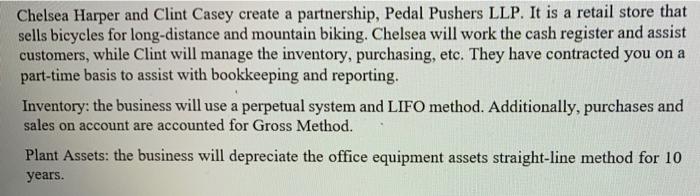

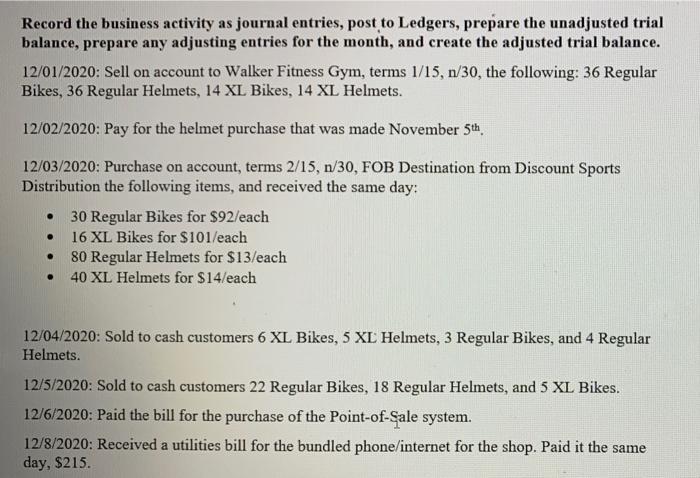

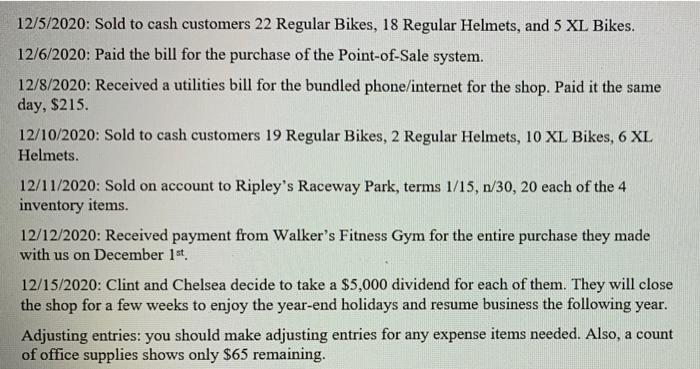

Chelsea Harper and Clint Casey create a partnership, Pedal Pushers LLP. It is a retail store that sells bicycles for long-distance and mountain biking. Chelsea will work the cash register and assist customers, while Clint will manage the inventory, purchasing, etc. They have contracted you on a part-time basis to assist with bookkeeping and reporting. Inventory: the business will use a perpetual system and LIFO method. Additionally, purchases and sales on account are accounted for Gross Method. Plant Assets: the business will depreciate the office equipment assets straight-line method for 10 years. Record the business activity as journal entries, post to Ledgers, prepare the unadjusted trial balance, prepare any adjusting entries for the month, and create the adjusted trial balance. 12/01/2020: Sell on account to Walker Fitness Gym, terms 1/15, n/30, the following: 36 Regular Bikes, 36 Regular Helmets, 14 XL Bikes, 14 XL Helmets. 12/02/2020: Pay for the helmet purchase that was made November 5th. 12/03/2020: Purchase on account, terms 2/15, n/30, FOB Destination from Discount Sports Distribution the following items, and received the same day: 30 Regular Bikes for $92/each 16 XL Bikes for $101/each 80 Regular Helmets for $13/each 40 XL Helmets for $14/each . . 12/04/2020: Sold to cash customers 6 XL Bikes, 5 XL Helmets, 3 Regular Bikes, and 4 Regular Helmets. 12/5/2020: Sold to cash customers 22 Regular Bikes, 18 Regular Helmets, and 5 XL Bikes. 12/6/2020: Paid the bill for the purchase of the Point-of-Sale system. 12/8/2020: Received a utilities bill for the bundled phone/internet for the shop. Paid it the same day, $215. 12/5/2020: Sold to cash customers 22 Regular Bikes, 18 Regular Helmets, and 5 XL Bikes. 12/6/2020: Paid the bill for the purchase of the Point-of-Sale system. 12/8/2020: Received a utilities bill for the bundled phone/internet for the shop. Paid it the same day, $215. 12/10/2020: Sold to cash customers 19 Regular Bikes, 2 Regular Helmets, 10 XL Bikes, 6 XL Helmets. 12/11/2020: Sold on account to Ripley's Raceway Park, terms 1/15, n/30, 20 each of the 4 inventory items. 