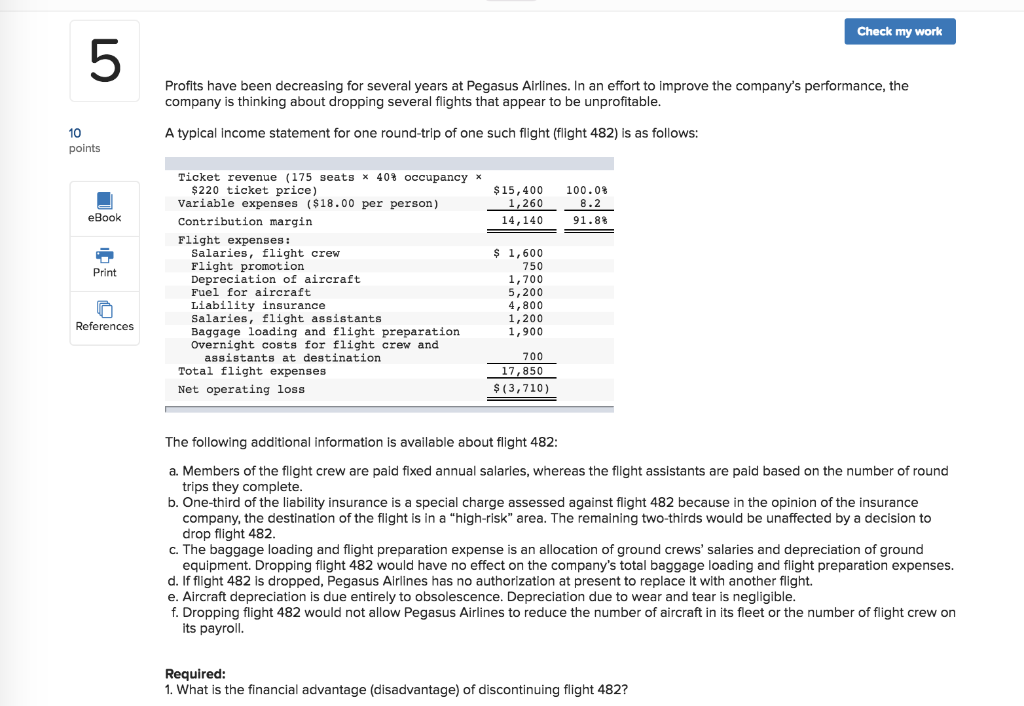

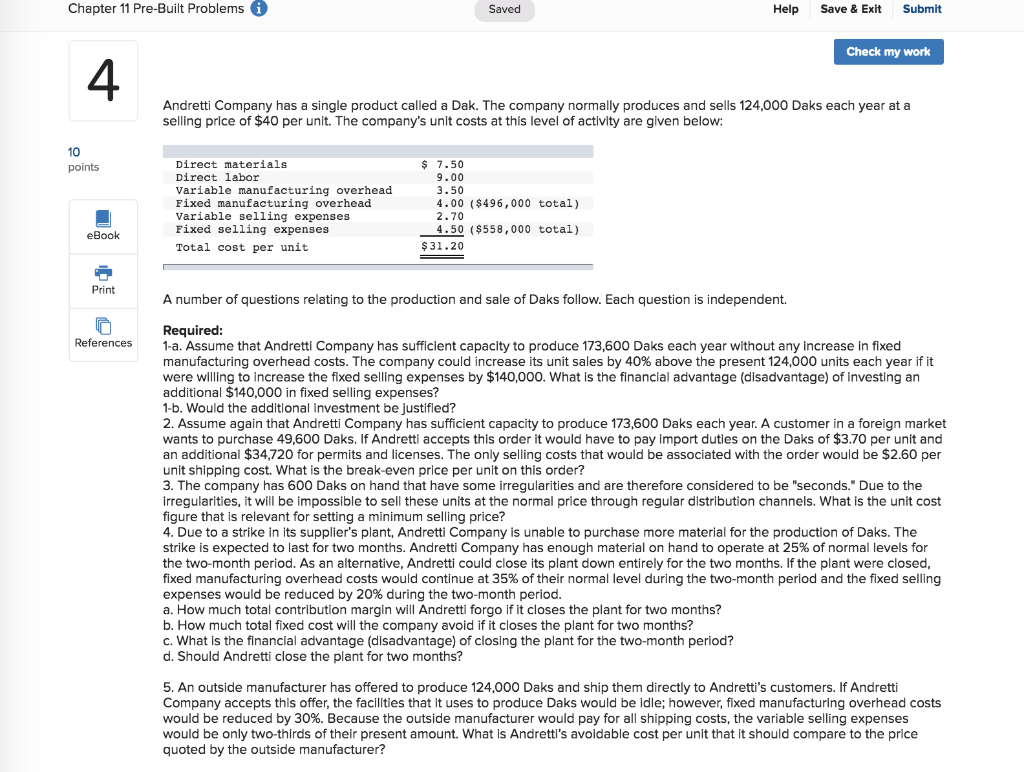

Check my work 5 Profits have been decreasing for several years at Pegasus Airlines. In an effort to improve the company's performance, the company is thinking about dropping several flights that appear to be unprofitable 10 points A typical income statement for one round-trip of one such flight (flight 482) is as follows: Ticket revenue (175 seats x 40% occupancy x $220 ticket price) Variable expenses ($18.00 per person) Contribution margin Flight expenses: $15,400 1,260 100.0% 8.2 eBook 14,140 91 , 8% Salaries, flight crevw Flight promotion Depreciation of aircraft Fuel for aircraft Liability insurance Salaries, flight assistants Baggage loading and flight preparation Overnight costs for flight crew and 1,600 750 1,700 5,200 4,800 1,200 1,900 Print References 700 17,850 assistants at destination Total flight expenses Net operating loss $ (3,710) The following additional information is available about flight 482 a. Members of the flight crew are pald fixed annual salarles, whereas the flight assistants are paid based on the number of round trips they complete b. One-third of the liability insurance is a special charge assessed against flight 482 because in the opinion of the insurance company, the destination of the flight is in a "high-risk" area. The remaining two-thirds would be unaffected by a decision to drop flight 482 C. The baggage loading and flight preparation expense is an allocation of ground crews, salaries and depreciation of ground equipment. Dropping flight 482 would have no effect on the company's total baggage loading and flight preparation expenses. d. If flight 482 is dropped, Pegasus Airlines has no authorization at present to replace it with another flight. e. Aircraft depreciation is due entirely to obsolescence. Depreciation due to wear and tear is negligible f. Dropping flight 482 would not allow Pegasus Airlines to reduce the number of aircraft in its fleet or the number of flight crew on its payroll. Required: 1. What is the financial advantage (disadvantage) of discontinuing flight 482? Chapter 11 Pre-Built Problems i Saved Help Save & Exit Submit Check my work 4 Andretti Company has a single product called a Dak. The company normally produces and sells 124,000 Daks each year at a selling price of $40 per unit. The company's unit costs at this level of activity are given below: 10 points Direct materials Direct labor Variable manufacturing overhead Fixed manufacturing overhead Variable selling expenses Fixed selling expenses Total cost per unit $ 7.50 9.00 3.50 4.00 ($496,000 total) 2.70 4.50 ($558.000 total) eBook $31.20 Print A number of questions relating to the production and sale of Daks follow. Each