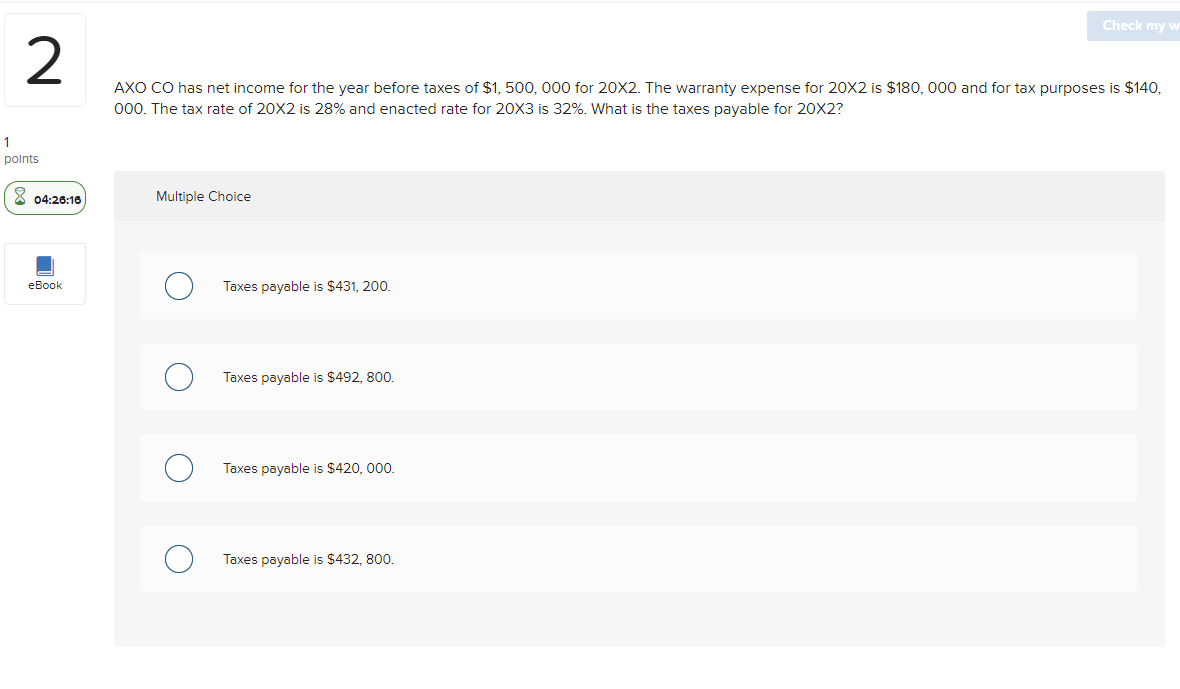

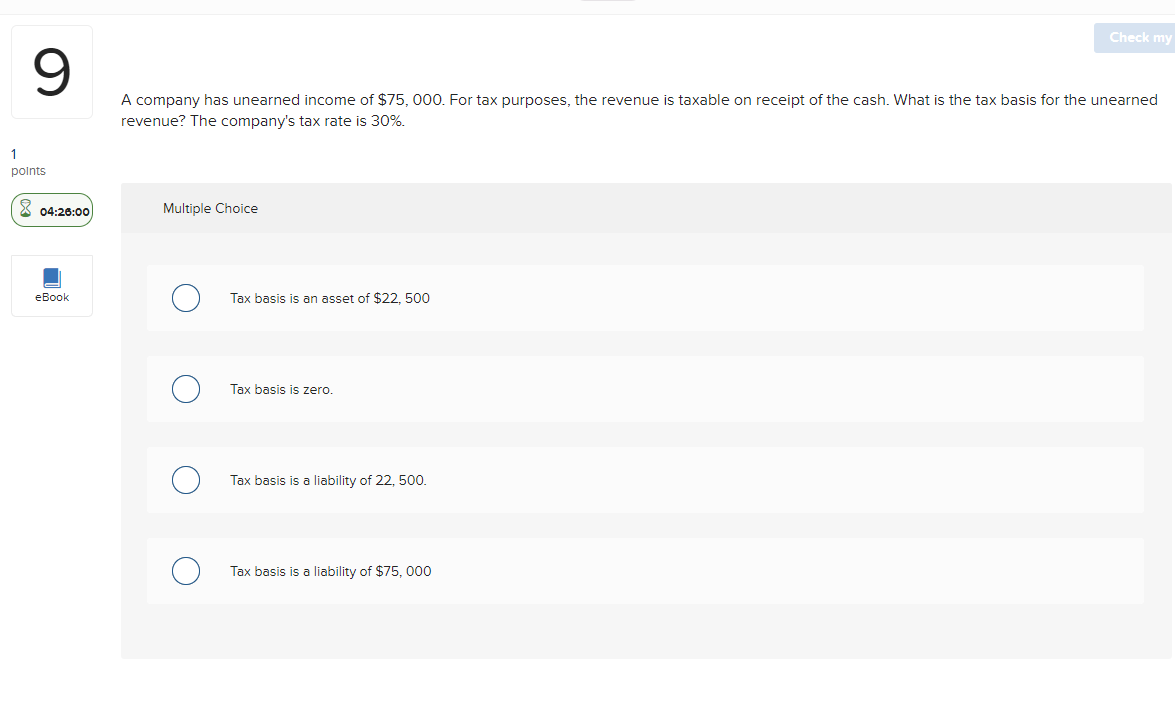

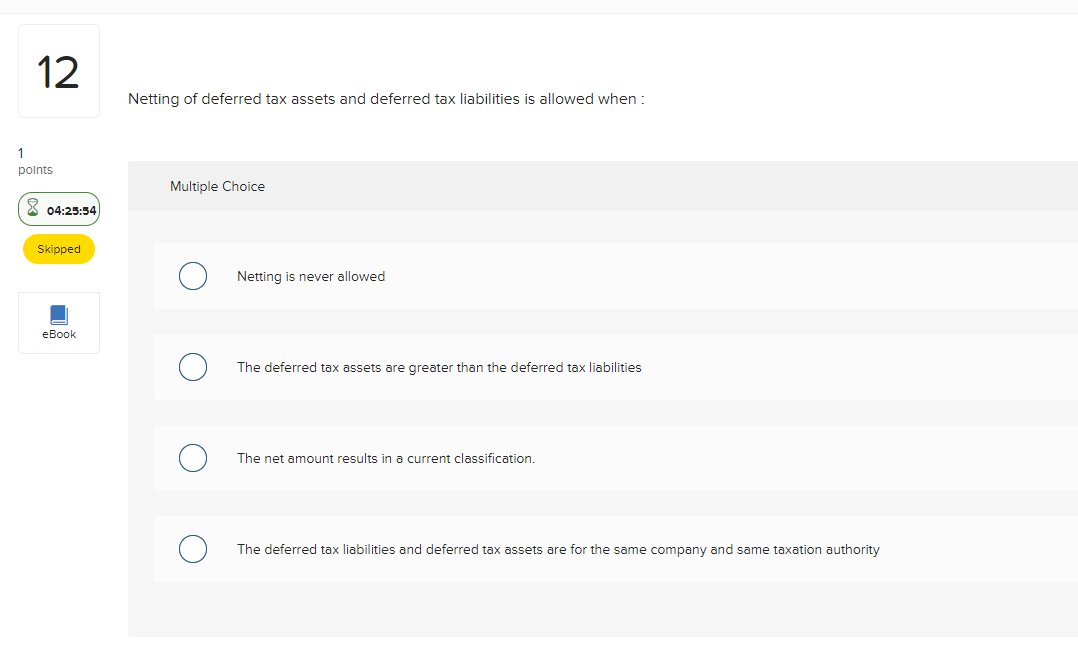

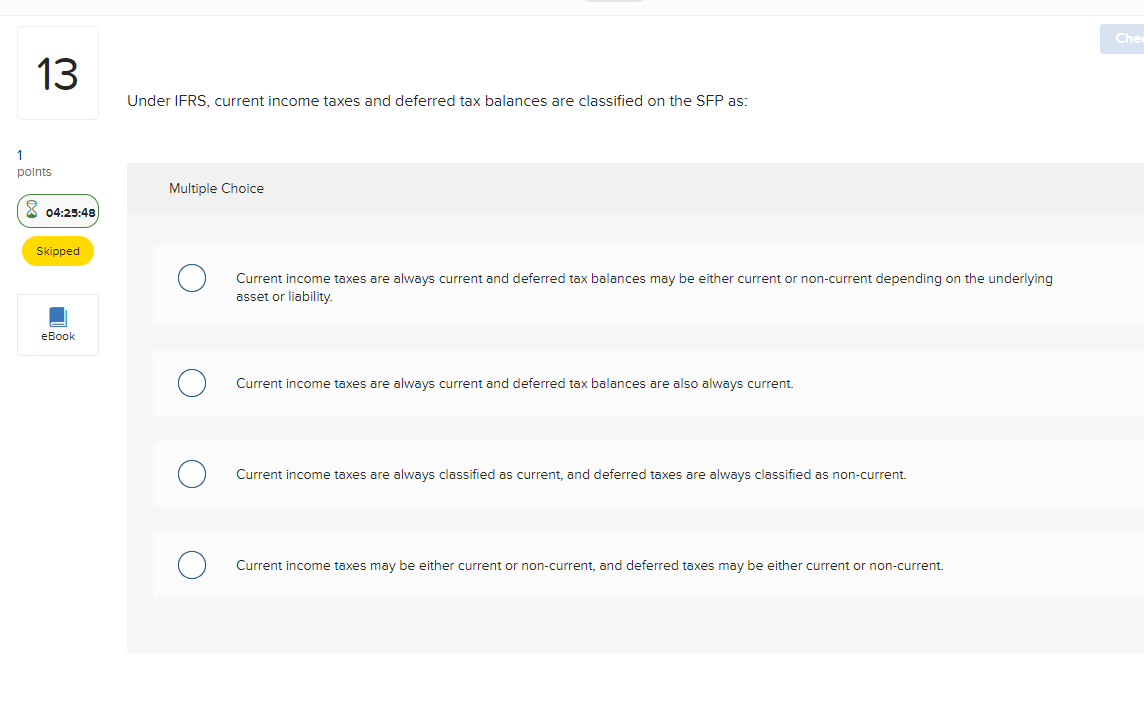

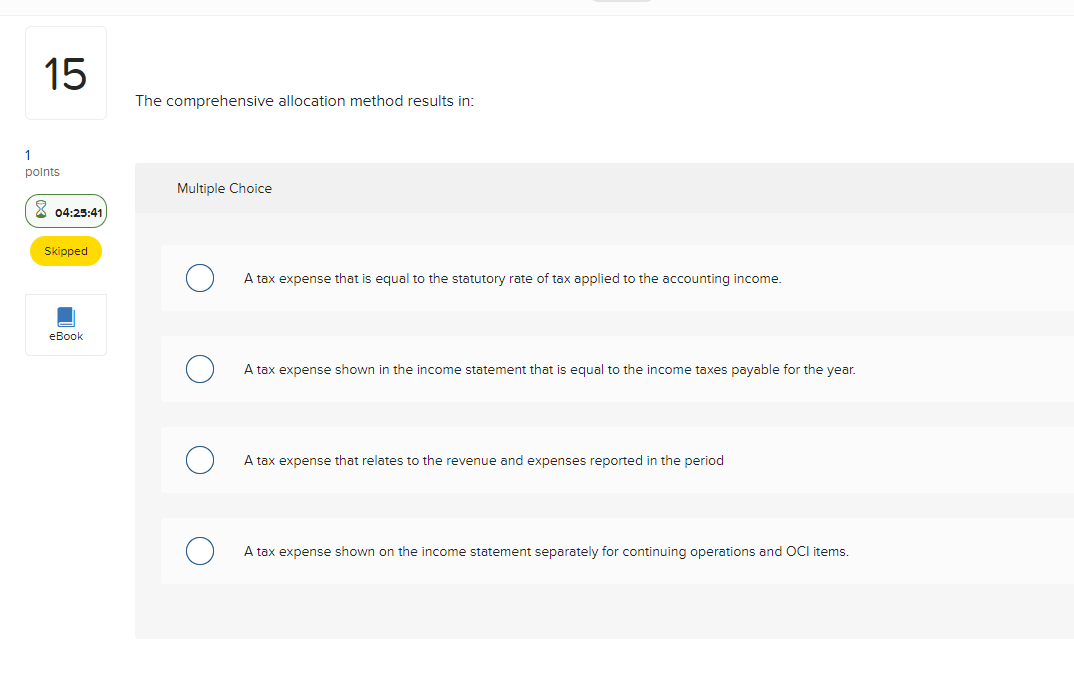

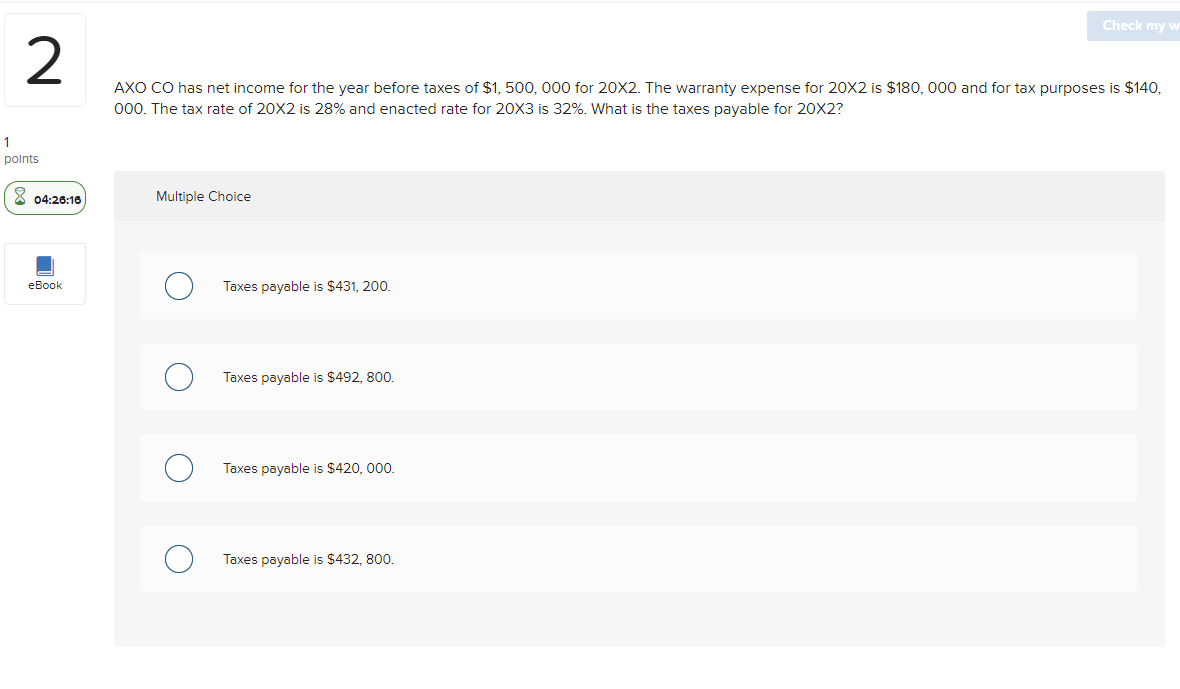

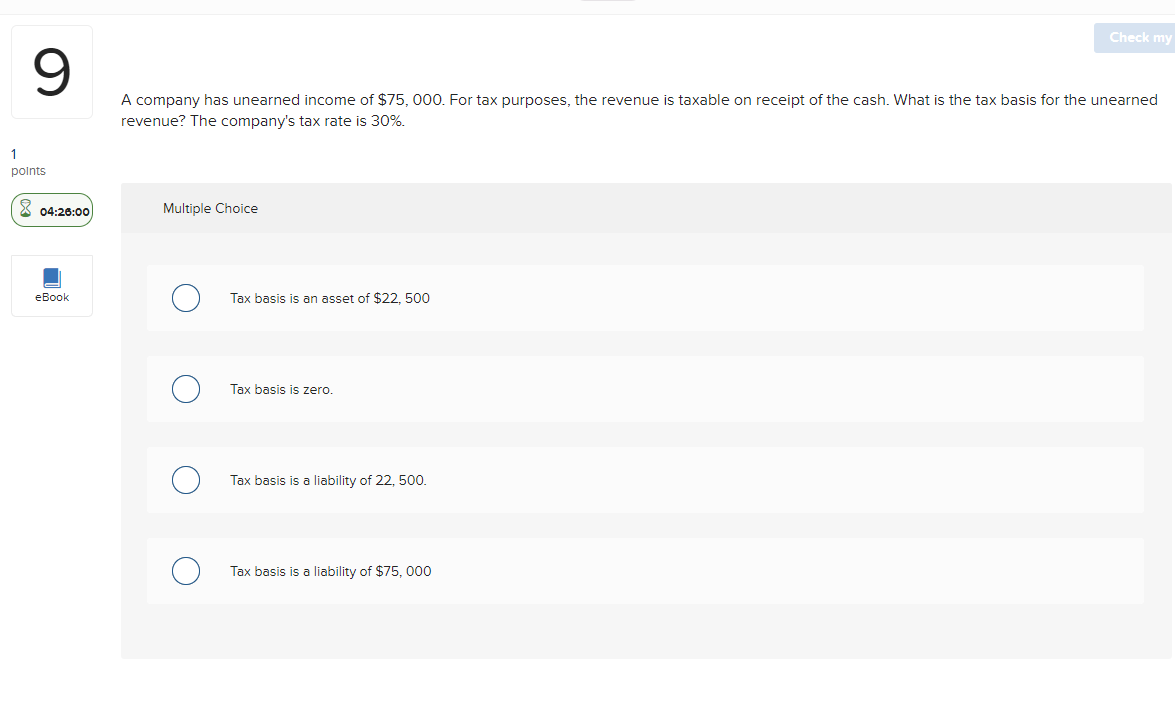

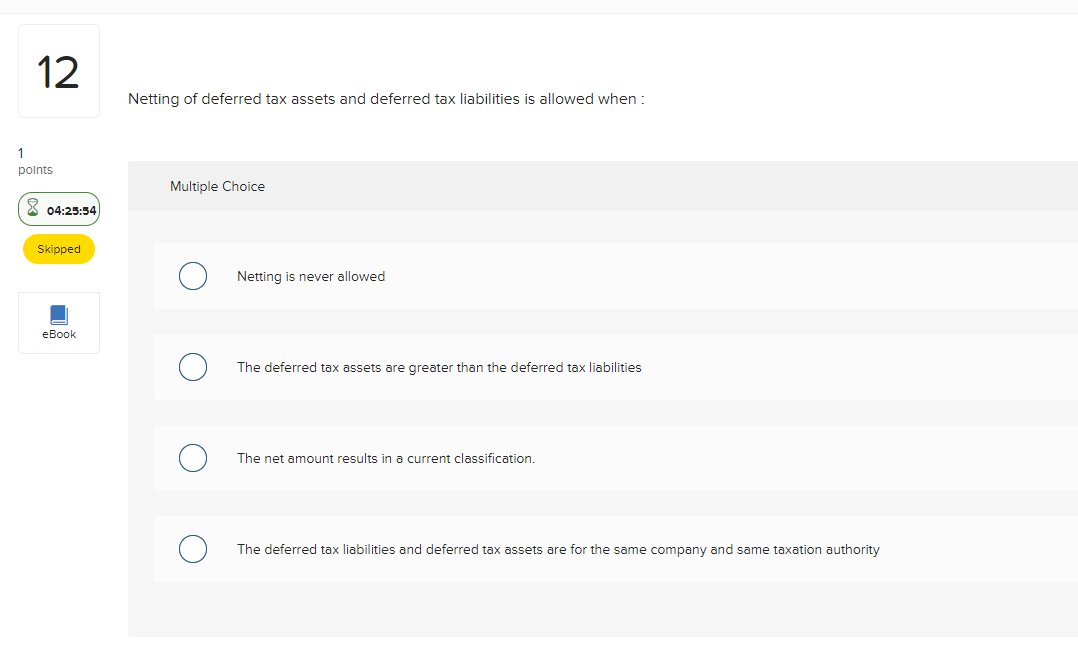

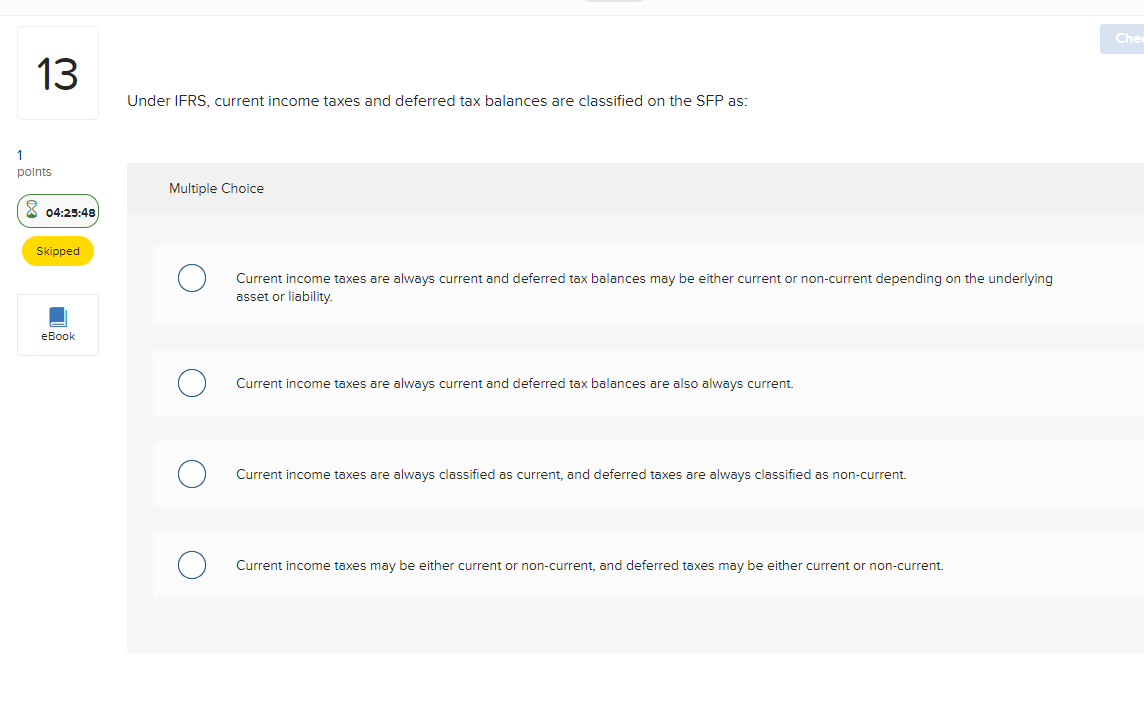

