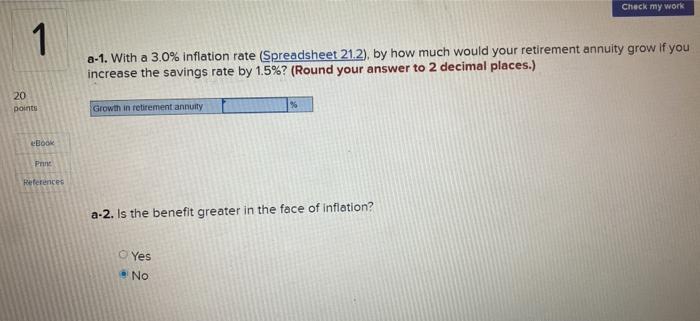

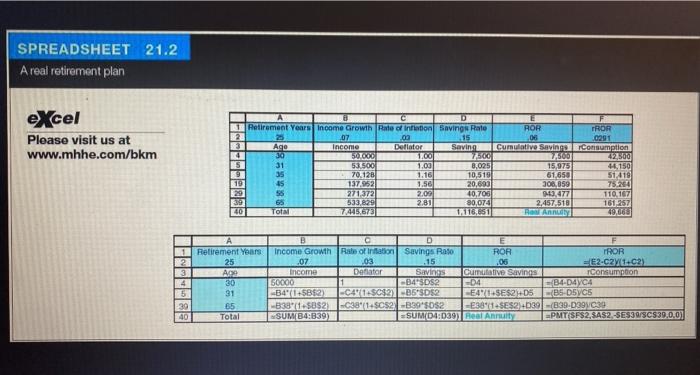

Check my work 1 a-1. With a 3.0% inflation rate (Spreadsheet 21.2), by how much would your retirement annuity grow if you increase the savings rate by 1.5%? (Round your answer to 2 decimal places.) 20 Doints Growth in retirement annuity % Book Prin References a-2. Is the benefit greater in the face of inflation? Yes No SPREADSHEET 21.2 A real retirement plan excel Please visit us at www.mhhe.com/bkm Retirement Years Income Grow Rate of infation Savings Rate ROR TROR 07 .00 15 08 0991 Age Income Deflator Saving Cumulative Saving Consumption 30 50.000 1.00 22.00 77560 42300 31 53.500 1.00 8,025 15,975 4,150 35 70.128 1.16 10,519 61.650 51.419 19 45 137,552 20,693 308,859 75204 55 271,372 2.00 40,700 9,477 110,167 65 533,829 2.81 80,074 2.457.518 161,257 40 1118,651 HANDEL 49.666 TO C D E 1 Retirement Years Income Growth Rate of inflation Savings Rato ROR TROR 2 25 .07 03 15 .06 EE2-C2-02) 3 A Income Deliator Savings Cumulative Savings Consumption 4 30 30000 -B4PSDS2 BA-DU4 5 31 -B415B2) -C41SC$20 B53052 E41SES2)405 B5-DSC5 30 65 -B381-5892)-C381.5CS-339 5052 -E38/1 SE$2.039 -839-029039 40 Total SUMB4:339) SUMD4D39) Best Annuity EPMTSF$2,3AS2-SSB0C530.0.0) Check my work 1 a-1. With a 3.0% inflation rate (Spreadsheet 21.2), by how much would your retirement annuity grow if you increase the savings rate by 1.5%? (Round your answer to 2 decimal places.) 20 Doints Growth in retirement annuity % Book Prin References a-2. Is the benefit greater in the face of inflation? Yes No SPREADSHEET 21.2 A real retirement plan excel Please visit us at www.mhhe.com/bkm Retirement Years Income Grow Rate of infation Savings Rate ROR TROR 07 .00 15 08 0991 Age Income Deflator Saving Cumulative Saving Consumption 30 50.000 1.00 22.00 77560 42300 31 53.500 1.00 8,025 15,975 4,150 35 70.128 1.16 10,519 61.650 51.419 19 45 137,552 20,693 308,859 75204 55 271,372 2.00 40,700 9,477 110,167 65 533,829 2.81 80,074 2.457.518 161,257 40 1118,651 HANDEL 49.666 TO C D E 1 Retirement Years Income Growth Rate of inflation Savings Rato ROR TROR 2 25 .07 03 15 .06 EE2-C2-02) 3 A Income Deliator Savings Cumulative Savings Consumption 4 30 30000 -B4PSDS2 BA-DU4 5 31 -B415B2) -C41SC$20 B53052 E41SES2)405 B5-DSC5 30 65 -B381-5892)-C381.5CS-339 5052 -E38/1 SE$2.039 -839-029039 40 Total SUMB4:339) SUMD4D39) Best Annuity EPMTSF$2,3AS2-SSB0C530.0.0)