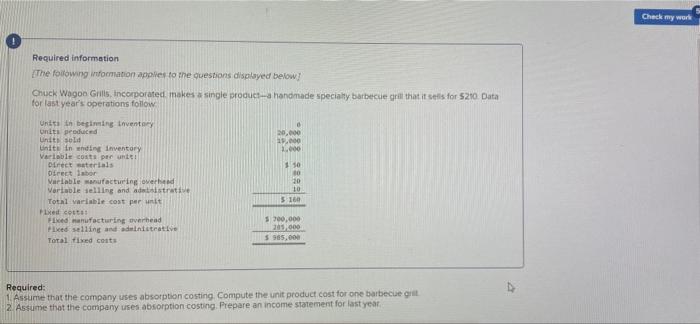

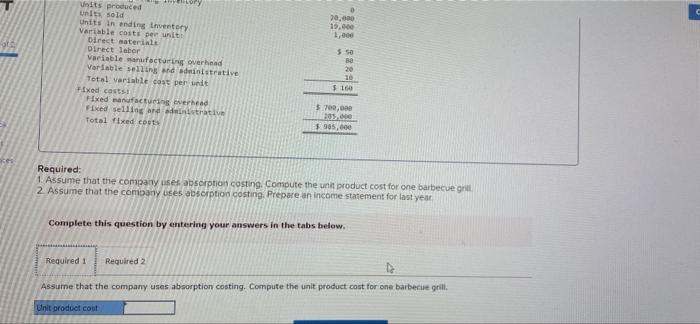

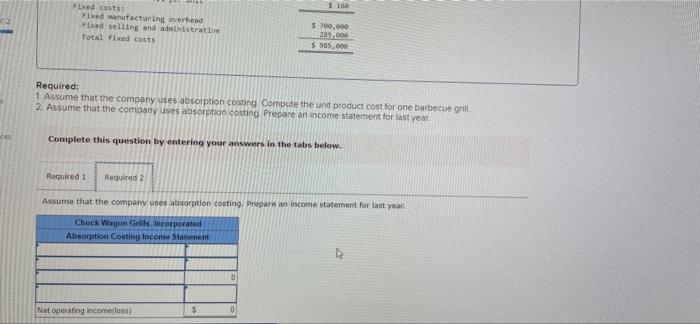

Check my work Required information The following information apples to the questions displayed below! Chuck Wagon Grills, Incorporated makes a single product handmade specialty barbecue grill that it is for $210 Data for last year's operations follow Unit th beginning inventory units produced 20.000 Unit sold 19.000 Uniti in ending inventory 2.000 Variable costs per un Direct saterials 10 Direct labor 00 Variable manufacturing overhead 20 Variable selling and distrative Total variable cost per unit $ 160 recot Fixed manufacturing overhead 5 700,000 Fixed selling and administrative 205,000 Total fixed costs $ 965,000 10 Required: Assume that the company uses absorption costing Compute the unit product cost for one barbecue grit 2. Assume that the company uses absorption costing. Prepare an income statement for last year 20.000 19.00 1.000 Units produced Units sold units in aning overtory Variable costs per unit Direct materials Direct labor Variable manufacturing overhead Variable selling and dinistrative Total variable cost per unit Exed costs Fixed manufacturing everhead Fixed selling and distrative Total fixed costs $50 Ba 20 10 166 $700,000 EOS.000 3 965,000 Required: 1. Assume that the company uses absorption costing. Compute the unit product cost for one barbecue 2 Assume that the company uses absorption costing Prepare an income statement for last year Complete this question by entering your answers in the tabs below. Required: Required 2 Assume that the company uses absorption costing. Compute the unit product cost for one barbecue grill Unit product cout SI Exed costs Fixed manufacturing overhead Ixed selling and administrative Total fixed costs 5.700,000 285.000 $905.000 Required: 1. Assume that the company uses absorption costing Compute the unit product cost for one barbecue grill 2. Assume that the company uses absorption costing Prepare an income statement for last year ce Complete this question by entering your answers in the tabs below. Required 1 Required 2 Assume that the company es absorption conting. Prepare an income statement for last year. Chuck Wagon Gils Incorporated Absorption Costing Income Statuent 0 Net operating incomelloss) $ 0