co. and sent a bill for $7,500. Sent another bill to Decker Company for the past due amount of $2,700. Reimbursed Graham's business automobile expense for 1,200 kilometres at $1.00 per kilometre. Paid Carly Smith for 14 days' work. Withdrew $3,600 cash from the business for personal use. 9. Prepare an income statement and a statement of changes in equity for the two months ended November 30, 2020, as well as a balance sheet at November 30, 2020. 30 30 22 24 18 25 28 13 2 5 8

Step by Step Solution

★★★★★

3.48 Rating (161 Votes )

There are 3 Steps involved in it

Step: 1

6 NOV 1 Prepaid expenses 1000 Cash 1000 NOV 2 Accounts receivable 9300 Cash 9300 NOV 5 Inventory 1920 Cash 1920 NOV 8 Accounts receivable 8700 Service...

Get Instant Access to Expert-Tailored Solutions

See step-by-step solutions with expert insights and AI powered tools for academic success

Step: 2

Step: 3

Ace Your Homework with AI

Get the answers you need in no time with our AI-driven, step-by-step assistance

Get Started