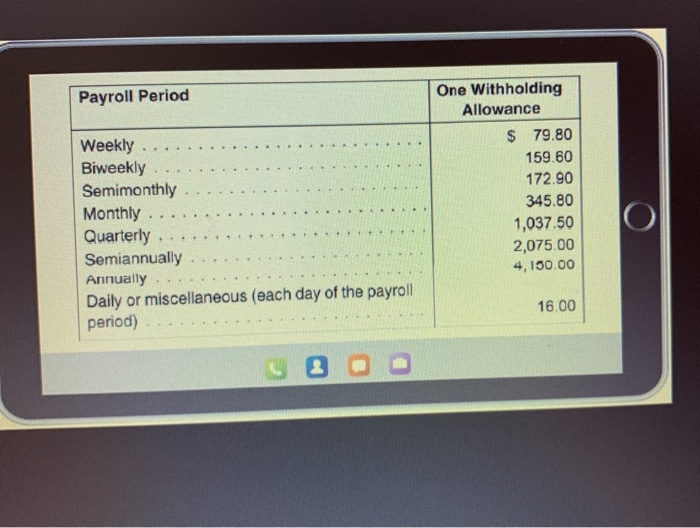

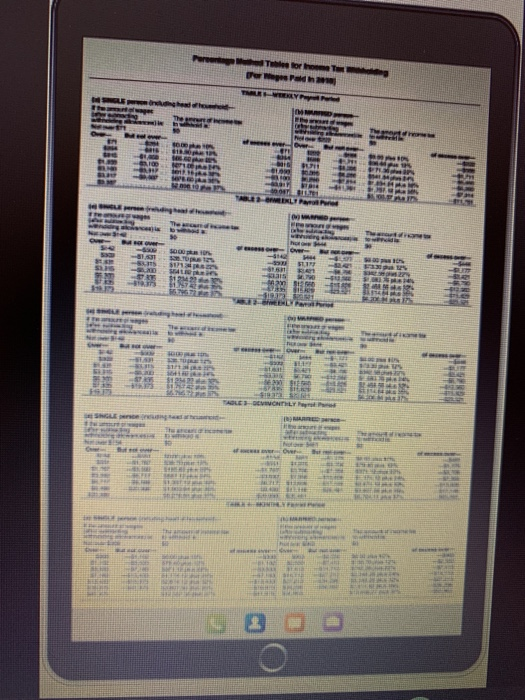

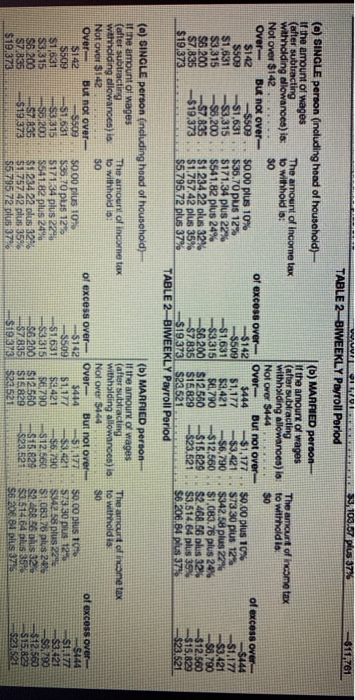

Check Rhonda Brennan found her first job after graduating from college through the classifieds of the Miami Herald. She was delighted when the offer came through at $16.00 per hour. She completed her W-4 stating that she is married with a child and claims an allowance of 3. Her company will pay her biweekly for 80 hours (assume a tax rate of 6.2% on $128,400 for Social Security and 1.45% for Medicare). Calculate her take-home pay for her first check. (Use Table 91 and Table 9.2) (Round your answer to the nearest cent.) Net pay Payroll Period One Withholding Allowance Weekly Biweekly Semimonthly Monthly Quarterly Semiannually Annually Daily or miscellaneous (each day of the payroll period) $ 79.80 159.60 172.90 345.80 1,037.50 2,075.00 4,150.00 16.00 Po tohet rah TRY NE $123 - 35 111 LES Tot EES 5191 STAR IS ADLE SOVINTILY I MARE IL HR HEL VROUE 103.67 plus 37% $11,761 TABLE 2- BIWEEKLY Payroll Period (a) SINGLE person (ncluding head of household) (6) MARRIED person If the amount of wages if the amount of wages (alter subtracting The amount of income tax (after subtracting The amount of income tax withholding allowances) is: to withholdis: withholding allowances) lo to withhold is Not over $142 SO Not Over $444 $0 Over But not over of excess over Over But not over of excess over $142 -$509 $0.00 plus 10% $142 $444 $1,177 $0.00 plus 10% -$444 $509 $1,631 $35.70 plus 12% -$509 $1,177 $3,421 $73 30 plus 12% $1,177 $1.631 -$3,315 $171.34 plus 22% -$1.631 $3,421 $6,790 $342.58 plus 22% -$3.421 $3,315 $8.200 $541.82 plus 24% $3315 $8,790 -$12,560 $1.083.76 plus 24% $8,790 S6.200 -$7.835 $1.234 22 olus 32% $6.200 S12560 $15.829 $2.468.56 olus 32% $12.560 $7,835 $19.373 $1,757.42 plus 35% -S7.835 $16.829 -$23,521 $3,514.64 plus 35% -$15.829 $19,373 $5.795.72 plus 37% $19 373 $23.521 $6.206.84 plus 37% $23,521 TABLE 2-BIWEEKLY Payroll Period (a) SINGLE person (ncluding head of household) (5) MARRIED person If the amount of wages If the amount of wages (after subtracting The amount of income tax (after subtracting withholding allowances) to withholdis: withholding allowances) is Not Over $142 SO Not Over $444 Over But not over of excess overOver But not over $142 5509 50.00 plus 10% 5142 $444 $1,177 5509 $1.631 $30.70 plus 125 --5509 $1,177 $3,421 $1,631 $3,315 517134 plus 2295 $1.631 $3,421 $6.790 $3,315 55.200 $541.82 plus 24% -$3.315 50,790 $12.560 S6.200 S7 835 $1 234 22 olus 32% -$6.200 $12560 $15.829 SZ.835 $19.373 $1.757.42 plus 35% S7 835 $15.829 523,521 $19.373 5579572 plus 37% $19.373 $23.521 The amount of income tax to withhold is 30 of excess over $0.00 plus 10% $144 S73.30 plus 12% $1,177 $342.58 plus 224 $3.421 $1,083.76 plus 242 -S6,790 S2.468.56 olus 32 $12.560 $3.514.64 plus 35% $15.829 $6.20 84 plus 3715