question is independent. Required 1a. Assume that Andretti Company has sufficient capacity to produce 173,600 Daks each year without any increase in fixed manufacturing overhead costs. The company could increase its unit sales by 40% above the present 124,000 units each year if it were willing to increase the fixed selling expenses by $140,000. What is the financial advantage (disadvantage) of investing an additional $140,000 in fixed selling expenses? 1-b. Would the additional investment be justified? 2. Assume again that Andretti Company has sufficient capacity to produce 173,600 Daks each year. A customer in a foreign market wants to purchase 49,600 Daks. If Andretti accepts this order it would have to pay import duties on the Daks of $3.70 per unit and an additional $34,720 for permits and licenses. The only selling costs that would be associated with the order would be $2.60 per unit shipping cost. What is the break-even price per unit on this order? 3. The company has 600 Daks on hand that have some irregularities and are therefore considered to be "seconds." Due to the irregularities, it will be impossible to sell these units at the normal price through regular distribution channels. What is the unit cost figure that is relevant for setting a minimum selling price? 4. Due to a strike in its supplier's plant, Andretti Company is unable to purchase more material for the production of Daks. The strike is expected to last for two months. Andretti Company has enough material on hand to operate at 25% of normal levels for the two-month period. As an alternative, Andretti could close its plant down entirely for the two months. If the plant were closed, fixed manufacturing overhead costs would continue at 35% of their normal level during the two-month period and the fixed selling expenses would be reduced by 20% during the two-month period a. How much total contribution margin will Andretti forgo if it closes the plant for two months? b. How much total fixed cost will the company avoid if it closes the plant for two months? C. What is the financial advantage (disadvantage) of closing the plant for the two-month period? d. Should Andretti close the plant for two months? References 5. An outside manufacturer has offered to produce 124,000 Daks and ship them directly to Andretti's customers. If Andretti Company accepts this offer, the facilities that it uses to produce Daks would be idle; however, fixed manufacturing overhead costs would be reduced by 30%. Because the outside manufacturer would pay for all shipping costs, the variable selling expenses would be only two-thirds of their present amount. What is Andretti's avoldable cost per unit that It should compare to the price quoted by the outside manufacturer