Answered step by step

Verified Expert Solution

Question

1 Approved Answer

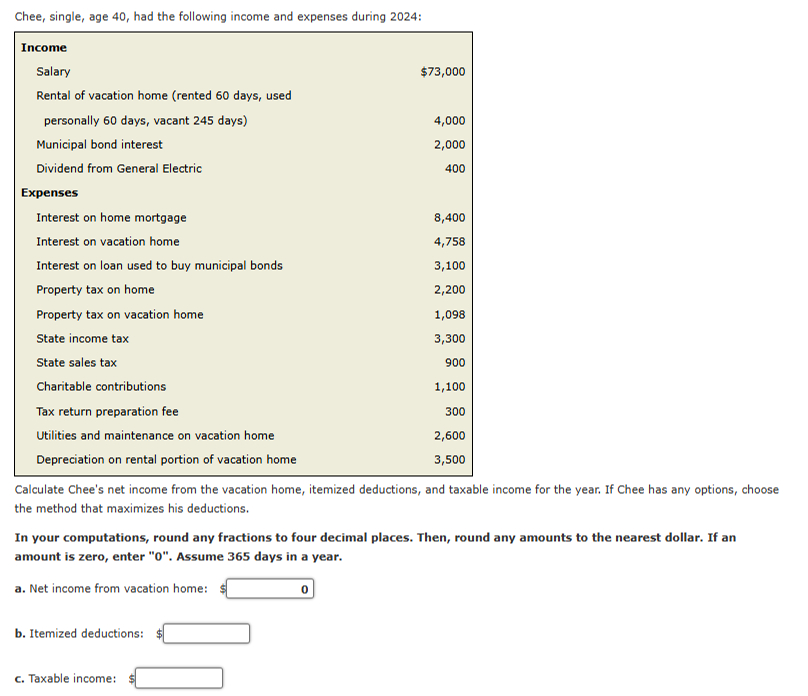

Chee, single, age 4 0 , had the following income and expenses during 2 0 2 4 : Calculate Chee's net income from the vacation

Chee, single, age had the following income and expenses during :

Calculate Chee's net income from the vacation home, itemized deductions, and taxable income for the year. If Chee has any options, choose

the method that maximizes his deductions.

In your computations, round any fractions to four decimal places. Then, round any amounts to the nearest dollar. If an

amount is zero, enter Assume days in a year.

a Net income from vacation home: $

b Itemized deductions: $

c Taxable income: &

Step by Step Solution

There are 3 Steps involved in it

Step: 1

Get Instant Access to Expert-Tailored Solutions

See step-by-step solutions with expert insights and AI powered tools for academic success

Step: 2

Step: 3

Ace Your Homework with AI

Get the answers you need in no time with our AI-driven, step-by-step assistance

Get Started