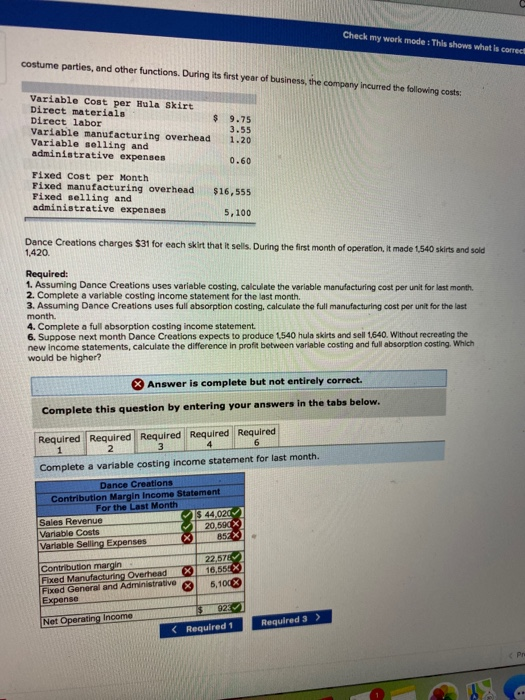

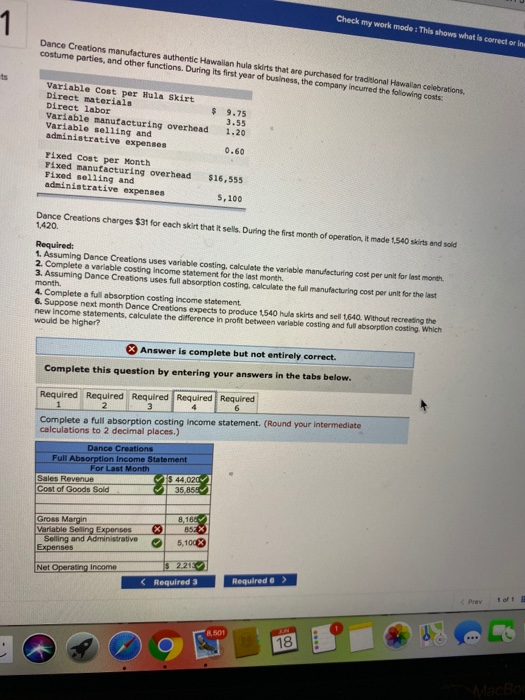

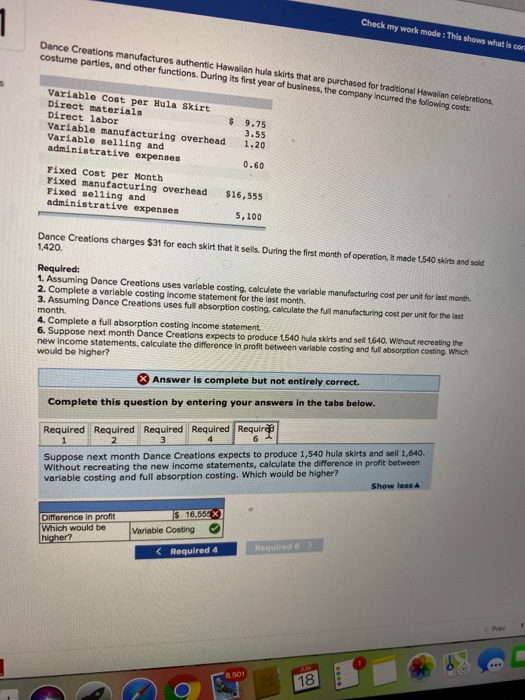

Check my work mode : This shows what is correct costume parties, and other functions. During its first year of business, the company incurred the following costs: Variable Cost per Hula Skirt Direct materials $ 9.75 Direct labor 3.55 Variable manufacturing overhead 1.20 Variable selling and administrative expenses 0.60 Fixed Cost per Month Fixed manufacturing overhead Fixed selling and administrative expenses $16,555 5, 100 Dance Creations charges $31 for each skirt that it sells. During the first month of operation, it made 1540 skirts and sold 1.420. Required: 1. Assuming Dance Creations uses variable costing, calculate the variable manufacturing cost per unit for last month. 2. Complete a variable costing income statement for the last month. 3. Assuming Dance Creations uses full absorption costing, calculate the full manufacturing cost per unit for the last month 4. Complete a full absorption costing income statement 6. Suppose next month Dance Creations expects to produce 1540 hula skirts and sell 1640. Without recreating the new Income statements, calculate the difference in profit between variable costing and full absorption costing. Which would be higher? Answer is complete but not entirely correct. Complete this question by entering your answers in the tabs below. Required Required Required Required Required 1 2 3 4 6 Complete a variable costing Income statement for last month. Dance Creations Contribution Margin Income Statement For the Last Month Sales Revenue $ 44,020 Variable Costs 20,590X Variable Selling Expenses X 852 Contribution margin 22,57 Fixed Manufacturing Overhead X 16,554 Fixed General and Administrative 5, 100% Expense $ 922 Net Operating Income 1 Check my work mode: This shows what is corrector in Dance Creations manufactures authentic Hawaiian hula siirts that are purchased for traditional Hawaiian celebrations, costume parties, and other functions. During its first year of business, the company incurred the following costs: Variable Cost per Hula Skirt Direct materials $ 9.75 Direct labor 3.55 Variable manufacturing overhead 1.20 Variable selling and administrative expenses 0.60 Yixed cost per Month Pixed manufacturing overhead $16,555 Fixed selling and administrative expenses 5,100 Dance Creations charges $31 for each skirt that it sells. During the first month of operation, it made 1540 skirts and sold 1420 Required: 1. Assuming Dance Creations uses variable costing, calculate the variable manufacturing cost per unit for last month. 2. Complete a variable costing income statement for the last month. 