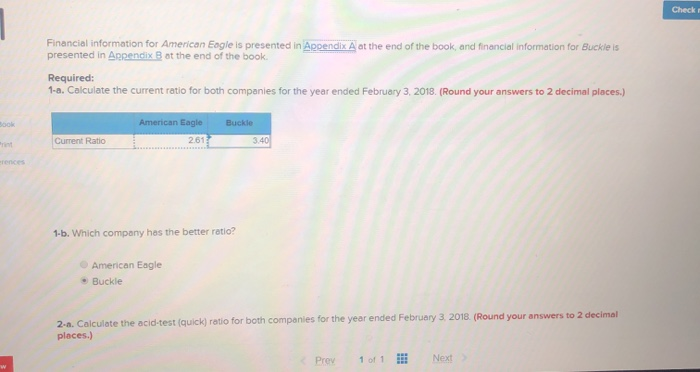

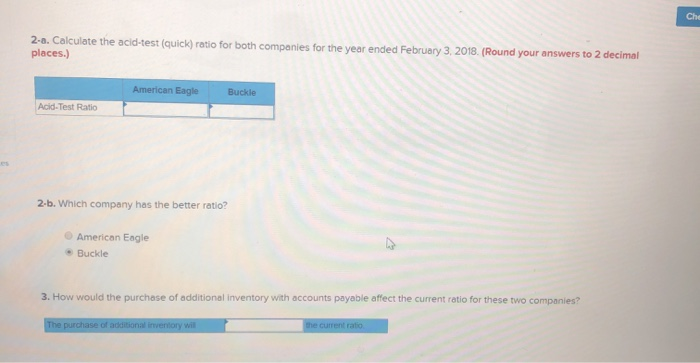

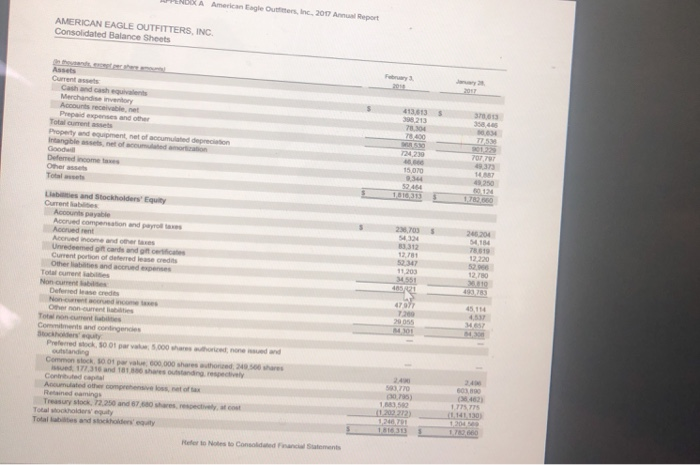

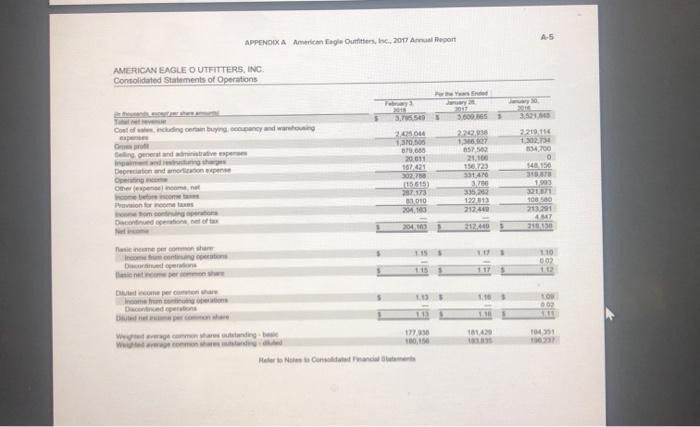

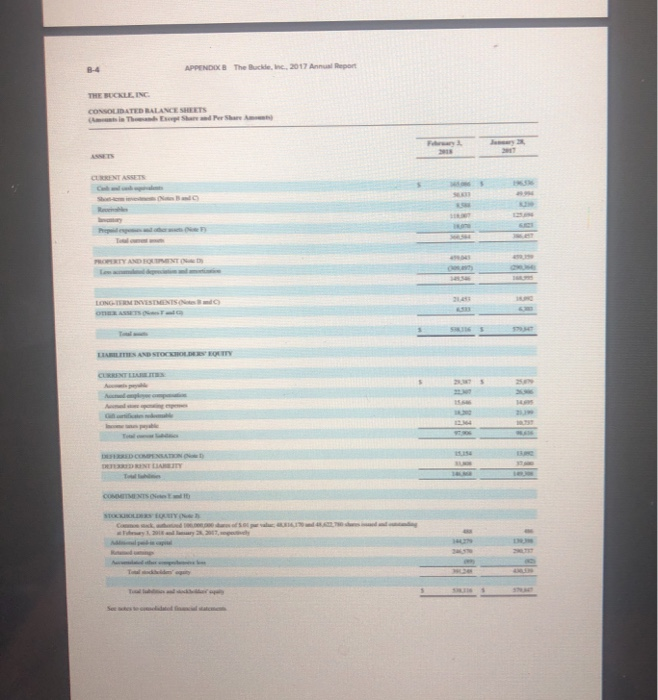

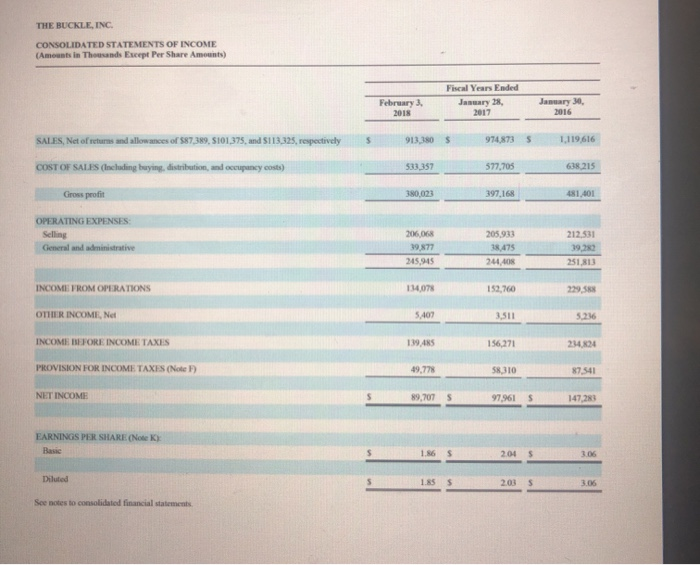

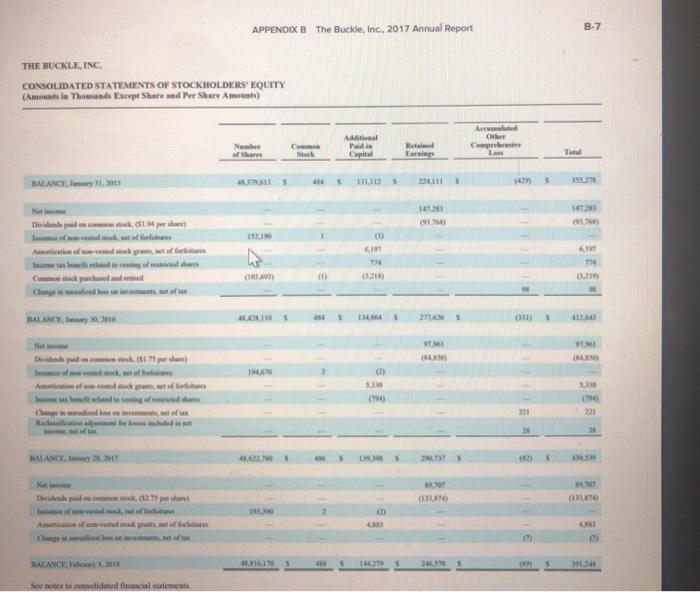

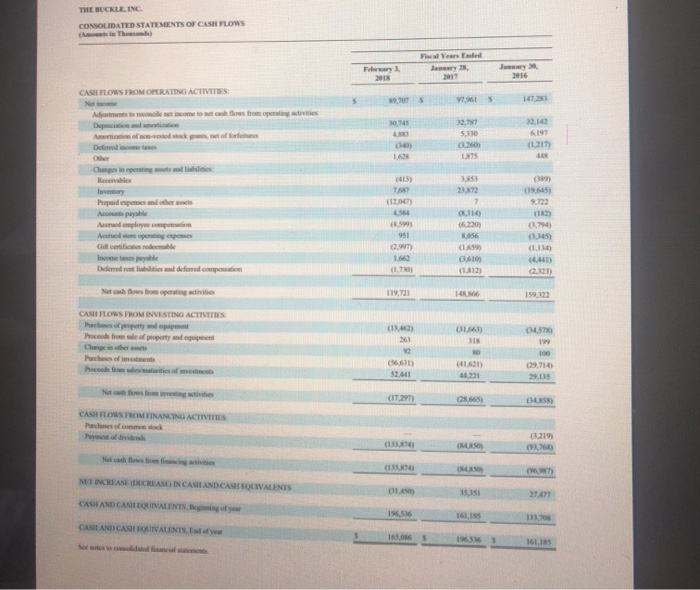

Check Financial information for American Eagle is presented in Appendix A at the end of the book, and financial information for Buckle is presented in Appendix B at the end of the book Required: 1-a. Calculate the current ratio for both companies for the year ended February 3, 2018. (Round your answers to 2 decimal places.) American Eagle Buckle Current Ratio 3.40 1-b. Which company has the better ratio? American Eagle Buckle 2-a. Calculate the acid-test (quick) ratio for both companies for the year ended February 3, 2018. (Round your answers to 2 decimal places.) Prev 1 of 1 # Next Che 2-a. Calculate the acid-test (quick) ratio for both companies for the year ended February 3, 2018. (Round your answers to 2 decimal places.) American Eagle Buckle Acid-Test Ratio 2.b. Which company has the better ratio? American Eagle Buckle 3. How would the purchase of additional inventory with accounts payable affect the current ratio for these two companies? The purchase of additional inventory wil the current ratio APPENDIX A Am Eagle Outfitters, Inc. 2017 Annual Report AMERICAN EAGLE OUTFITTERS, INC Consolidated Statements of Operations Costing b 3.795.505 y andro 2702 879,95 20.617 8572 21.166 156.723 5 Conce Other moment (15,515) 28717 12213 come from on e Dosto 204.100 D income on here www 177 No Canada APPENDXB The Bucking 2017 Annual Report THE BUCKLEIN CONSOLIDATED BALANCE SHEETS CLIENT ASSETS Y AND ROLLEN LONG INVESTMENTS ASSETS DIDINTITY COMMITMENTS STOCKHOLDE DOS 10. THE BUCKLE, INC. CONSOLIDATED STATEMENTS OF INCOME (Amounts in Thousands Ecept Per Share Amounts) Final Year Ended February 3, January 28, January 30, 2016 2017 SALES, Net of returns and allowances of $87,389, 5101,375, and $113,325, respectively 913.380 $ 