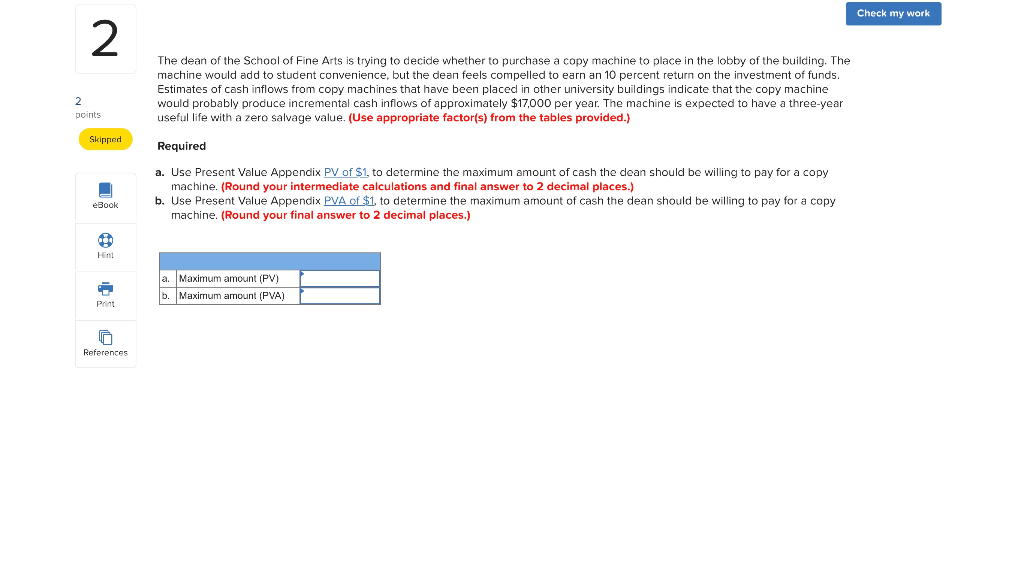

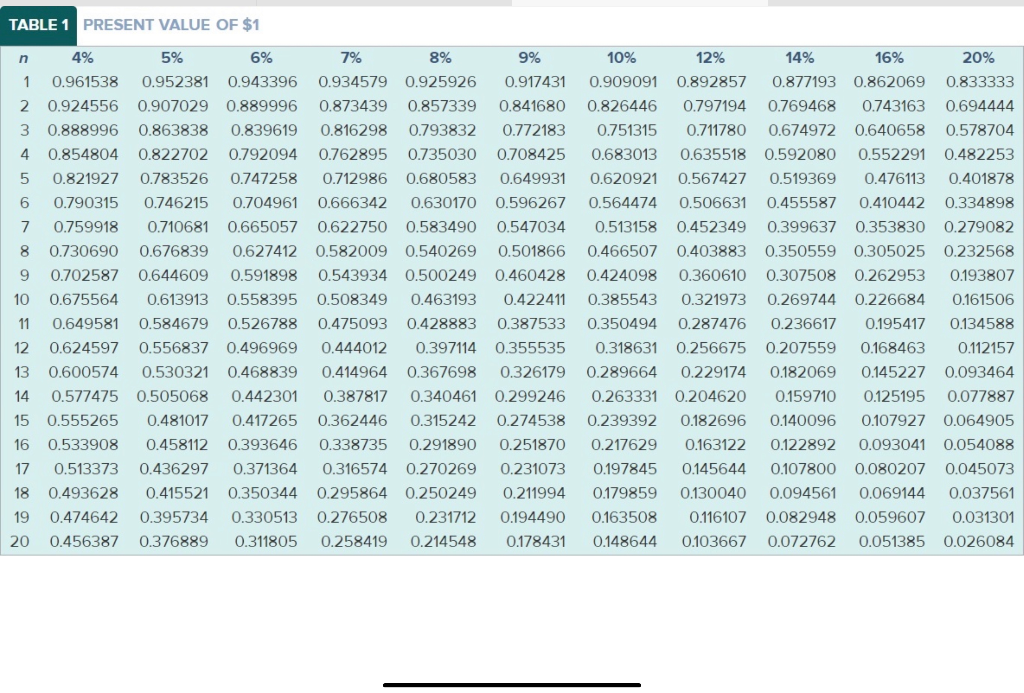

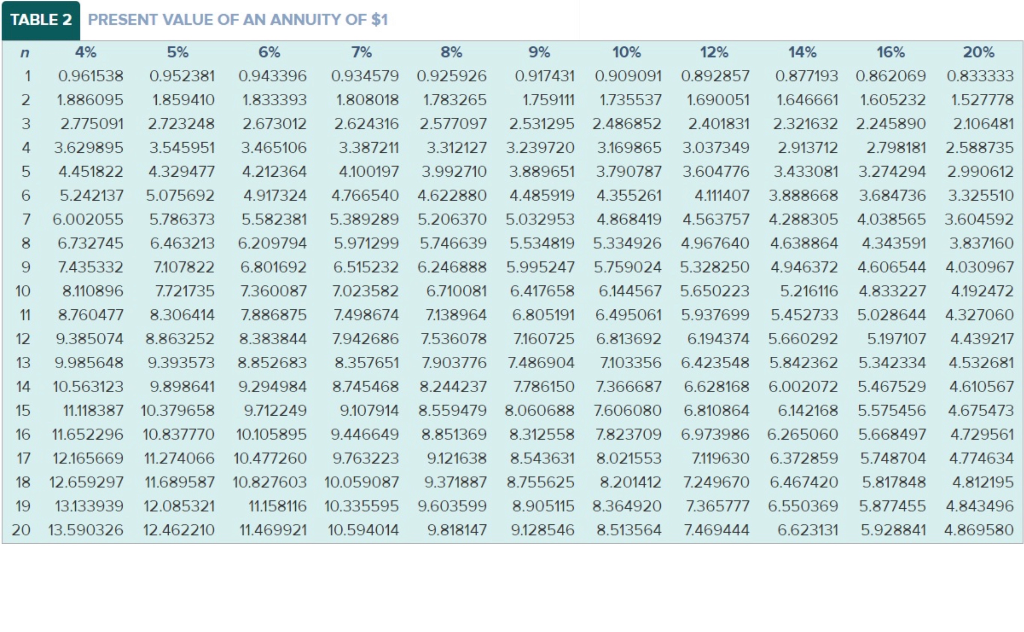

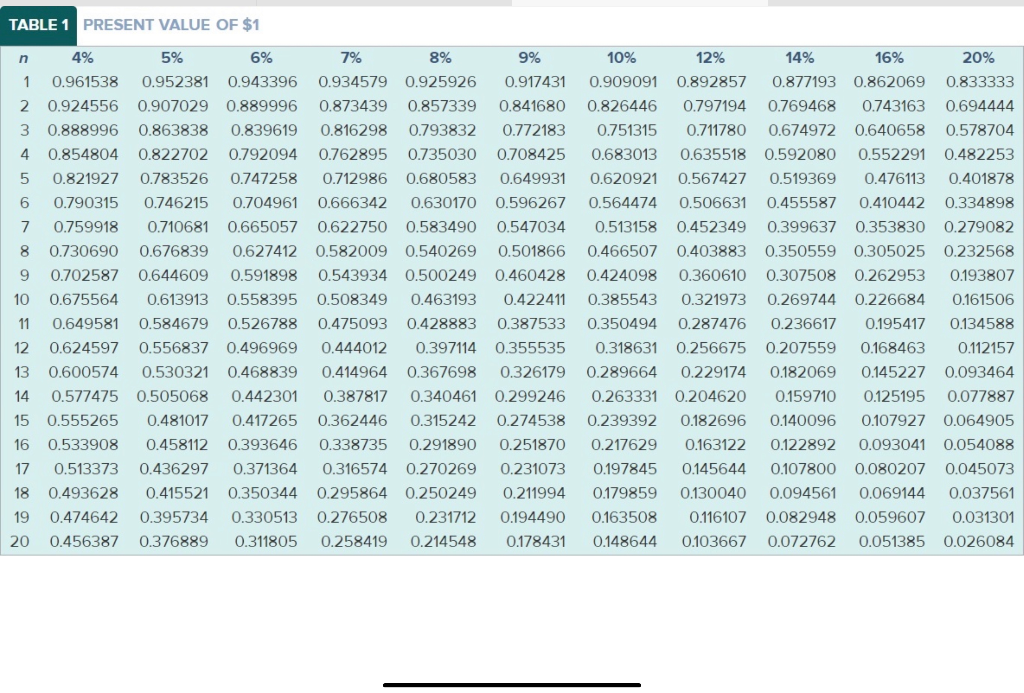

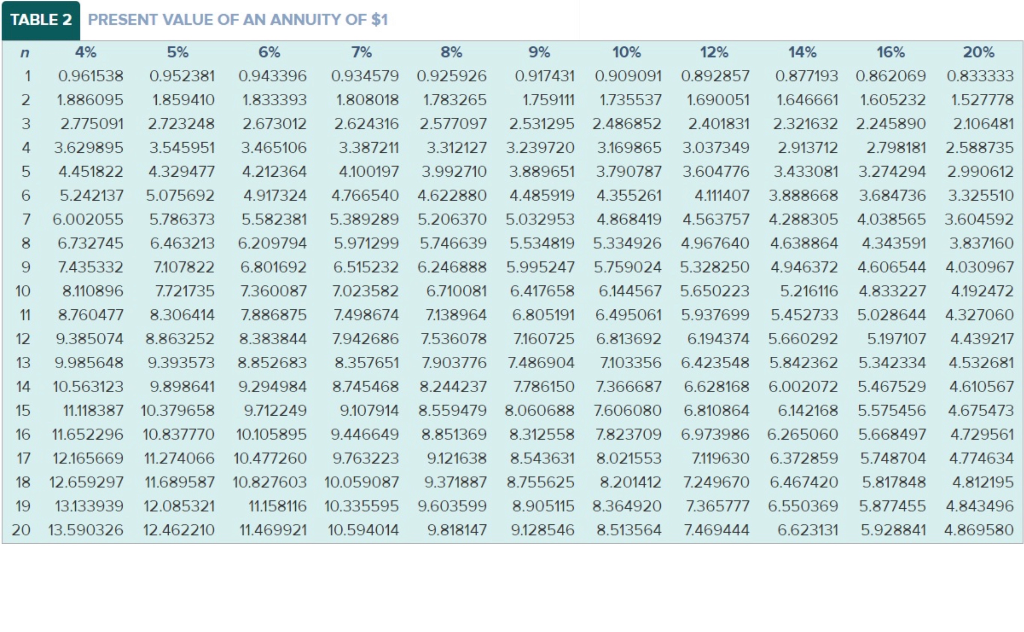

Check my work 2 The dean of the School of Fine Arts is trying to decide whether to purchase a copy machine place in the lobby of the building. The machine would add to student convenience, but the dean feels compelled to earn an 10 percent return on the investment of funds. Estimates of cash inflows from copy machines that have been placed in other university buildings indicate that the copy machine would probably produce incremental cash inflows of approximately $17,000 per year. The machine is expected to have a three-year useful life with a zero salvage value. (Use appropriate factor(s) from the tables provided.) 2. points Skipped Required a. Use Present Value Appendix PV of $1 to determine the maximum amount of cash the dean should be willing to pay for a copy machine. (Round your intermediate calculations and final answer to 2 decimal places.) b. Use Present Value Appendix PVA of $1, to determine the maximum amount of cash the dean should be willing to pay for a copy machine. (Round your final answer to 2 decimal places.) eBook Hint a. Maximum amount (PV) b. Maxirrium amount (PVA) Print References TABLE 1 PRESENT VALUE OF $1 n 1 2 3 4 5 6 7 8 9 10 4% 5% 6% 