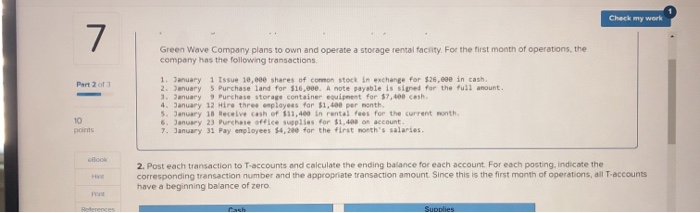

Check my work Green Wave Company plans to own and operate a storage rental facility For the first month of operations, the company has the following transactions Part 2 1. January 1 Issue 10,000 shares of common stock in exchange for $26,eee in cash 2. January 5 Purchase land for $16,ove. A note payable is signed for the full amount. 3. January 9 Purchase storage container vient for $7,00 Cash 4. January 12 wire three employees for $1.00 per month 5. January 18 Receive cash of $11,400 in rental fees for the current month 6. January 23 Purchase office suplies for $1,402 on account 7. January 31 Pay employees 4,200 for the first month's salaries 2. Post each transaction to T accounts and calculate the ending balance for each account for each posting indicate the corresponding transaction number and the appropriate transaction amount. Since this is the first month of operations, all T-accounts have a beginning balance of zero 1.&2. Record the necessary entries in the Journal Entry Worksheet below. 3. Calculate the year-end adjusted balances of Prepaid Insurance and Insurance Expense (assuming the balance of Prepaid Insurance at the beginning of the year is $0). Complete this question by entering your answers in the tabs below. Required 1 and 2 Required 3 Calculate the year-end adjusted balances of Prepaid Insurance and Insurance Expense (assuming the balance of Prepaid Insurance at the beginning of the year is $0). Ending Balance Prepaid insurance Insurance expense Check my work Green Wave Company plans to own and operate a storage rental facility For the first month of operations, the company has the following transactions Part 2 1. January 1 Issue 10,000 shares of common stock in exchange for $26,eee in cash 2. January 5 Purchase land for $16,ove. A note payable is signed for the full amount. 3. January 9 Purchase storage container vient for $7,00 Cash 4. January 12 wire three employees for $1.00 per month 5. January 18 Receive cash of $11,400 in rental fees for the current month 6. January 23 Purchase office suplies for $1,402 on account 7. January 31 Pay employees 4,200 for the first month's salaries 2. Post each transaction to T accounts and calculate the ending balance for each account for each posting indicate the corresponding transaction number and the appropriate transaction amount. Since this is the first month of operations, all T-accounts have a beginning balance of zero 1.&2. Record the necessary entries in the Journal Entry Worksheet below. 3. Calculate the year-end adjusted balances of Prepaid Insurance and Insurance Expense (assuming the balance of Prepaid Insurance at the beginning of the year is $0). Complete this question by entering your answers in the tabs below. Required 1 and 2 Required 3 Calculate the year-end adjusted balances of Prepaid Insurance and Insurance Expense (assuming the balance of Prepaid Insurance at the beginning of the year is $0). Ending Balance Prepaid insurance Insurance expense