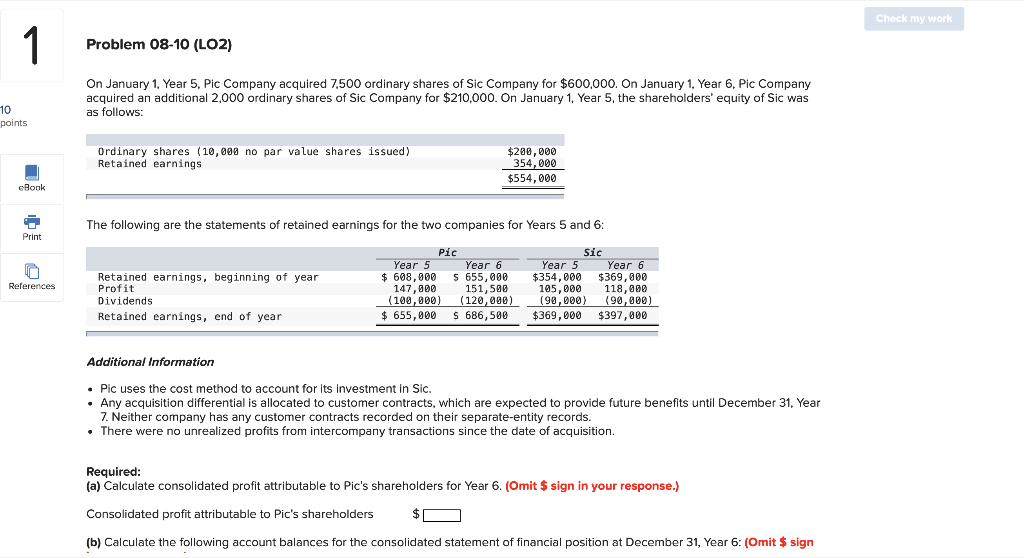

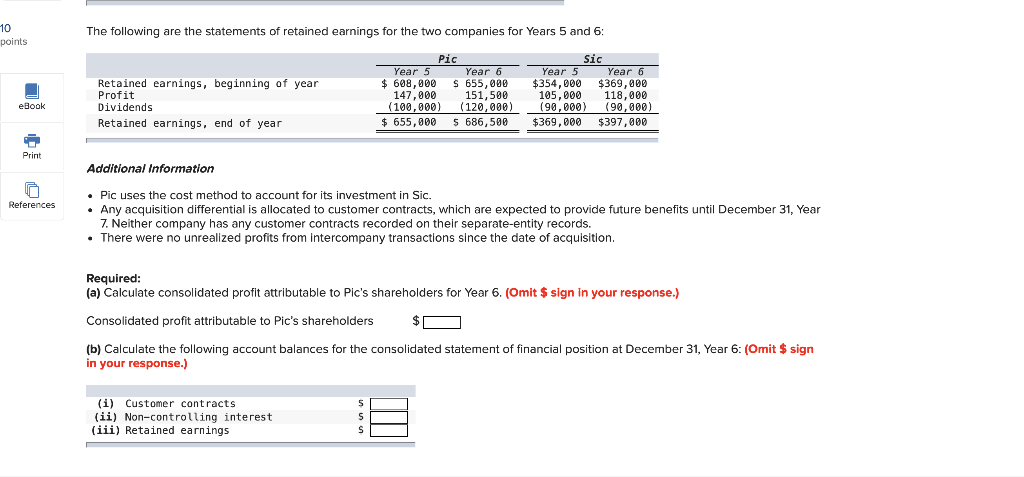

Check my work 1 Problem 08-10 (LO2) On January 1. Year 5. Pic Company acquired 7.500 ordinary shares of Sic Company for $600,000. On January 1, Year 6. Pic Company acquired an additional 2,000 ordinary shares of Sic Company for $210,000. On January 1, Year 5, the shareholders' equity of Sic was 10 points as follows: Ordinary shares (10,000 no par value shares issued) Retained earnings $200,000 354,000 $554,000 eBook The following are the statements of retained earnings for the two companies for Years 5 and 6: Print References Retained earnings, beginning of year Profit Dividends Retained earnings, end of year Pic Year 5 Year 6 $ 608,000 $ 655,000 147,000 151,500 (100,000) (120,000) $ 655,000 S 686,500 Sic Year 5 Year 6 $354,000 $369,000 105,000 118,000 (90,000) (90,000) $369,000 $397,000 Additional Information Pic uses the cost method to account for its investment in Sic. Any acquisition differential is allocated to customer contracts, which are expected to provide future benefits until December 31, Year Neither company has any customer contracts recorded on their separate-entity records. . There were no unrealized profits from intercompany transactions since the date of acquisition. Required: (a) Calculate consolidated profit attributable to Pic's shareholders for Year 6. (Omit $ sign in your response.) Consolidated profit attributable to Pic's shareholders (b) Calculate the following account balances for the consolidated statement of financial position at December 31, Year 6: (Omit $ sign 10 points The following are the statements of retained earnings for the two companies for Years 5 and 6: Pic Year 5 Year 6 $ 608,900 S 655,000 147,000 151,500 (100,000) (120,000) $ 655,800 $ 686,588 Retained earnings, beginning of year Profit Dividends Retained earnings, end of year Sic Year 5 Year 6 $354,000 $369,000 105,000 118,000 (90,000) (90,000) $369,000 $397,000 eBook Print Additional Information References Pic uses the cost method to account for its investment in Sic. Any acquisition differential is allocated to customer contracts, which are expected to provide future benefits until December 31, Year 7. Neither company has any customer contracts recorded on their separate-entity records. There were no unrealized profits from intercompany transactions since the date of acquisition. Required: (a) Calculate consolidated profit attributable to Pic's shareholders for Year 6. (Omit $ sign in your response.) Consolidated profit attributable to Pic's shareholders (b) Calculate the following account balances for the consolidated statement of financial position at December 31, Year 6: (Omit $ sign in your response.) (i) Customer contracts (ii) Non-controlling