0.961538 0.952381 0.943396 0.924556 0.907029 0.889996 0.888996 0.863838 0.839619 0.854804 0.822702 0.792094 0.821927 0.783526 0.747258 0.790315 0.746215 0.704961 0.759918 0.710681 0.665057 0.730690 0.676839 0.627412 0.702587 0.644609 0.591898 0.675564 0.613913 0.558395 0.649581 0.584679 0.526788 0.624597 0.556837 0.496969 0.600574 0.530321 0.468839 0.577475 0.505068 0.442301 0.555265 0.481017 0.417265 0.533908 0.458112 0.393646 0.513373 0.436297 0.371364 0.493628 0.415521 0.350344 0.474642 0.395734 0.330513 0.456387 0.376889 0.311805 7% 8% 0.934579 0.925926 0.873439 0.857339 0.816298 0.793832 0.762895 0.735030 0.712986 0.680583 0.666342 0.630170 0.622750 0.583490 0.582009 0.540269 0.543934 0.500249 0.508349 0.463193 0.475093 0.428883 0.444012 0.397114 0.414964 0.367698 0.387817 0.340461 0.362446 0.315242 0.338735 0.291890 0.316574 0.270269 0.295864 0.250249 0.276508 0.231712 0.258419 0.214548 9% 0.917431 0.841680 0.772183 0.708425 0.649931 0.596267 0.547034 0.501866 0.460428 0.422411 0.387533 0.355535 0.326179 0.299246 0.274538 0.251870 0.231073 0.211994 0.194490 0.178431 10% 12% 0.909091 0.892857 0.826446 0.797194 0.751315 0.711780 0.683013 0.635518 0.620921 0.567427 0.564474 0.506631 0.513158 0.452349 0.466507 0.403883 0.424098 0.360610 0.385543 0.321973 0.350494 0.287476 0.318631 0.256675 0.289664 0.229174 0.263331 0.204620 0.239392 0.182696 0.217629 0.163122 0.197845 