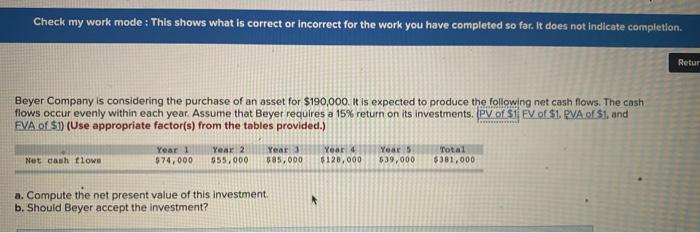

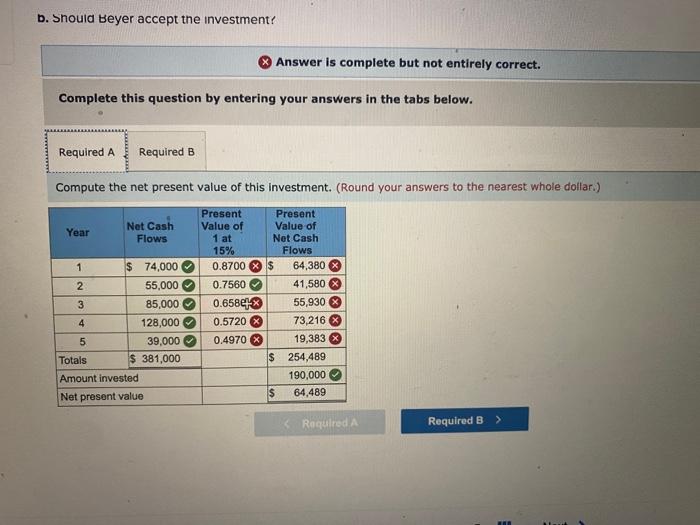

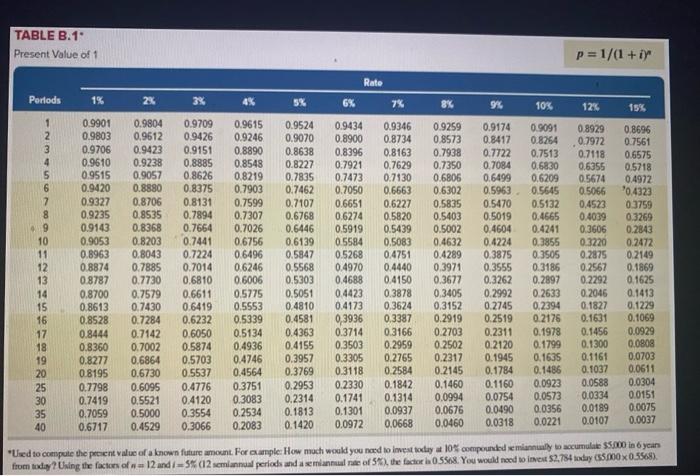

Check my work mode : This shows what is correct or incorrect for the work you have completed so far. It does not indicate completion. Retur Beyer Company is considering the purchase of an asset for $190,000. It is expected to produce the following net cash flows. The cash flows occur evenly within each year. Assume that Beyer requires a 15% return on its investments. PV of 1 EV of $1. PVA of S1, and FVA of $1) (Use appropriate factor(s) from the tables provided.) Year 1 $74,000 Year 2 $55,000 Year 3 585,000 Year 4 $120,000 Net cash flows Year 5 $39,000 Total $381,000 a. Compute the net present value of this investment. b. Should Beyer accept the investment? b. Should Beyer accept the investment? Answer is complete but not entirely correct. Complete this question by entering your answers in the tabs below. Required A Required B Compute the net present value of this investment. (Round your answers to the nearest whole dollar.) Year Net Cash Flows 1 $ 74,000 2 55,000 3 85,000 4 128,000 5 39,000 Totals $ 381,000 Amount invested Net present value Present Present Value of Value of 1 at Net Cash 15% Flows 0.8700 $ 64,380 0.7560 41,580 0.658e1-X 55,930 0.5720 73,216 x 0.4970 19,383 $ 254,489 190,000 $ 64.489 > Required A Required B > TABLE B.1 Present Value of 1 p=1/(1+iY Rato Periods 2x 3% 4% 5% 6% 7% 8% 96 10% 126 15% 1 2 3 4 5 6 7 8 09 10 11 12 13 14 15 16 17 18 19 20 25 30 35 40 0.9901 0.9803 0.9706 0.9610 0.9515 0.9420 0.9327 0.9235 0.9143 0.9053 0.8963 0.8874 0.8787 0.8700 0.8613 0.8528 0.8444 0.8360 0.8277 0.8195 0.7798 0.7419 0.7059 0.6717 0.9804 0.9612 0.9423 0.9238 0.9057 0.8880 0.8706 0.8535 0.8368 0.8203 0.8043 0.7885 0.7730 0.7579 0.7430 0.7284 0.7142 0.7002 0.6864 0.6730 0.6095 0.5521 0.5000 0.4529 0.9709 0.9426 09151 0.8885 0.8626 0.8375 0.8131 0.7894 0.7664 0.7441 0.7224 