974,8735 1,119,616 COST OF SALES (Including buying, distribution, and occupancy costs) 583.357 577,705 618 215 Gross profit 10021 397,168 481.401 OPERATING EXPENSES: Selling General and administrative 205.913 212.531 2060 1977 245.945 INCOME FROM OPERATIONS 134,078 152,760 OTHER INCOME, Net 5.407 3.511 INCOME BEFORE INCOME TAXES 119. 45 156,271 PROVISION FOR INCOME TAXES (Note ) 49.77 5310 87 541 NET INCOME 97.961 147.283 EARNINGS PER SHARE (Note: Diluted See notes to consolidated financial statements APPENDIX B The Buckle, Inc., 2017 Annual Report THE BUCKLE INC. CONSOLIDATED STATEMENTS OF STOCKHOLDERS' EQUITY (Amounts in Thousands Except Share and Per Share Amounts) Accumulated Number Carbone BALANCE. J y 31, 2015 379.613 5 454531112322111 $ (429) 1473 (93.768 147233 093765 Dividende puiden (51. share) Lo ckstofforbres Amortinti oferited stock rata, te factures Income benefited to vesting of red dres Com ock purchased and retired Change in weird low on investments, stofu (101 ) BALANCE, ary 30, 2016 1105 1548645 277.6265 (331) 5 41260 97,91 (USO) ( S SO) Dividend paid en c o ck. (51.75 perse ) lance of stock, et offres Amorti v es of me Income be d te vesting of restricted Chung in de ve n eto Reclassificatio n for de met BALANCE, Juary 2017 ( 14) Dividends poids come stock. (12.75 persa) leno vested stock, ndoff Amortization of nevested stock grans, et offres Change in a lowevestments, nct of BALANCE, February 3, 2018 13 See notes to consolidated financial statements. THE BUCKLE INC. CONSOLIDATED STATEMENTS OF CASH FLOWS iThu ) C CASE FLOW FROM OPERATING ACTIVITIES 1472 A c est c ash flows from tives 32.142 Deprecated Awo Deferred - deck of 5.130 (121) (13) 12 (120) A (31) 62200 Iwwery Pradespeses and payable Academy posting Gift certifierade In be Dedr a l defend compas (19.645) 9.7 (182) (1,7 ) 5) (11) 440) (599 951 . ) A (1.65 1. Net cash flow pr activities 159.322 (11) (34,57 CASH FLOWS FROM INVESTING ACTIVITIES so property Procedere property and Change in the Pacements Pec e s of 21 (661) (61621 714) (INT) CS 034 ) CASE FLOUSOM FINANCING ACTIVITIES Pecsomok 3219 ( 4) NET INCREASE DECREASE INCASEANDCAST EQUIVALENTS 0140) 15150 27.477 CASE AND CASIITQUIVALENTS. 