12/12/2020: Received payment from Walker's Fitness Gym for the entire purchase they made with us on December 1st. 12/15/2020: Clint and Chelsea decide to take a $5,000 dividend for each of them. They will close the shop for a few weeks to enjoy the year-end holidays and resume business the following year. Adjusting entries: you should make adjusting entries for any expense items needed. Also, a count of office supplies shows only $65 remaining. Chelsea Harper and Clint Casey create a partnership, Pedal Pushers LLP. It is a retail store that sells bicycles for long-distance and mountain biking. Chelsea will work the cash register and assist customers, while Clint will manage the inventory, purchasing, etc. They have contracted you on a part-time basis to assist with bookkeeping and reporting. Inventory: the business will use a perpetual system and LIFO method. Additionally, purchases and sales on account are accounted for Gross Method. Plant Assets: the business will depreciate the office equipment assets straight-line method for 10 years. Record the business activity as journal entries, post to Ledgers, prepare the unadjusted trial balance, prepare any adjusting entries for the month, and create the adjusted trial balance. 12/01/2020: Sell on account to Walker Fitness Gym, terms 1/15, n/30, the following: 36 Regular Bikes, 36 Regular Helmets, 14 XL Bikes, 14 XL Helmets. 12/02/2020: Pay for the helmet purchase that was made November 5th. 12/03/2020: Purchase on account, terms 2/15, n/30, FOB Destination from Discount Sports Distribution the following items, and received the same day: 30 Regular Bikes for $92/each 16 XL Bikes for $101/each 80 Regular Helmets for $13/each 40 XL Helmets for $14/each . . 12/04/2020: Sold to cash customers 6 XL Bikes, 5 XL Helmets, 3 Regular Bikes, and 4 Regular Helmets. 12/5/2020: Sold to cash customers 22 Regular Bikes, 18 Regular Helmets, and 5 XL Bikes. 12/6/2020: Paid the bill for the purchase of the Point-of-Sale system. 12/8/2020: Received a utilities bill for the bundled phone/internet for the shop. Paid it the same day, $215. 12/5/2020: Sold to cash customers 22 Regular Bikes, 18 Regular Helmets, and 5 XL Bikes. 12/6/2020: Paid the bill for the purchase of the Point-of-Sale system. 12/8/2020: Received a utilities bill for the bundled phone/internet for the shop. Paid it the same day, $215. 12/10/2020: Sold to cash customers 19 Regular Bikes, 2 Regular Helmets, 10 XL Bikes, 6 XL Helmets. 12/11/2020: Sold on account to Ripley's Raceway Park, terms 1/15, n/30, 20 each of the 4 inventory items. 12/12/2020: Received payment from Walker's Fitness Gym for the entire purchase they made with us on December 1st. 12/15/2020: Clint and Chelsea decide to take a $5,000 dividend for each of them. They will close the shop for a few weeks to enjoy the year-end holidays and resume business the following year. Adjusting entries: you should make adjusting entries for any expense items needed. Also, a count of office supplies shows only $65 remaining