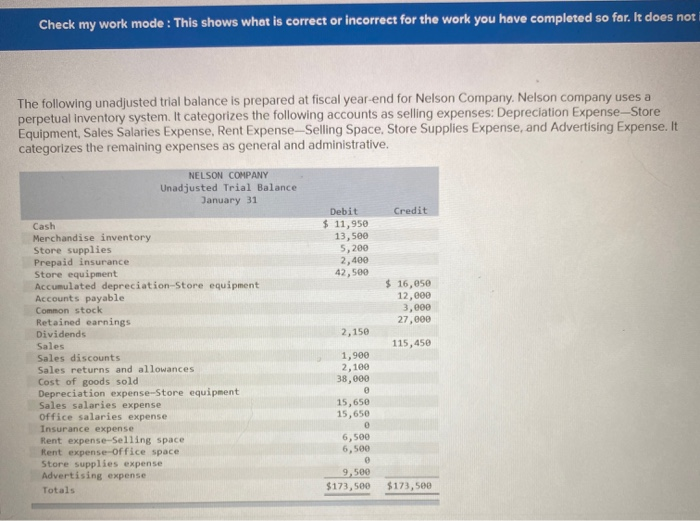

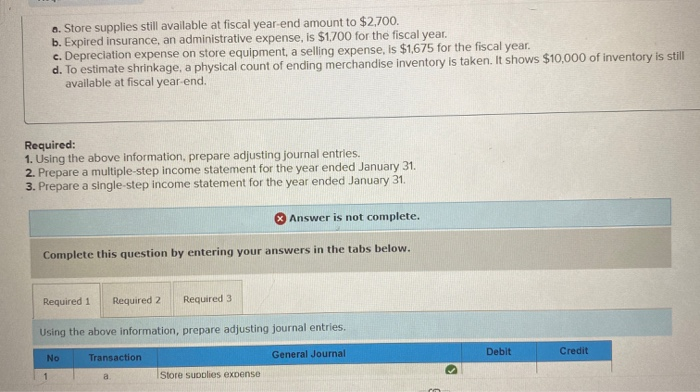

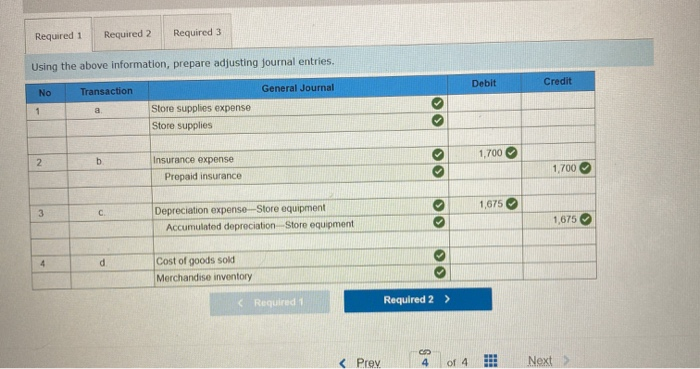

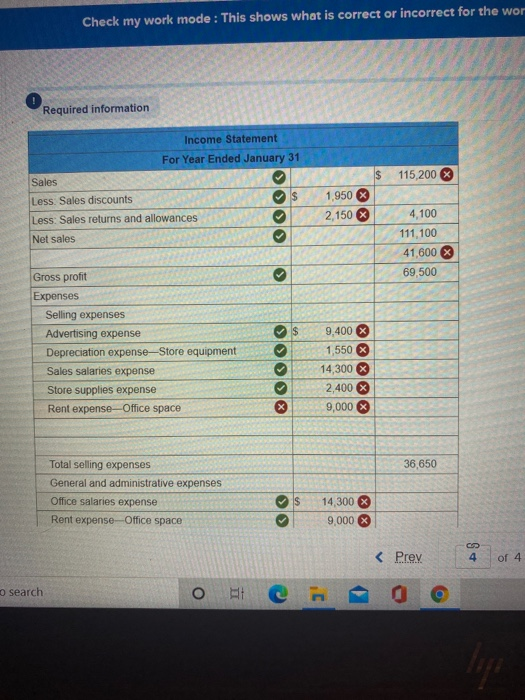

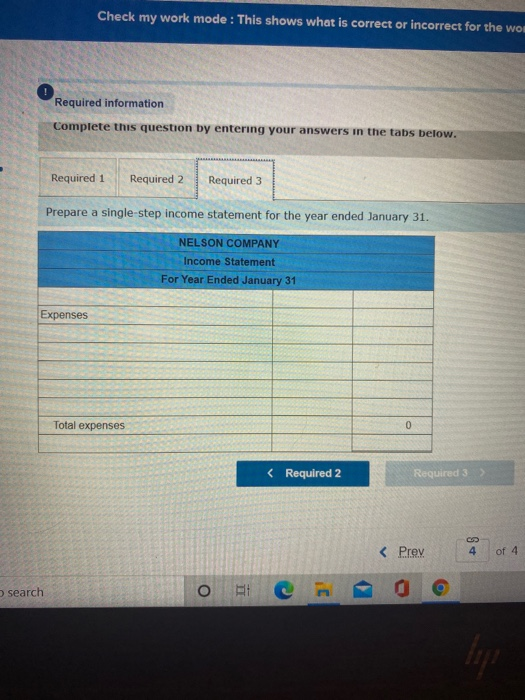

Check my work mode : This shows what is correct or incorrect for the work you have completed so far. It does not The following unadjusted trial balance is prepared at fiscal year-end for Nelson Company. Nelson company uses a perpetual inventory system. It categorizes the following accounts as selling expenses: Depreciation Expense-Store Equipment, Sales Salaries Expense, Rent Expense-Selling Space, Store Supplies Expense, and Advertising Expense. It categorizes the remaining expenses as general and administrative. NELSON COMPANY Unadjusted Trial Balance January 31 Credit Debit $ 11,950 13,500 5,200 2,400 42,500 $ 16,050 12,000 3,000 27,000 2,150 115,450 Cash Merchandise inventory Store supplies Prepaid insurance Store equipment Accumulated depreciation-Store equipment Accounts payable Common stock Retained earnings Dividends Sales Sales discounts Sales returns and allowances Cost of goods sold Depreciation expense-Store equipment Sales salaries expense Office salaries expense Insurance expense Rent expense-Selling space Rent expense-office space Store supplies expense Advertising expense Totals 1,900 2,100 38,000 15,650 15,650 O 6,500 6,500 9,500 $173,500 $173,500 o. Store supplies still available at fiscal year-end amount to $2,700. b. Expired insurance, an administrative expense, is $1.700 for the fiscal year. c. Depreciation expense on store equipment, a selling expense, is $1,675 for the fiscal year. d. To estimate shrinkage, a physical count of ending merchandise inventory is taken. It shows $10,000 of inventory is still available at fiscal year end. Required: 1. Using the above information, prepare adjusting journal entries. 2. Prepare a multiple-step income statement for the year ended January 31. 3. Prepare a single-step income statement for the year ended January 31. Answer is not complete. Complete this question by entering your answers in the tabs below. Required 1 Required 2 Required 3 Using the above information, prepare adjusting journal entries. Debit No Credit General Journal Transaction a Store supplies expense Required 1 Required 2 Required 3 Using the above information, prepare adjusting journal entries. Debit Credit No Transaction General Journal 1 a Store supplies expense Store supplies 1,700 2 b Insurance expense Prepaid insurance 30 1,700 1,675 3 C Depreciation expense-Store equipment Accumulated depreciation Store equipment >S 1,675 4 d Cost of goods sold Merchandise inventory Required Required 2 > RE