Answered step by step

Verified Expert Solution

Question

1 Approved Answer

Check my work On July 1, 2023, Yorkton Company purchased for $431,000 equipment having an estimated useful life of ten years with an estimated

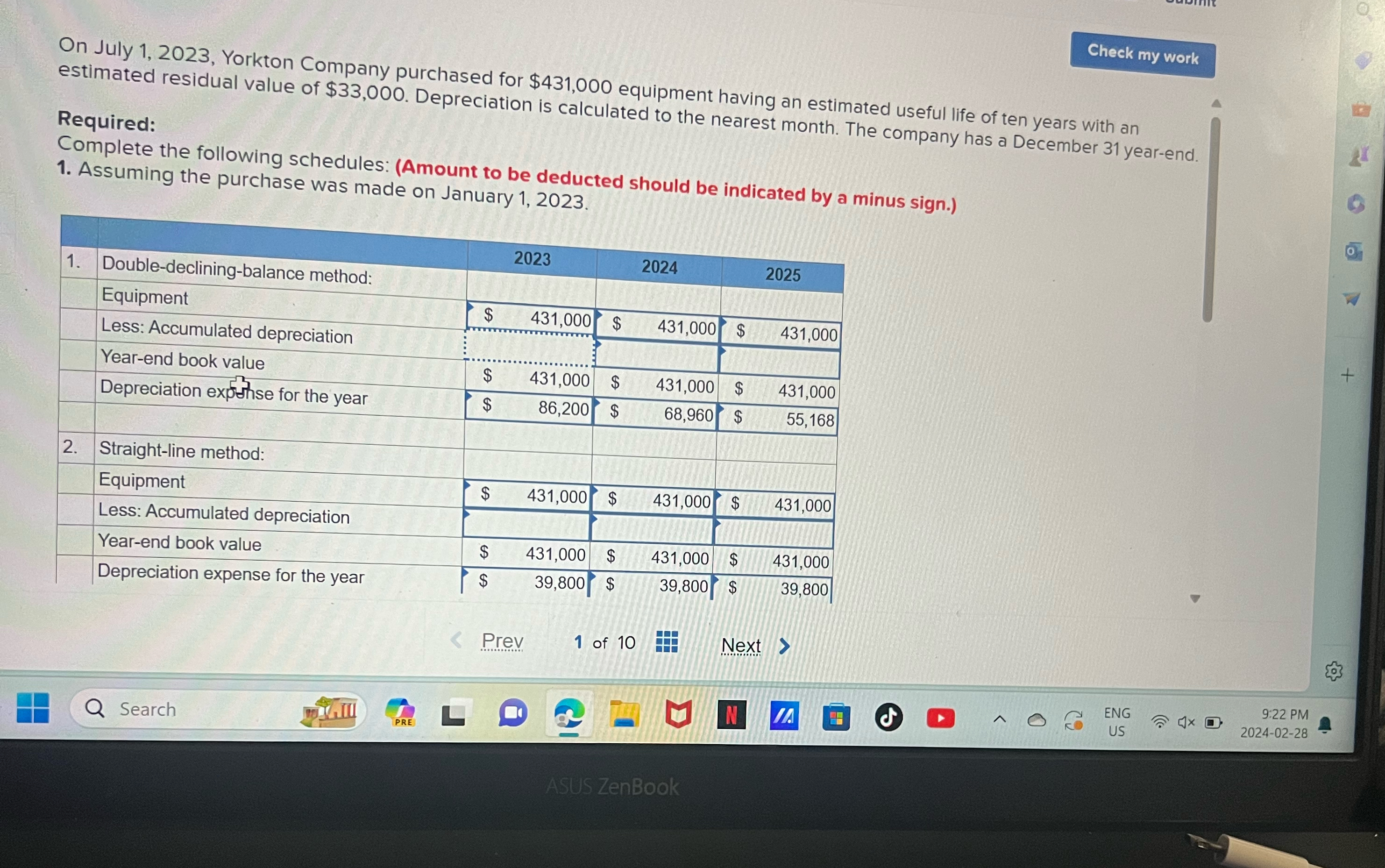

Check my work On July 1, 2023, Yorkton Company purchased for $431,000 equipment having an estimated useful life of ten years with an estimated residual value of $33,000. Depreciation is calculated to the nearest month. The company has a December 31 year-end. Required: Complete the following schedules: (Amount to be deducted should be indicated by a minus sign.) 1. Assuming the purchase was made on January 1, 2023. 2023 2024 2025 1. Double-declining-balance method: Equipment $ 431,000 $ 431,000 $ 431,000 Less: Accumulated depreciation Year-end book value $ 431,000 $ 431,000 $ 431,000 Depreciation expense for the year $ 86,200 $ 68,960 $ 55,168 2. Straight-line method: Equipment $ 431,000 $ 431,000 $ 431,000 Less: Accumulated depreciation Year-end book value SA $ Depreciation expense for the year $ SA 39,800 431,000 $ $ 431,000 $ 431,000 39,800 $ 39,800 < Prev 1 of 10 Next > Q Search PRE L ASUS ZenBook N JA ENG US 9:22 PM 2024-02-28 +

Step by Step Solution

There are 3 Steps involved in it

Step: 1

Get Instant Access to Expert-Tailored Solutions

See step-by-step solutions with expert insights and AI powered tools for academic success

Step: 2

Step: 3

Ace Your Homework with AI

Get the answers you need in no time with our AI-driven, step-by-step assistance

Get Started