Question

Check my workCheck My Work button is now enabled Item 2 Item 2 10 points Item Skipped Calculations Marketing Inc. issued 12.0% bonds with a

Check my workCheck My Work button is now enabled

Item 2

Item 2 10 points Item Skipped

Calculations Marketing Inc. issued 12.0% bonds with a par value of $490,000 and a five-year life on January 1, 2020, for $527,836. The bonds pay interest on June 30 and December 31. The market interest rate was 10% on the original issue date. Use TABLE 14A.1 and TABLE 14A.2. (Use appropriate factor(s) from the tables provided.) Required: 1. Calculate the total bond interest expense over the life of the bonds.

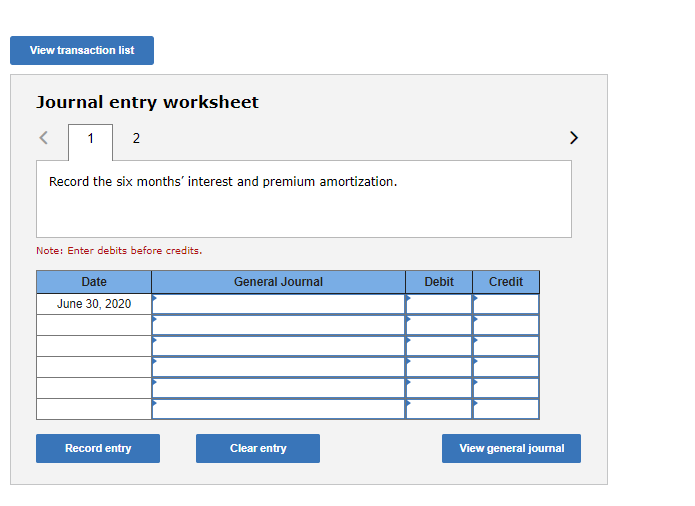

3. Show the journal entries that Calculations Marketing Inc. would make to record the first two interest payments assuming a December 31 year-end. (Do not round intermediate calculations. Round the final answers to the nearest whole dollar.)

4. Use the original market interest rate to calculate the present value of the remaining cash flows for these bonds as of December 31, 2022. Compare your answer with the amount shown on the amortization table as the balance for that date. (Do not round intermediate calculations. Round the final answers to the nearest whole dollar.)

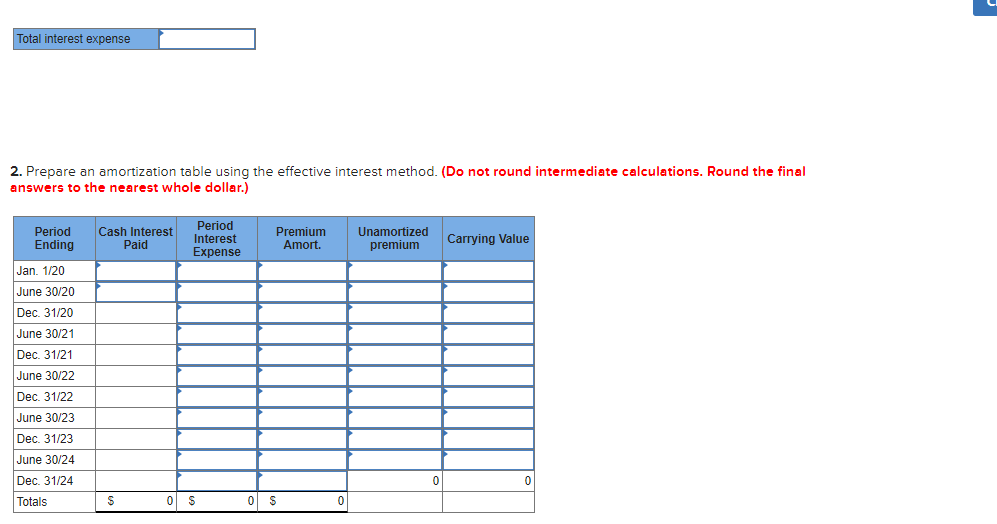

Total interest expense 2. Prepare an amortization table using the effective interest method. (Do not round intermediate calculations. Round the final answers to the nearest whole dollar.) Period Ending Cash Interest Paid Period Interest Expense Premium Amort. Unamortized premium Carrying Value Jan. 1/20 June 30/20 Dec. 31/20 June 30/21 Dec. 31/21 June 30/22 Dec. 31/22 June 30/23 Dec. 31/23 June 30/24 Dec. 31/24 Totals 0 0 S 0 S 0 S View transaction list Journal entry worksheet Record the six months' interest and premium amortization. Note: Enter debits before credits. General Journal Debit Credit Date June 30, 2020 Record entry Clear entry View general journal Present value of the remaining cash flows

Step by Step Solution

There are 3 Steps involved in it

Step: 1

Get Instant Access to Expert-Tailored Solutions

See step-by-step solutions with expert insights and AI powered tools for academic success

Step: 2

Step: 3

Ace Your Homework with AI

Get the answers you need in no time with our AI-driven, step-by-step assistance

Get Started