1956 11 CASI AND CASI QUIVALENTS.deyewe 1965 Check Financial information for American Eagle is presented in Appendix A at the end of the book, and financial information for Buckle is presented in Appendix B at the end of the book Required: 1-a. Calculate the current ratio for both companies for the year ended February 3, 2018. (Round your answers to 2 decimal places.) American Eagle Buckle Current Ratio 3.40 1-b. Which company has the better ratio? American Eagle Buckle 2-a. Calculate the acid-test (quick) ratio for both companies for the year ended February 3, 2018. (Round your answers to 2 decimal places.) Prev 1 of 1 # Next Che 2-a. Calculate the acid-test (quick) ratio for both companies for the year ended February 3, 2018. (Round your answers to 2 decimal places.) American Eagle Buckle Acid-Test Ratio 2.b. Which company has the better ratio? American Eagle Buckle 3. How would the purchase of additional inventory with accounts payable affect the current ratio for these two companies? The purchase of additional inventory wil the current ratio APPENDIX A Am Eagle Outfitters, Inc. 2017 Annual Report AMERICAN EAGLE OUTFITTERS, INC Consolidated Statements of Operations Costing b 3.795.505 y andro 2702 879,95 20.617 8572 21.166 156.723 5 Conce Other moment (15,515) 28717 12213 come from on e Dosto 204.100 D income on here www 177 No Canada APPENDXB The Bucking 2017 Annual Report THE BUCKLEIN CONSOLIDATED BALANCE SHEETS CLIENT ASSETS Y AND ROLLEN LONG INVESTMENTS ASSETS DIDINTITY COMMITMENTS STOCKHOLDE DOS 10. THE BUCKLE, INC. CONSOLIDATED STATEMENTS OF INCOME (Amounts in Thousands Ecept Per Share Amounts) Final Year Ended February 3, January 28, January 30, 2016 2017 SALES, Net of returns and allowances of $87,389, 5101,375, and $113,325, respectively 913.380 $ 974,8735 1,119,616 COST OF SALES (Including buying, distribution, and occupancy costs) 583.357 577,705 618 215 Gross profit 10021 397,168 481.401 OPERATING EXPENSES: Selling General and administrative 205.913 212.531 2060 1977 245.945 INCOME FROM OPERATIONS 134,078 152,760 OTHER INCOME, Net 5.407 3.511 INCOME BEFORE INCOME TAXES 119. 