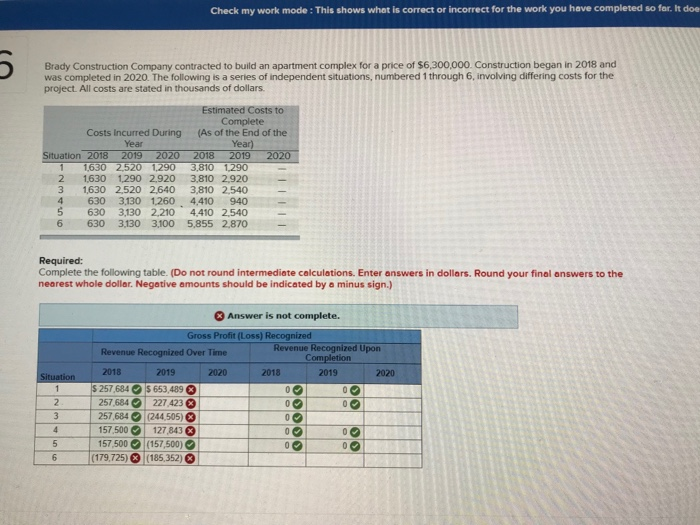

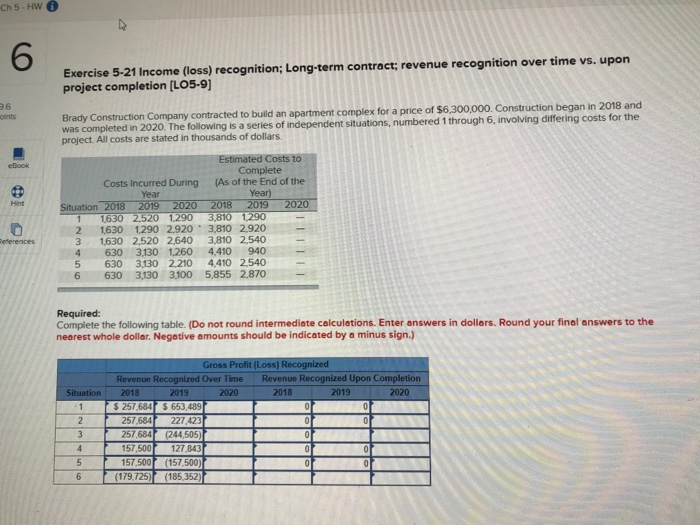

Check my work mode: This shows what is correct or incorrect for the work you have completed so far. I dou Brady Construction Company contracted to build an apartment complex for a price of $6,300.000. Construction began in 2018 and was completed in 2020. The following is a series of independent situations, numbered through 6, involving differing costs for the project. All costs are stated in thousands of dollars. Estimated Costs to Complete (As of the End of the Year 2020 Costs incurred During Year Situation 2018 2019 2020 168021520190 2 1630 1.290 2,920 3 1.630 2,520 2.640 4 630 3.130 1260 5 630 3,130 2,210 6 630 3,130 3,100 2018 2019 37810 1290 3.810 2,920 3,810 2,540 4.410 940 4.410 2.540 5,855 2,870 Required: Complete the following table. (Do not round intermediate calculations. Enter answers in dollars. Round your final answers to the nearest whole dollar. Negative amounts should be indicated by a minus sign.) Answer is not complete. 2020 Gross Profit (Loss) Recognized Revenue Recognized Over Time Revenue Recognized Upon Completion 2018 2019 2020 2018 2019 $ 257684 $ 653,489 0 257,684 227 423 257,684 (244505) 157.500 127 84 157.500 (157,500) (179,725) (185,352) En 5 - HW Exercise 5-21 Income (loss) recognition; Long-term contract; revenue recognition over time vs. upon project completion [LO5-9) Brady Construction Company contracted to build an apartment complex for a price of $6,300,000. Construction began in 2018 and was completed in 2020. The following is a series of independent situations, numbered 1 through 6, involving differing costs for the project. All costs are stated in thousands of dollars Year Estimated Costs to Complete Costs incurred During (As of the End of the Year) Situation 2018 2019 2020 2018 2019 2020 1 1630 2.520 1290 3,810 1290 1.630 1290 2.9203,810 2.920 3 1630 2,520 2640 3,810 2,540 630 3.130 1.260 4.410 940 5 630 3,130 2.210 4.410 2.540 630 3,130 3,100 5,855 2.870 References Required: Complete the following table. (Do not round intermediate calculations. Enter answers in dollars. Round your final answers to the nearest whole dollar. Negative amounts should be indicated by a minus sign.) Situation Gross Profit (Loss) Recognized Revenue Recognized Over Time Revenue Recognized Upon Completion 2018 2019 2020 2018 2019 2020 $ 257 584 $ 653 489 o or 257,684 227.423 0 0 257 684 244505) O 157.500 127 8431 T 157.500 (157.500) (179.725) (185,352)