Answered step by step

Verified Expert Solution

Question

1 Approved Answer

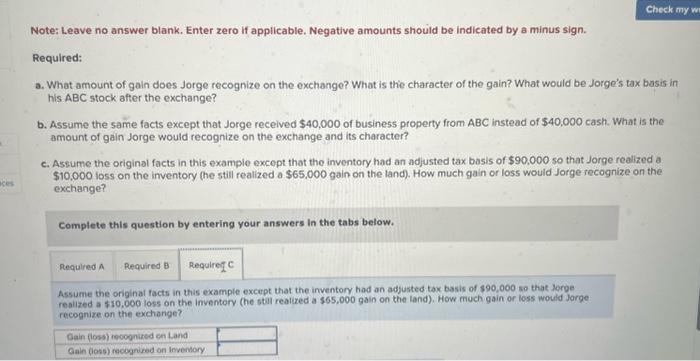

Check my ww aces Note: Leave no answer blank. Enter zero if applicable. Negative amounts should be indicated by a minus sign. Required: a.

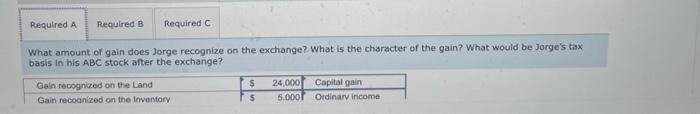

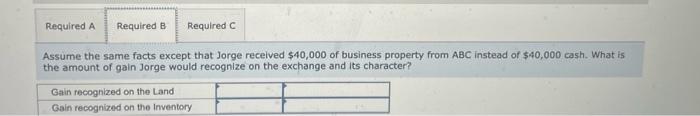

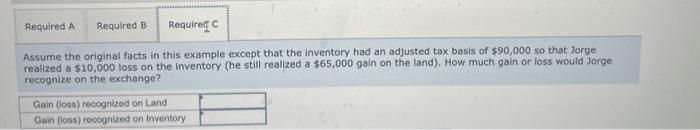

Check my ww aces Note: Leave no answer blank. Enter zero if applicable. Negative amounts should be indicated by a minus sign. Required: a. What amount of gain does Jorge recognize on the exchange? What is the character of the gain? What would be Jorge's tax basis in his ABC stock after the exchange? b. Assume the same facts except that Jorge received $40,000 of business property from ABC instead of $40,000 cash. What is the amount of gain Jorge would recognize on the exchange and its character? c. Assume the original facts in this example except that the inventory had an adjusted tax basis of $90,000 so that Jorge realized a $10,000 loss on the inventory (he still realized a $65,000 gain on the land). How much gain or loss would Jorge recognize on the exchange? Complete this question by entering your answers in the tabs below. Required A Required B Required C Assume the original facts in this example except that the inventory had an adjusted tax basis of $90,000 so that Jorge realized a $10,000 loss on the inventory (he still realized a $65,000 gain on the land). How much gain or loss would Jorge recognize on the exchange? Gain (loss) recognized on Land Gain (loss) recognized on Inventory Required A Required B Required C What amount of gain does Jorge recognize on the exchange? What is the character of the gain? What would be Jorge's tax basis in his ABC stock after the exchange? Gain recognized on the Land Gain recognized on the Inventory $ 24,000 Capital gain 5.000 Ordinary income Required A Required B Required C Assume the same facts except that Jorge received $40,000 of business property from ABC instead of $40,000 cash. What is the amount of gain Jorge would recognize on the exchange and its character? Gain recognized on the Land Gain recognized on the Inventory Required A Required B Required C Assume the original facts in this example except that the inventory had an adjusted tax basis of $90,000 so that Jorge realized a $10,000 loss on the inventory (he still realized a $65,000 gain on the land). How much gain or loss would Jorge recognize on the exchange? Gain (loss) recognized on Land Gain (loss) recognized on Inventory

Step by Step Solution

There are 3 Steps involved in it

Step: 1

Get Instant Access to Expert-Tailored Solutions

See step-by-step solutions with expert insights and AI powered tools for academic success

Step: 2

Step: 3

Ace Your Homework with AI

Get the answers you need in no time with our AI-driven, step-by-step assistance

Get Started