interest (iii) Retained earnings 5 5 S Check my work 1 Problem 08-10 (LO2) On January 1. Year 5. Pic Company acquired 7.500 ordinary shares of Sic Company for $600,000. On January 1, Year 6. Pic Company acquired an additional 2,000 ordinary shares of Sic Company for $210,000. On January 1, Year 5, the shareholders' equity of Sic was 10 points as follows: Ordinary shares (10,000 no par value shares issued) Retained earnings $200,000 354,000 $554,000 eBook The following are the statements of retained earnings for the two companies for Years 5 and 6: Print References Retained earnings, beginning of year Profit Dividends Retained earnings, end of year Pic Year 5 Year 6 $ 608,000 $ 655,000 147,000 151,500 (100,000) (120,000) $ 655,000 S 686,500 Sic Year 5 Year 6 $354,000 $369,000 105,000 118,000 (90,000) (90,000) $369,000 $397,000 Additional Information Pic uses the cost method to account for its investment in Sic. Any acquisition differential is allocated to customer contracts, which are expected to provide future benefits until December 31, Year Neither company has any customer contracts recorded on their separate-entity records. . There were no unrealized profits from intercompany transactions since the date of acquisition. Required: (a) Calculate consolidated profit attributable to Pic's shareholders for Year 6. (Omit $ sign in your response.) Consolidated profit attributable to Pic's shareholders (b) Calculate the following account balances for the consolidated statement of financial position at December 31, Year 6: (Omit $ sign 10 points The following are the statements of retained earnings for the two companies for Years 5 and 6: Pic Year 5 Year 6 $ 608,900 S 655,000 147,000 151,500 (100,000) (120,000) $ 655,800 $ 686,588 Retained earnings, beginning of year Profit Dividends Retained earnings, end of year Sic Year 5 Year 6 $354,000 $369,000 105,000 118,000 (90,000) (90,000) $369,000 $397,000 eBook Print Additional Information References Pic uses the cost method to account for its investment in Sic. Any acquisition differential is allocated to customer contracts, which are expected to provide future benefits until December 31, Year 7. Neither company has any customer contracts recorded on their separate-entity records. There were no unrealized profits from intercompany transactions since the date of acquisition. Required: (a) Calculate consolidated profit attributable to Pic's shareholders for Year 6. (Omit $ sign in your response.) Consolidated profit attributable to Pic's shareholders (b) Calculate the following account balances for the consolidated statement of financial position at December 31, Year 6: (Omit $ sign in your response.) (i) Customer contracts (ii) Non-controlling interest (iii) Retained earnings 5 5 S