0.145644 0.179859 0.130040 0.163508 0.116107 0.148644 0.103667 14% 16% 20% 0.877193 0.862069 0.833333 0.769468 0.743163 0.694444 0.674972 0.640658 0.578704 0.592080 0.552291 0.482253 0.519369 0.476113 0.401878 0.455587 0.410442 0.334898 0.399637 0.353830 0.279082 0.350559 0.305025 0.232568 0.307508 0.262953 0.193807 0.269744 0.226684 0.161506 0.236617 0.195417 0.134588 0.207559 0.168463 0.112157 0.182069 0.145227 0.093464 0.159710 0.125195 0.077887 0.140096 0.107927 0.064905 0.122892 0.093041 0.054088 0.107800 0.080207 0.045073 0.094561 0.069144 0.037561 0.082948 0.059607 0.031301 0.072762 0.051385 0.026084 11 12 13 14 15 16 17 18 19 20 TABLE 2 PRESENT VALUE OF AN ANNUITY OF $1 1 7 n 4% 0.961538 2 1.886095 3 2.775091 4 3.629895 5 4.451822 6 5.242137 6.002055 8 6.732745 9 7.435332 10 8.110896 11 8.760477 12 9.385074 13 9.985648 14 10.563123 15 11.118387 16 11.652296 17 12.165669 18 12.659297 19 13.133939 20 13.590326 5% 6% 0.952381 0.943396 1.859410 1.833393 2.723248 2.673012 3.545951 3.465106 4.329477 4.212364 5.075692 4.917324 5.786373 5.582381 6.463213 6.209794 7.107822 6.801692 7.721735 7.360087 8.306414 7.886875 8.863252 8.383844 9.393573 8.852683 9.898641 9.294984 10.379658 9.712249 10.837770 10.105895 11.274066 10.477260 11.689587 10.827603 12.085321 11.158116 12.462210 11.469921 7% 8% 9% 10% 12% 14% 0.934579 0.925926 0.917431 0.909091 0.892857 0.877193 1.808018 