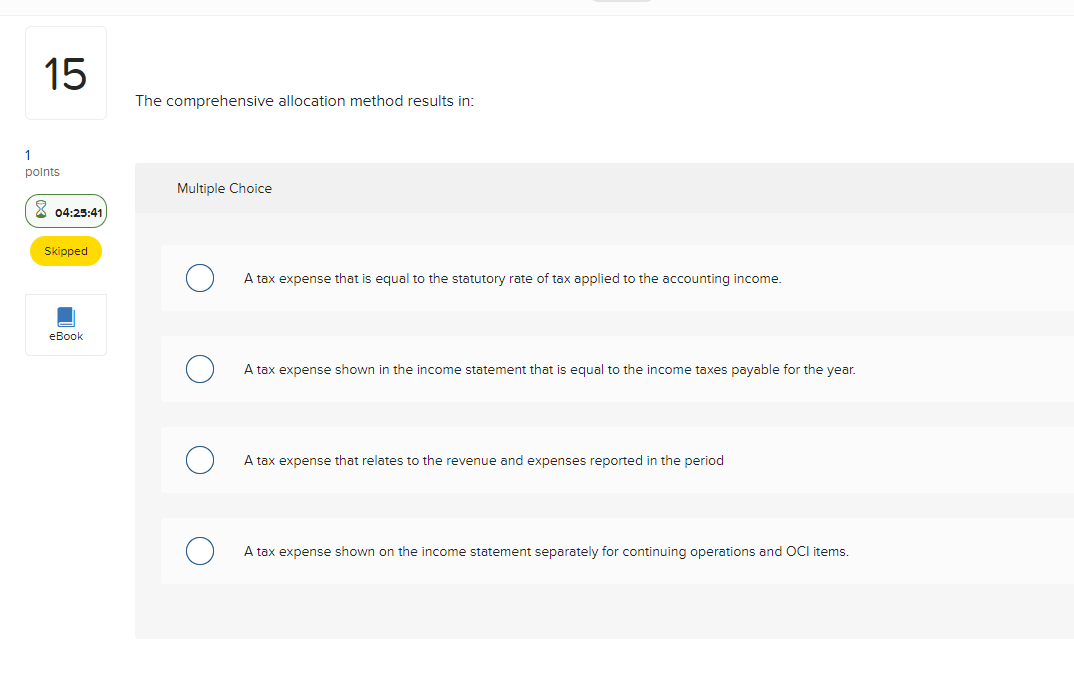

Check my w 2 AXO CO has net income for the year before taxes of $1,500,000 for 20X2. The warranty expense for 20X2 is $180,000 and for tax purposes is $140, 000. The tax rate of 20X2 is 28% and enacted rate for 20X3 is 32%. What is the taxes payable for 20x2? 1 points 04:26:16 Multiple Choice eBook Taxes payable is $431, 200. Taxes payable