Answered step by step

Verified Expert Solution

Question

1 Approved Answer

check-cashing store is in the business of making personal loans to walk-up customers. ne store makes only one-week loans at 7 percent interest per week.

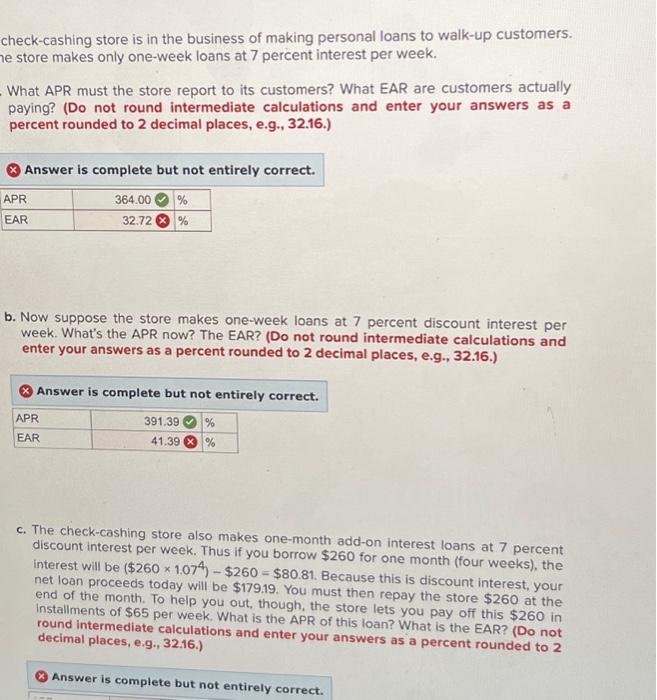

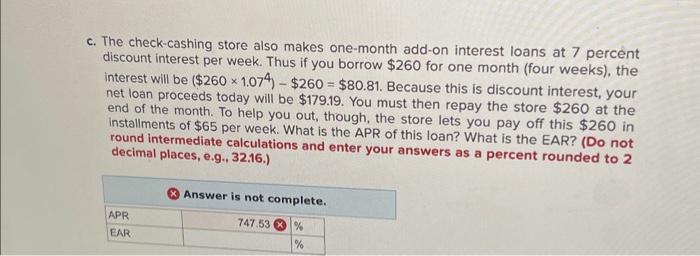

check-cashing store is in the business of making personal loans to walk-up customers. ne store makes only one-week loans at 7 percent interest per week. - What APR must the store report to its customers? What EAR are customers actually paying? (Do not round intermediate calculations and enter your answers as a percent rounded to 2 decimal places, e.g., 32.16.) Answer is complete but not entirely correct. APR EAR 364.00 % 32.72 X % b. Now suppose the store makes one-week loans at 7 percent discount interest per week. What's the APR now? The EAR? (Do not round intermediate calculations and enter your answers as a percent rounded to 2 decimal places, e.g., 32.16.) APR EAR Answer is complete but not entirely correct. 391.39 % 41.39 X % c. The check-cashing store also makes one-month add-on interest loans at 7 percent discount interest per week. Thus if you borrow $260 for one month (four weeks), the interest will be ($260 x 1.074) - $260 = $80.81. Because this is discount interest, your net loan proceeds today will be $179.19. You must then repay the store $260 at the end of the month. To help you out, though, the store lets you pay off this $260 in installments of $65 per week. What is the APR of this loan? What is the EAR? (Do not round intermediate calculations and enter your answers as a percent rounded to 2 decimal places, e.g., 32.16.)

Step by Step Solution

There are 3 Steps involved in it

Step: 1

Get Instant Access to Expert-Tailored Solutions

See step-by-step solutions with expert insights and AI powered tools for academic success

Step: 2

Step: 3

Ace Your Homework with AI

Get the answers you need in no time with our AI-driven, step-by-step assistance

Get Started