1.783265 1.759111 1.735537 1.690051 1.646661 2.624316 2.577097 2.531295 2.486852 2.401831 2.321632 3.387211 3.312127 3.239720 3.169865 3.037349 2.913712 4.100197 3.992710 3.889651 3.790787 3.604776 3.433081 4.766540 4.622880 4.485919 4.355261 4.111407 3.888668 5.389289 5.206370 5.032953 4.868419 4.563757 4.288305 5.971299 5.746639 5.534819 5.334926 4.967640 4.638864 6.515232 6.246888 5.995247 5.759024 5.328250 4.946372 7.023582 6.710081 6.417658 6.144567 5.650223 5.216116 7.498674 7.138964 6.805191 6.495061 5.937699 5.452733 7.942686 7.536078 7.160725 6.813692 6.194374 5.660292 8.357651 7.903776 7.486904 7.103356 6.423548 5.842362 8.745468 8.244237 7.786150 7.366687 6.628168 6.002072 9.107914 8.559479 8.060688 7.606080 6.810864 6.142168 9.446649 8.851369 8.312558 7.823709 6.973986 6.265060 9.763223 9.121638 8.543631 8.021553 7.119630 6.372859 10.059087 9.371887 8.755625 8.201412 7.249670 6.467420 10.335595 9.603599 8.905115 8.364920 7.365777 6.550369 10.594014 9.818147 9.128546 8.513564 7.469444 6.623131 16% 20% 0.862069 0.833333 1.605232 1.527778 2.245890 2.106481 2.798181 2.588735 3.274294 2.990612 3.684736 3.325510 4.038565 3.604592 4.343591 3.837160 4.606544 4.030967 4.833227 4.192472 5.028644 4.327060 5.197107 4.439217 5.342334 4.532681 5.467529 4.610567 5.575456 4.675473 5.668497 4.729561 5.748704 4.774634 5.817848 4.812195 5.877455 4.843496 5.928841 4.869580