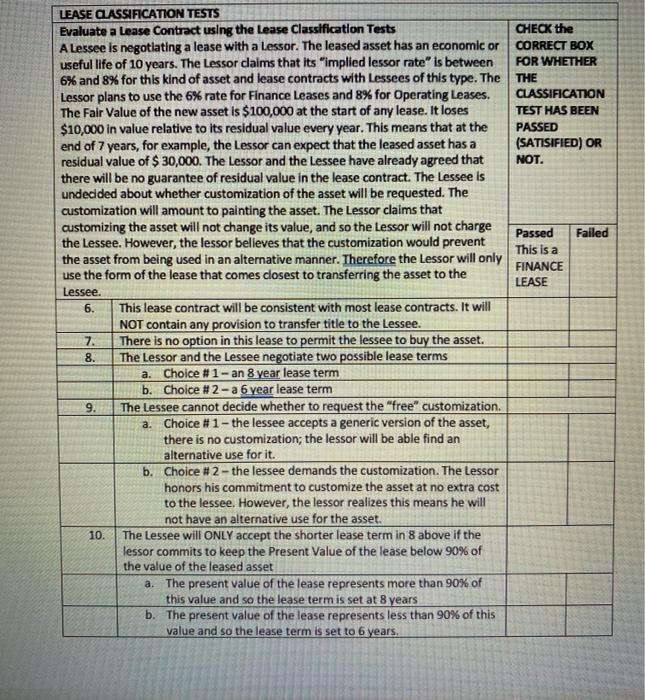

CHECK the CORRECT BOX FOR WHETHER THE CLASSIFICATION TEST HAS BEEN PASSED (SATISIFIED) OR NOT. Failed Passed This is a FINANCE LEASE LEASE CLASSIFICATION TESTS Evaluate a Lease Contract using the lease Classification Tests A Lessee is negotiating a lease with a Lessor. The leased asset has an economic or useful life of 10 years. The Lessor claims that its "implied lessor rate" is between 6% and 8% for this kind of asset and lease contracts with Lessees of this type. The Lessor plans to use the 6% rate for Finance Leases and 8% for Operating Leases. The Fair Value of the new asset is $100,000 at the start of any lease. It loses $10,000 in value relative to its residual value every year. This means that at the end of 7 years, for example, the Lessor can expect that the leased asset has a residual value of $ 30,000. The Lessor and the Lessee have already agreed that there will be no guarantee of residual value in the lease contract. The Lessee is undecided about whether customization of the asset will be requested. The customization will amount to painting the asset. The Lessor claims that customizing the asset will not change its value, and so the lessor will not charge the Lessee. However, the lessor believes that the customization would prevent the asset from being used in an alternative manner. Therefore the Lessor will only use the form of the lease that comes closest to transferring the asset to the Lessee. 6. This lease contract will be consistent with most lease contracts. It will NOT contain any provision to transfer title to the Lessee. 7. There is no option in this lease to permit the lessee to buy the asset. 8. The Lessor and the Lessee negotiate two possible lease terms a. Choice #1 - an 8 year lease term b. Choice #2-a 6 year lease term 9. The Lessee cannot decide whether to request the "free" customization. a. Choice #1 - the lessee accepts a generic version of the asset, there is no customization; the lessor will be able find an alternative use for it. b. Choice # 2 - the lessee demands the customization. The Lessor honors his commitment to customize the asset at no extra cost to the lessee. However, the lessor realizes this means he will not have an alternative use for the asset. 10. The Lessee will ONLY accept the shorter lease term in 8 above if the lessor commits to keep the Present Value of the lease below 90% of the value of the leased asset a. The present value of the lease represents more than 90% of this value and so the lease term is set at 8 years b. The present value of the lease represents less than 90% of this value and so the lease term is set to 6 years. CHECK the CORRECT BOX FOR WHETHER THE CLASSIFICATION TEST HAS BEEN PASSED (SATISIFIED) OR NOT. Failed Passed This is a FINANCE LEASE LEASE CLASSIFICATION TESTS Evaluate a Lease Contract using the lease Classification Tests A Lessee is negotiating a lease with a Lessor. The leased asset has an economic or useful life of 10 years. The Lessor claims that its "implied lessor rate" is between 6% and 8% for this kind of asset and lease contracts with Lessees of this type. The Lessor plans to use the 6% rate for Finance Leases and 8% for Operating Leases. The Fair Value of the new asset is $100,000 at the start of any lease. It loses $10,000 in value relative to its residual value every year. This means that at the end of 7 years, for example, the Lessor can expect that the leased asset has a residual value of $ 30,000. The Lessor and the Lessee have already agreed that there will be no guarantee of residual value in the lease contract. The Lessee is undecided about whether customization of the asset will be requested. The customization will amount to painting the asset. The Lessor claims that customizing the asset will not change its value, and so the lessor will not charge the Lessee. However, the lessor believes that the customization would prevent the asset from being used in an alternative manner. Therefore the Lessor will only use the form of the lease that comes closest to transferring the asset to the Lessee. 6. This lease contract will be consistent with most lease contracts. It will NOT contain any provision to transfer title to the Lessee. 7. There is no option in this lease to permit the lessee to buy the asset. 8. The Lessor and the Lessee negotiate two possible lease terms a. Choice #1 - an 8 year lease term b. Choice #2-a 6 year lease term 9. The Lessee cannot decide whether to request the "free" customization. a. Choice #1 - the lessee accepts a generic version of the asset, there is no customization; the lessor will be able find an alternative use for it. b. Choice # 2 - the lessee demands the customization. The Lessor honors his commitment to customize the asset at no extra cost to the lessee. However, the lessor realizes this means he will not have an alternative use for the asset. 10. The Lessee will ONLY accept the shorter lease term in 8 above if the lessor commits to keep the Present Value of the lease below 90% of the value of the leased asset a. The present value of the lease represents more than 90% of this value and so the lease term is set at 8 years b. The present value of the lease represents less than 90% of this value and so the lease term is set to 6 years