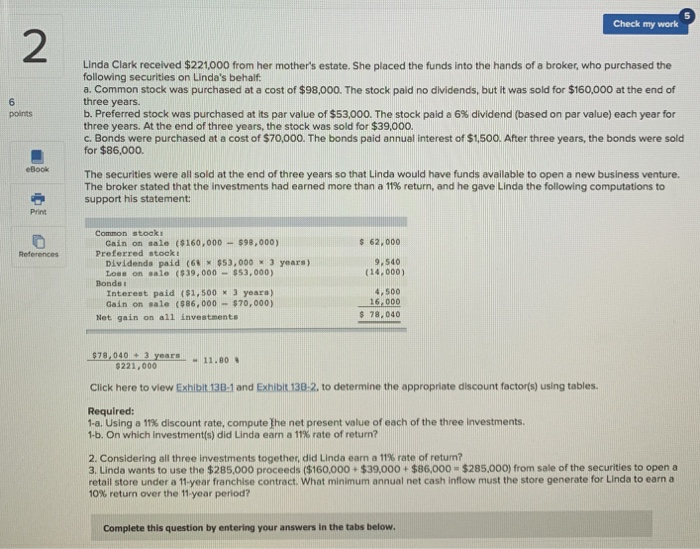

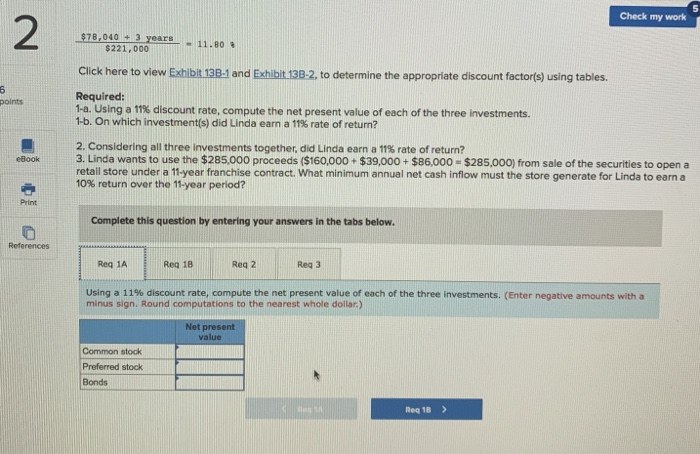

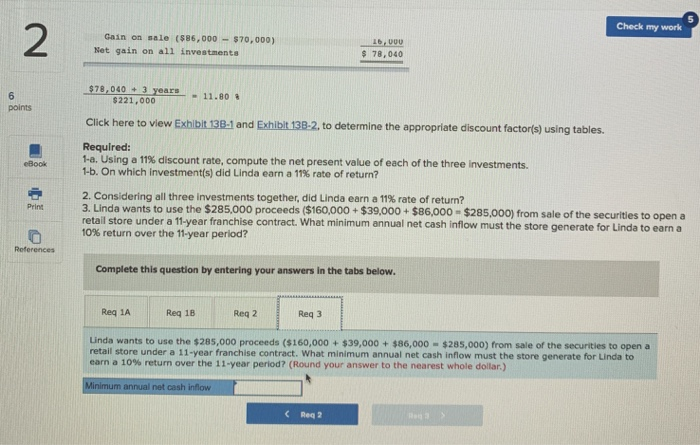

Check my work 2 Linda Clark received $221,000 from her mothers estate. She placed the funds into the hands of a broker, who purchased the following securities on Linda's behalf a. Common stock was purchased at a cost of $98,000. The stock paid no dividends, but it was sold for $160,000 at the end of three years. b. Preferred stock was purchased at its par value of $53,000. The stock paid a 6% dividend (based on par value) each year for three years. At the end of three years, the stock was sold for $39,000. c. Bonds were purchased at a cost of $70,000. The bonds paid annual interest of $1,500. After three years, the bonds were sold for $86,000. 6 points eBoo k The securities were all sold at the end of three years so that Linda would have funds available to open a new business venture. The broker stated that the investments had earned more than a 11% return, and he gave Linda the following computations to support his statement Print Common stock $ 62,000 Cain on sale ($160,000-$98,000) Preferred stock References Dividends paid (6 $53,000 x 3 years) Loss on sale ($39,000-$53,000) 9 540 (14-000) Bonds i 4,500 16/000 s 78,040 Interest paid ($1,500 3 years) Gain on sale ($86,000-$70,000) Net gain on all investments $78,040 + 3 years. -11.00 8221,000 Click here to view Exhibit 13B-1 and Exhibit 138-2. to determine the appropriate discount factors) using tables Required: 1.a. Using a 11% discount rate, compute]he net present value of each of the three investments. 1-b. On which investment(s) did Linda earn a 11% rate of return? 2. Considering all three investments together, did Linda earn a 11% rate of return? 3. Linda wants to use the $285,000 proceeds ($160,000 $39,000 $86,000- $285,000) from sale of the securities to open a retail store under a 11 year franchise contract. What minimum annual net cash inflow must the store generate for Linda to earn a 10% return over the 11-year period? Complete this question by entering your answers in the tabs below. Check my work 2 $78,040 +3 yeare .11.8 8-0639 1.00ea -I.60. Click here to view Exhibit 13B-1 and Exhibit 13B-2, to determine the appropriate discount factor(s) using tables. Required 1-a Using a 11% discount rate, compute the net present value of each of the three investments. 1-b on which investments) did Linda earn a 11% rate of return? points 2. Considering all three investments together, did Linda earn a 11% rate of return? 3. Linda wants to use the $285,000 proceeds ($160,000 + $39,000 + $86,000 = $285,000) from sale of the securities to open a retail store under a 11-year franchise contract. What minimum annual net cash inflow must the store generate for Linda to earn a 10% return over the 11-year period? eBook Print Complete this question by entering your answers in the tabs below. References Req 1A Req 18 Req 2 Req 3 Using a 11% discount rate, compute the net present value of each of the three investments. (Enter negative amounts with a minus sign. Round computations to the nearest whole dollar.) Net present Common stock Preferred stock Bonds Req 18 Check my work Gain on sale ($86,000 $70,000) Net gain on all investments b,000 78,040 Goms 478 031, 0 $221,000 points Click here to view Exhibit 138-1 and Exhiblt 138-2, to determine the appropriate discount factors) using tables Required 1-a. Using a 11% discount rate, compute the net present value of each of the three investments. 1-b. On which investment(s) did Linda earn a 11% rate of return? eBook 2. Considering all three investments together, did Linda earn a 11% rte of return? 3. Linda wants to use the $285,000 proceeds ($160,000+$39,000+$86,000 $285,000) from sale of the securities to open a retail store under a 11-year franchise contract. What minimum annual net cash inflow must the store generate for Linda to earn a 10% return over the 11-year period? Print References Complete this question by entering your answers in the tabs below. Req 1A Req 2 Req 18 Req 3 unda wants to use the $285,000 retail store under a 11-year franchise contract. What minimum annual net cash inflow must the store generate for Linda to earn a 10% return over the 11-year period? (Round your answer to the nearest whole dollar.) proceeds ($160,000 + $39,000+$86,000 - $285,000) from sale of the securities to open a C Req 2