45 156,271 PROVISION FOR INCOME TAXES (Note ) 49.77 5310 87 541 NET INCOME 97.961 147.283 EARNINGS PER SHARE (Note: Diluted See notes to consolidated financial statements APPENDIX B The Buckle, Inc., 2017 Annual Report THE BUCKLE INC. CONSOLIDATED STATEMENTS OF STOCKHOLDERS' EQUITY (Amounts in Thousands Except Share and Per Share Amounts) Accumulated Number Carbone BALANCE. J y 31, 2015 379.613 5 454531112322111 $ (429) 1473 (93.768 147233 093765 Dividende puiden (51. share) Lo ckstofforbres Amortinti oferited stock rata, te factures Income benefited to vesting of red dres Com ock purchased and retired Change in weird low on investments, stofu (101 ) BALANCE, ary 30, 2016 1105 1548645 277.6265 (331) 5 41260 97,91 (USO) ( S SO) Dividend paid en c o ck. (51.75 perse ) lance of stock, et offres Amorti v es of me Income be d te vesting of restricted Chung in de ve n eto Reclassificatio n for de met BALANCE, Juary 2017 ( 14) Dividends poids come stock. (12.75 persa) leno vested stock, ndoff Amortization of nevested stock grans, et offres Change in a lowevestments, nct of BALANCE, February 3, 2018 13 See notes to consolidated financial statements. THE BUCKLE INC. CONSOLIDATED STATEMENTS OF CASH FLOWS iThu ) C CASE FLOW FROM OPERATING ACTIVITIES 1472 A c est c ash flows from tives 32.142 Deprecated Awo Deferred - deck of 5.130 (121) (13) 12 (120) A (31) 62200 Iwwery Pradespeses and payable Academy posting Gift certifierade In be Dedr a l defend compas (19.645) 9.7 (182) (1,7 ) 5) (11) 440) (599 951 . ) A (1.65 1. Net cash flow pr activities 159.322 (11) (34,57 CASH FLOWS FROM INVESTING ACTIVITIES so property Procedere property and Change in the Pacements Pec e s of 21 (661) (61621 714) (INT) CS 034 ) CASE FLOUSOM FINANCING ACTIVITIES Pecsomok 3219 ( 4) NET INCREASE DECREASE INCASEANDCAST EQUIVALENTS 0140) 15150 27.477 CASE AND CASIITQUIVALENTS. 1956 11 CASI AND CASI QUIVALENTS.deyewe 1965