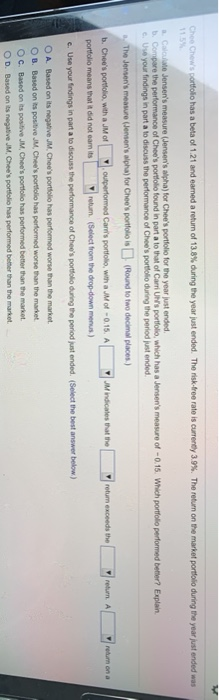

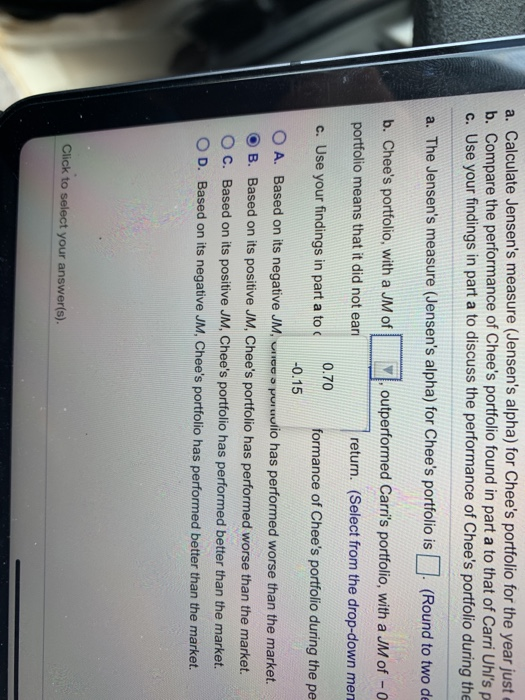

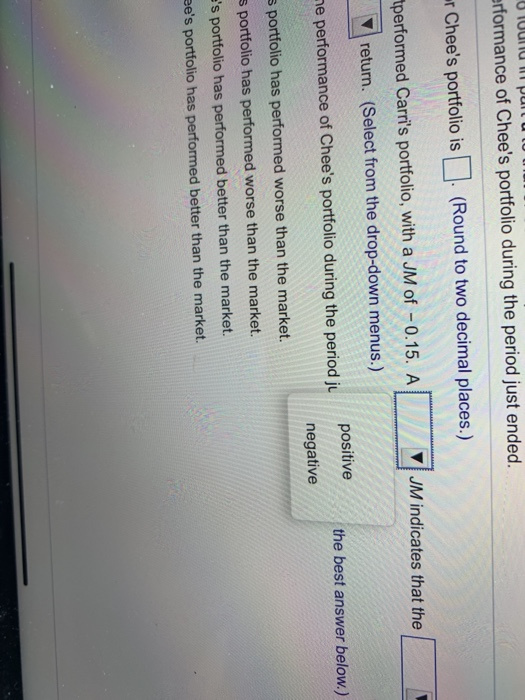

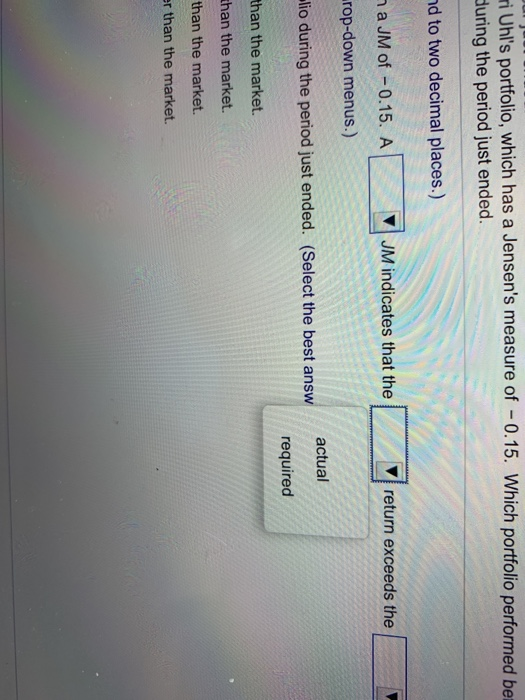

Chee Chew's portfolio has a beta of 1.21 and earned a return of 13.8% during the year just ended. The risk-free rate is currently 3.9%. The return on the market portfolio during the year just ended was Calculate Jensen's measure (Jensen's alpha) for Chee's portfolio for the year just ended 1. Compare the performance of Chee's portfolio found in part a to that of Carri's portfolio, which has a Jensen's measure of -0.15. Which portfolio performed better? Explain c. Use your findings in part a to discuss the performance of Chee's portfolio during the period just ended. The Jenner's measure (Jemen's alpha) for Chee's portfolio is (Round to two decimal places) b. Chee's portfolio with a JM of outperformed Carri's portfolio with a JM of -0.15. A JM indicates that the retum exceeds the return. A portfolio means that it did not eam its return (Select from the drop-down menus) c. Use your findings in part to discuss the performance of Chee's portfolio during the period just ended. (Select the best answer below) return on a O A Based on its negative JM. Chee's portfolio has performed worse than the market OB. Based on its positive JM, Chee's portfolio has performed worse than the market OC. Based on its positive JM, Chee's portfolio has performed better than the market. OD. Based on its negative JM, Chee's portfolio has performed better than the market a. Calculate Jensen's measure (Jensen's alpha) for Chee's portfolio for the year just b. Compare the performance of Chee's portfolio found in part a to that of Carri Uhl's p c. Use your findings in part a to discuss the performance of Chee's portfolio during the a. The Jensen's measure (Jensen's alpha) for Chee's portfolio is (Round to two de b. Chee's portfolio, with a JM of outperformed Carri's portfolio, with a JM of - 0 portfolio means that it did not eari return. (Select from the drop-down men 0.70 c. Use your findings in part a to formance of Chee's portfolio during the pe -0.15 O A. Based on its negative JM, une o pruutio has performed worse than the market. B. Based on its positive JM, Chee's portfolio has performed worse than the market. O C. Based on its positive JM, Chee's portfolio has performed better than the market. OD. Based on its negative JM, Chee's portfolio has performed better than the market. Click to select your answer(s). U IUUIU I puru erformance of Chee's portfolio during the period just ended. - Chee's portfolio is . (Round to two decimal places.) JM indicates that the tperformed Carri's portfolio, with a JM of - 0.15. A return. (Select from the drop-down menus.) positive the best answer below.) ne performance of Chee's portfolio during the period ju negative portfolio has performed worse than the market. 5 portfolio has performed worse than the market. e's portfolio has performed better than the market. ee's portfolio has performed better than the market. ti Uhl's portfolio, which has a Jensen's measure of -0.15. Which portfolio performed be during the period just ended. nd to two decimal places.) na JM of -0.15. A JM indicates that the return exceeds the rop-down menus.) actual lio during the period just ended. (Select the best answ required than the market. than the market. than the market. er than the market. return exceeds the return. A return on a actual -W.) required ? e return on the Which portfolio performed better? Explain. return on a return. A return exceeds the positive negative below.)