Answered step by step

Verified Expert Solution

Question

1 Approved Answer

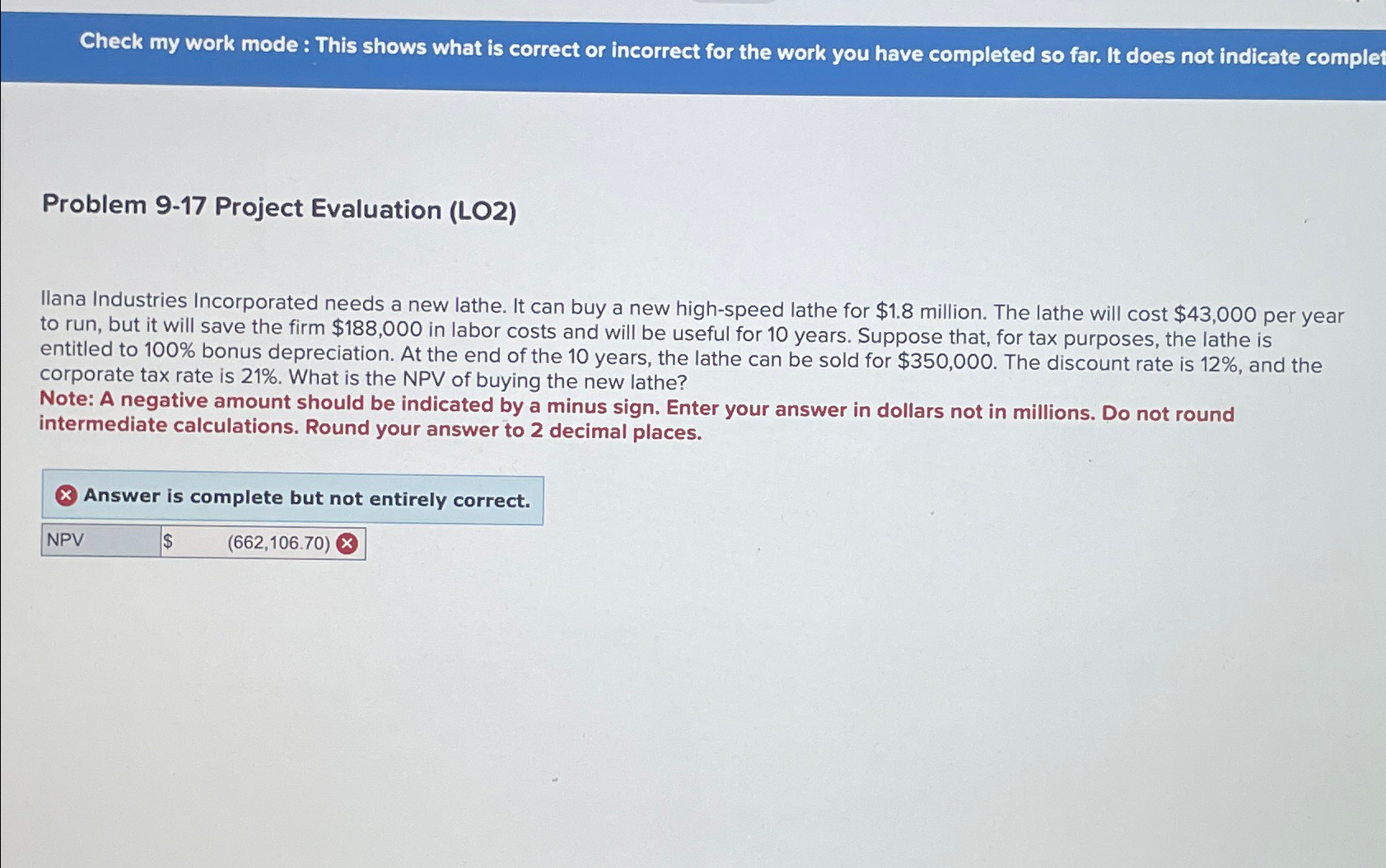

Check my work mode : This shows what is correct or incorrect for the work you have completed so far. It does not indicate comple:

Check my work mode : This shows what is correct or incorrect for the work you have completed so far. It does not indicate comple:

Problem Project Evaluation LO

Ilana Industries Incorporated needs a new lathe. It can buy a new highspeed lathe for $ million. The lathe will cost $ per year to run, but it will save the firm $ in labor costs and will be useful for years. Suppose that, for tax purposes, the lathe is entitled to bonus depreciation. At the end of the years, the lathe can be sold for $ The discount rate is and the corporate tax rate is What is the NPV of buying the new lathe?

Note: A negative amount should be indicated by a minus sign. Enter your answer in dollars not in millions. Do not round intermediate calculations. Round your answer to decimal places.

Answer is complete but not entirely correct.

$

Step by Step Solution

There are 3 Steps involved in it

Step: 1

Get Instant Access to Expert-Tailored Solutions

See step-by-step solutions with expert insights and AI powered tools for academic success

Step: 2

Step: 3

Ace Your Homework with AI

Get the answers you need in no time with our AI-driven, step-by-step assistance

Get Started