Answered step by step

Verified Expert Solution

Question

1 Approved Answer

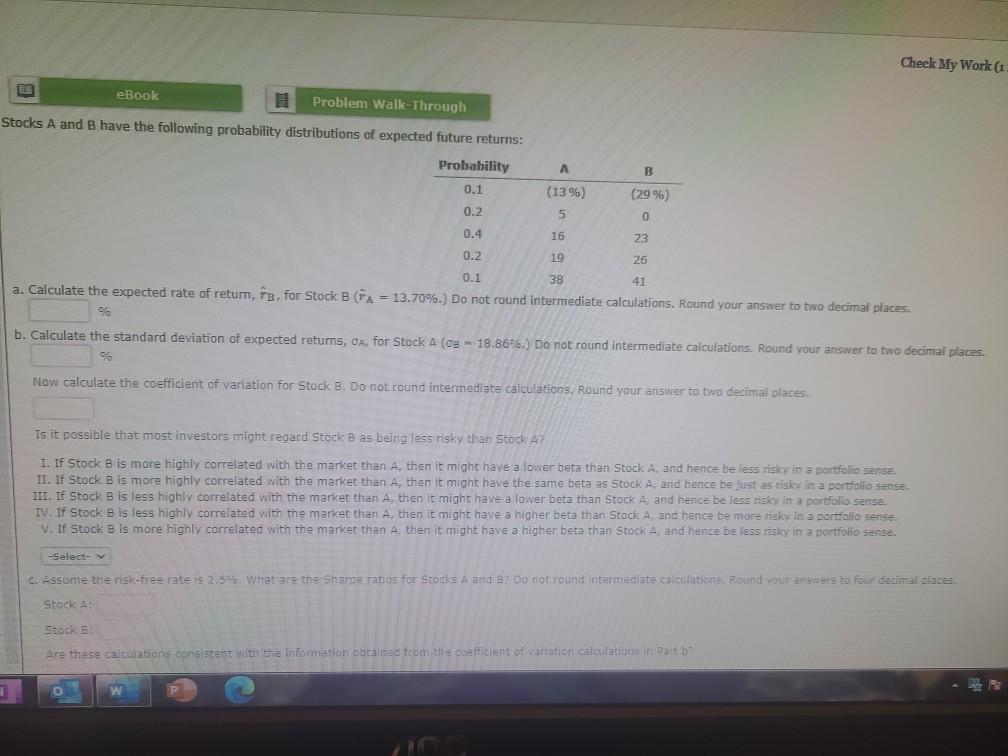

Check My Work eBook Problem Walk-Through Stocks A and B have the following probability distributions of expected future returns: Probability 0.1 A B (13%) (29%)

