Answered step by step

Verified Expert Solution

Question

1 Approved Answer

chegg guidelines says you can answer a total of 4 questions. Please help with these questions. (Discounted payback period) The Callaway Cattle Company is considering

chegg guidelines says you can answer a total of 4 questions. Please help with these questions.

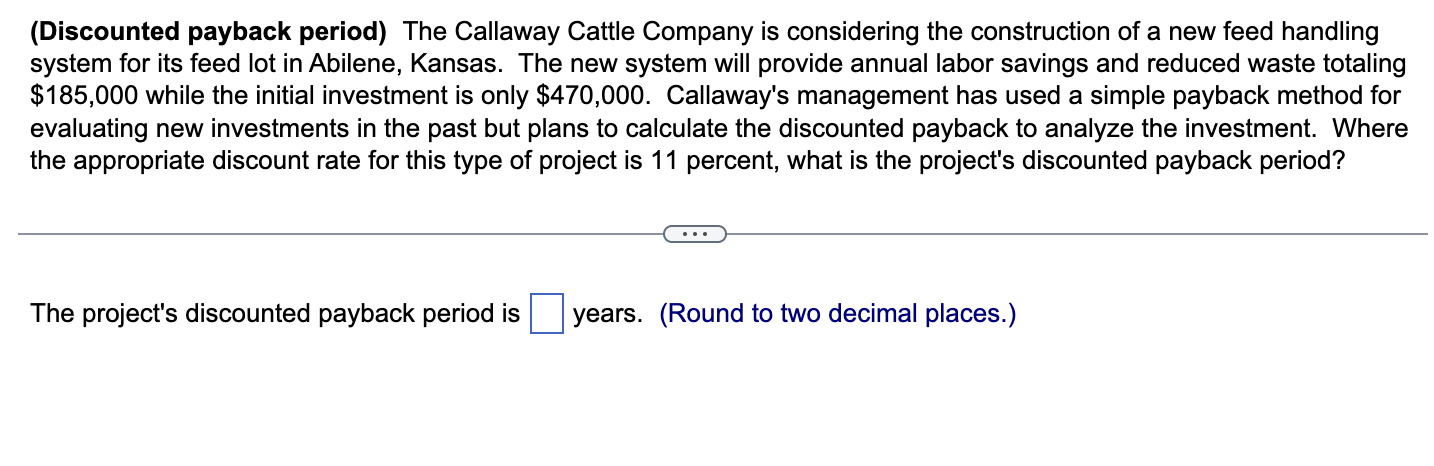

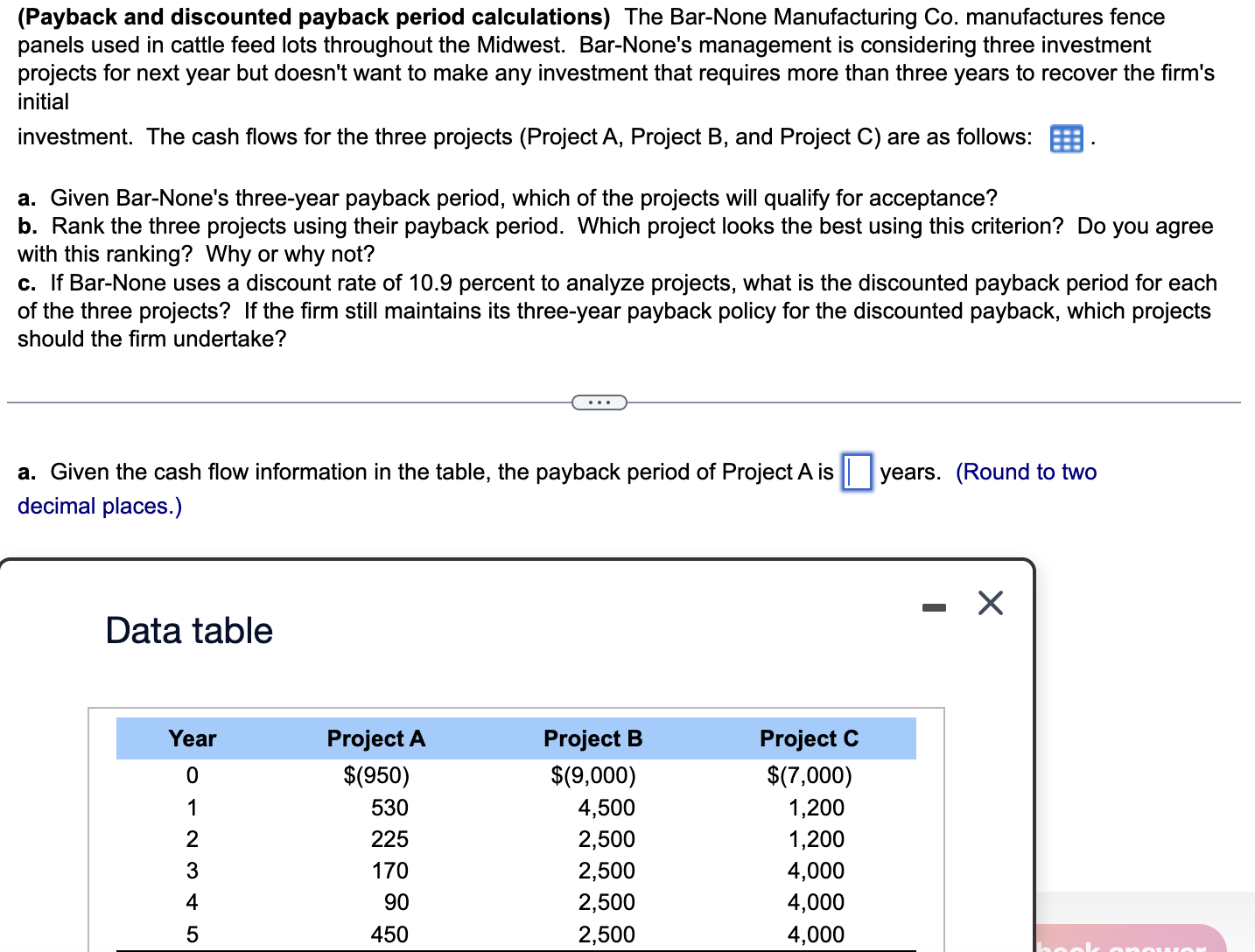

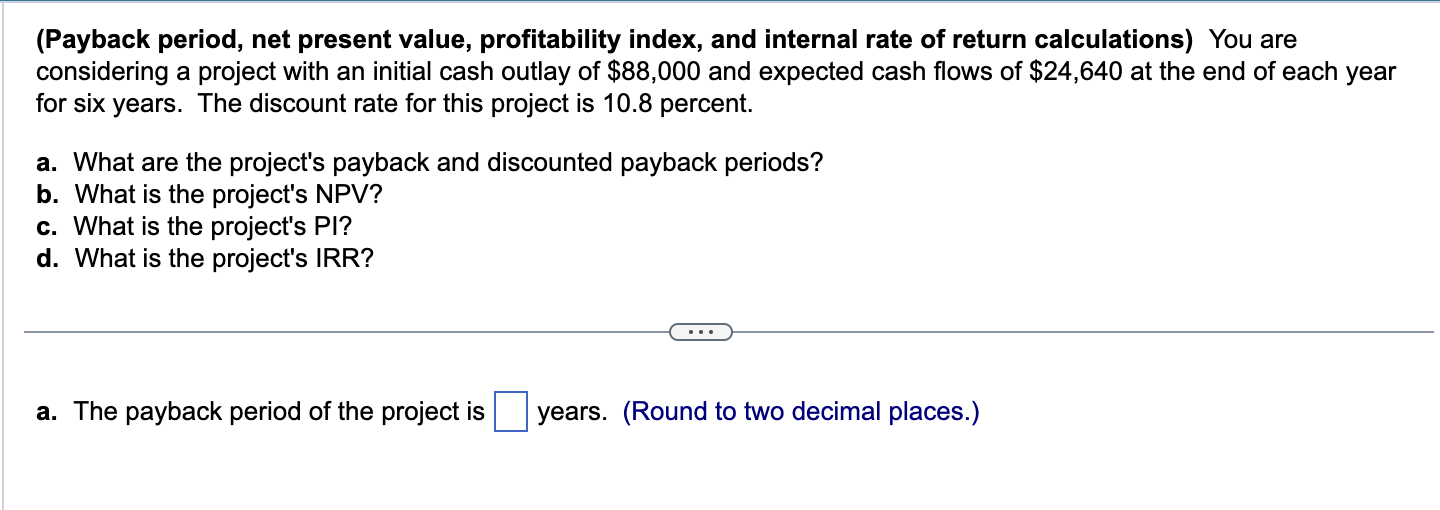

(Discounted payback period) The Callaway Cattle Company is considering the construction of a new feed handling system for its feed lot in Abilene, Kansas. The new system will provide annual labor savings and reduced waste totaling $185,000 while the initial investment is only $470,000. Callaway's management has used a simple payback method for evaluating new investments in the past but plans to calculate the discounted payback to analyze the investment. Where the appropriate discount rate for this type of project is 11 percent, what is the project's discounted payback period? The project's discounted payback period is years. (Round to two decimal places.) (Payback and discounted payback period calculations) The Bar-None Manufacturing Co. manufactures fence panels used in cattle feed lots throughout the Midwest. Bar-None's management is considering three investment projects for next year but doesn't want to make any investment that requires more than three years to recover the firm's initial