is $492, 800. Taxes payable is $420,000. Taxes payable is $432, 800. Check my 9 A company has unearned income of $75, 000. For tax purposes, the revenue is taxable on receipt of the cash. What is the tax basis for the unearned revenue? The company's tax rate is 30%. 1 points 8 04:28:00 Multiple Choice eBook Tax basis is an asset of $22, 500 Tax basis is zero. Tax basis is a liability of 22,500. O Tax basis is a liability of $75,000 12 Netting of deferred tax assets and deferred tax liabilities is allowed when : 1 points Multiple Choice 04:25:54 Skipped Netting is never allowed eBook The deferred tax assets are greater than the deferred tax liabilities The net amount results in a current classification. The deferred tax liabilities and deferred tax assets are for the same company and same taxation authority Chet 13 Under IFRS, current income taxes and deferred tax balances are classified on the SFP as: 1 points Multiple Choice X 04:25:48 Skipped Current income taxes are always current and deferred tax balances may be either current or non-current depending on the underlying asset or liability. eBook Current income taxes are always current and deferred tax balances are also always current. O O Current income taxes are always classified as current and deferred taxes are always classified as non-current. Current income taxes may be either current or non-current, and deferred taxes may be either current or non-current. 15 The comprehensive allocation method results in: 1 points Multiple Choice 04:25:41 Skipped A tax expense that is equal to the statutory rate of tax applied to the accounting income. eBook tax expense shown in the income statement that is equal to the income taxes payable for the year. A tax expense that relates to the revenue and expenses reported in the period A tax expense shown on the income statement separately for continuing operations and OCl items