3. Assuming Dance Creations uses full absorption costing, calculate the full manufacturing cost per unit for the last month 4. Complete a full absorption costing income statement 6. Suppose next month Dence Creations expects to produce 1540 hula skits and sell 1640 Without recreating the new income statements, calculate the difference in profit between variable costing and full absorption costing. Which would be higher? Answer is complete but not entirely correct. Complete this question by entering your answers in the tabs below. Required Required Required Required Required 1 6 Complete a full absorption costing Income statement. (Round your intermediate calculations to 2 decimal places.) Dance Creations Full Absorption Income Statement For Last Month Sales Revenue $ 44,020 Cost of Goods Sold 35,855 Gross Margin 8,166 Variable Selling Expenses X 852X Selling and Administrative Expenses 5,100X Net Operating Income 5 221 8.501 18 1 Check my work mode: This shows what is com Dance Creations manufactures authentic Hawaiian hula skirts that are purchased for traditional Hawaiian celebrations costume parties, and other functions. During its first year of business, the company incurred the following costs Variable Cost per Hula Skirt Direct materials $ 9.75 Direct labor 3.55 Variable manufacturing overhead 1.20 Variable selling and administrative expenses 0.60 Fixed cost per Month Yixed manufacturing overhead Fixed selling and administrative expenses $16,555 5,100 Dance Creations charges $31 for each skirt that it sells. During the first month of operation, it made 1540 skirts and sold 1,420 Required: 1. Assuming Dance Creations uses variable costing, calculate the variable manufacturing cost per unit for last month. 2. Complete a variable costing income statement for the last month. 3. Assuming Dance Creations uses full absorption costing. calculate the full manufacturing cost per unit for the last month. 4. Complete a full absorption costing Income statement 6. Suppose next month Dance Creations expects to produce 1540 hula skirts and sell 1640. Without recreating the new income statements, calculate the difference in profit between variable costing and full absorption costing. Which would be higher? Answer is complete but not entirely correct. Complete this question by entering your answers in the tabs below. Required Required Required Required Required 2 3 Suppose next month Dance Creations expects to produce 1,540 hula skirts and sell 1,640. Without recreating the new income statements, calculate the difference in profit between variable costing and full absorption costing. Which would be higher? Show less 1 6 Difference in profit Which would be higher? 1$ 16,55 Variable Costing