investment. The cash flows for the three projects (Project A, Project B, and Project C) are as follows: a. Given Bar-None's three-year payback period, which of the projects will qualify for acceptance? b. Rank the three projects using their payback period. Which project looks the best using this criterion? Do you agree with this ranking? Why or why not? c. If Bar-None uses a discount rate of 10.9 percent to analyze projects, what is the discounted payback period for each of the three projects? If the firm still maintains its three-year payback policy for the discounted payback, which projects should the firm undertake? a. Given the cash flow information in the table, the payback period of Project A is years. (Round to two decimal places.) Data table (Payback period and NPV calculations) Plato Energy is an oil and gas exploration and development company located in Farmington, New Mexico. The company drills shallow wells in hopes of finding significant oil and gas deposits. The firm is considering two different drilling opportunities that have very different production potentials. The first is in the Barnett Shale region of central Texas and the other is in the Gulf Coast. The Barnett Shale project requires a much larger initial investment but provides cash flows (if successful) over a much longer period of time than the Gulf Coast opportunity. In addition, the longer life of the Barnett Shale project also results in additional expenditures in year 3 of the project to enhance production throughout the project's 10-year expected life. This expenditure involves pumping either water or CO2 down into the wells in order to increase the flow of oil and gas from the structure. The expected cash flows for the two projects are as follows: a. What is the payback period for each of the two projects? b. Based on the payback periods, which of the two projects appears to be the best alternative? What are the limitations of the payback period ranking? That is, what does the payback period not consider that is important in determining the Data table ears. (Round to (Payback period, net present value, profitability index, and internal rate of return calculations) You are considering a project with an initial cash outlay of $88,000 and expected cash flows of $24,640 at the end of each year for six years. The discount rate for this project is 10.8 percent. a. What are the project's payback and discounted payback periods? b. What is the project's NPV? c. What is the project's PI? d. What is the project's IRR? a. The payback period of the project is years. (Round to two decimal places.)

Step by Step Solution

There are 3 Steps involved in it

Step: 1

Get Instant Access to Expert-Tailored Solutions

See step-by-step solutions with expert insights and AI powered tools for academic success

Step: 2

Step: 3

Ace Your Homework with AI

Get the answers you need in no time with our AI-driven, step-by-step assistance

Get Started