0.7014 0.6810 0.6611 0.6419 0.6232 0.6050 0.5874 0.5703 0.5537 0.4776 0.4120 0.3554 0.3066 0.9615 0.9246 0.8890 0.8548 0.8219 0.7903 0.7599 0.7307 0.7026 0.6756 0.6496 0.6246 0.6006 0.5775 0.5553 0.5339 0.5134 0.4936 0.4746 0.4564 0.3751 0.3083 0.2534 0.2083 0.9524 0.9070 0.8638 0.8227 0.7835 0.7462 0.7107 0.6768 0.6446 0.6139 0.5847 0.5568 0.5303 0.5051 0.4810 0.4581 0.4363 0.4155 0.3957 0.3769 0.2953 0.2314 0.1813 0.1420 0.9434 0.8900 0.8396 0.7921 0.7473 0.7050 0.6651 0.6274 0.5919 05584 0.5268 0.4970 0.4688 0.4423 0.4173 0,3936 0.3714 0.3503 0.3305 0.3118 0.2330 0.1741 0.1301 0.0972 0.9346 0.8734 0.8163 0.7629 0.7130 0.6663 0.6227 0.5820 0.5439 0.5083 0.4751 0.4440 0.4150 0.3878 0.3624 0.3387 0.3166 0.2959 0.2765 0.2584 0.1842 0.1314 0.0937 0.0668 0.9259 0.8573 0.7938 0.7350 0.6806 0.6302 0.5835 0.5403 0.5002 0.4632 0.4289 0.3971 0.3677 0.3405 0.3152 0.2919 0.2703 0.2502 0.2317 0.2145 0.1460 0.0994 0.0676 0.0460 0.9174 0.9091 0.8417 0.8264 0.7722 0.7513 0.7084 0.6830 0.6499 0.6209 0.5963, 0.5645 0.5470 0.5132 0.5019 0.4665 0.4604 0.4241 0.4224 0.3855 0.3875 0.3505 0.3555 0.3186 0.3262 0.2897 0.2992 0.2633 0.2745 0.2394 0.2519 0.2176 0.2311 0.1978 0.2120 0.1799 0.1945 0.1635 0.1784 0.1486 0.1160 0.0923 0.0754 0.0573 0.0490 0.0356 0.0318 0.0221 0.8929 0.7972 0.7118 0.6355 0.5674 0.5066 0.4523 0.4039 0.3606 0.3220 0.2875 0.2567 0.2292 0.2046 0.1827 0.1631 0.1456 0.1300 0.1161 0.1037 0.0588 0.0334 0.0189 0.0107 0.8696 0.7561 0.6575 0.5718 0.4972 0.4323 0.3759 0.3269 0.2843 0.2472 0.2149 0.1869 0.1625 0.1413 0.1279 0.1069 0.0929 0.0808 0.0703 0.0611 0.0304 0.0151 0.0075 0.0037 "Uued to compute the present value of a known future amount. For example: How much would you need to invest today at 10% compounded semiannuly to accumulate 35.000 in 6 years from today? Using the face of 12 and 15% (12 semiannual periods and a semiannute of 5), the factor is 0.5568. You would need to invest $2.784 today 5.000x 0.3568)