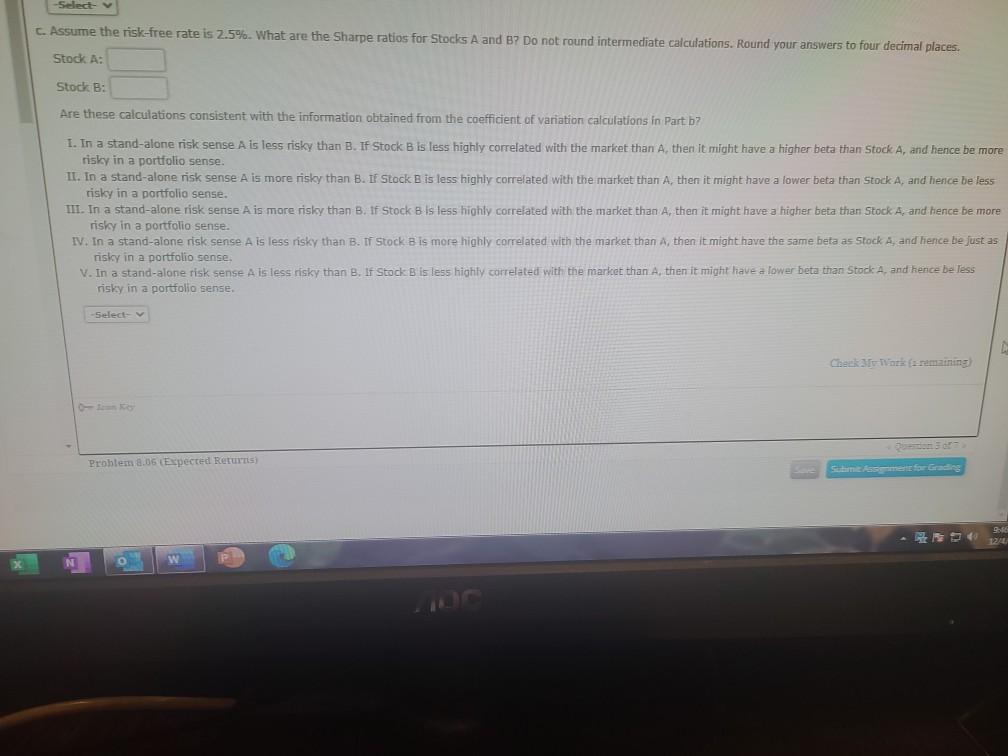

Check My Work eBook Problem Walk-Through Stocks A and B have the following probability distributions of expected future returns: Probability 0.1 A B (13%) (29%) 0.2 5 0 0.4 16 23 0.2 19 0.1 38 a. Calculate the expected rate of retum, f. for Stock B (FA = 13.70%.) Do not round intermediate calculations. Round your answer to two decimal places. 26 b. Calculate the standard deviation of expected retums, JA, for Stock A (0 - 18.86%.) Do not round intermediate calculations. Round your answer to two decimal places. Now calculate the coefficient of variation for Stock B. Do not round intermediate calculations, Round your answer to two decimal places Is it possible that most investors might regard Stock B as being less risky than Stock A? I. If Stock B is more highly correlated with the market than A, then it might have a lower beta than Stock A, and hence be less risky in a portfolio sense. 11. If Stock B is more highly correlated with the market than A, then it might have the same beta as Stock A, and hence be just as risk in a portfolio sense. III. If Stock B is less highly correlated with the market than A, then it might have a lower beta than Stock A, and hence be less risky in a portfolio sense. IV. If Stock B is less highly correlated with the market than A, then it might have a higher beta than Stock A, and hence be more risky in a portfolio sense V. If Stock B is more highly correlated with the market than A, then it might have a higher beta than Stock A, and hence be less risky in a portfolio sense. -Select- C. Assume the risk-free rate is 2.5%. What are the Sharpe ratios for Stocks A and B7 Do not round intermediate calculations. Round your answers to four decimal places Stock Stock B: Are these calculations consistent with the information obtained from the coefficient of variation calculations in Partib W -Select- Assume the risk-free rate is 2.5%. What are the Sharpe ratios for Stocks A and B? Do not round intermediate calculations. Round your answers to four decimal places. Stock A: Stock B: Are these calculations consistent with the information obtained from the coefficient of variation calculations in Part b? 1. In a stand-alone risk sense A is less risky than B. If Stock B is less highly correlated with the market than A, then it might have a higher beta than Stock A, and hence be more risky in a portfolio sense. II. In a stand-alone risk sense A is more risky than B. If Stock B is less highly correlated with the market than A, then it might have a lower beta than Stock A, and hence be less tisky in a portfolio sense. III. In a stand-alone risk sense A is more risky than 3. If Stock 3 is less highly correlated with the market than A, then it might have a higher beta than Stock A, and hence be more risky in a portfolio sense. IV. In a stand-alone risk sense A is less risky than B. If Stock 8 is more highly correlated with the market than A, then it might have the same beta as Stock A, and hence be just as risky in a portfolio sense. V. In a stand-alone risk sense A is less risky than B. If Stock B is less highly correlated with the market than A, then it might have a lower beta than Stock A, and hence be less risky in a portfolio sense. Select- Problem 8.05 Expected Returns) Se Grading 12/1 w

Step by Step Solution

There are 3 Steps involved in it

Step: 1

Get Instant Access to Expert-Tailored Solutions

See step-by-step solutions with expert insights and AI powered tools for academic success

Step: 2

Step: 3

Ace Your Homework with AI

Get the answers you need in no time with our AI-driven, step-by-step assistance

Get Started