Question

Chemical Cleanup Corp. (CCC) engaged Charles, CPA, to audit its financial statements for the year ended July 31, Year 1 in accordance with Government Auditing

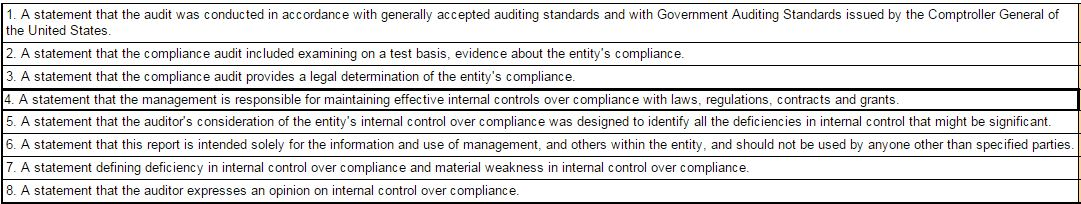

Chemical Cleanup Corp. (CCC) engaged Charles, CPA, to audit its financial statements for the year ended July 31, Year 1 in accordance with Government Auditing Standards. CCC is a not-for-profit organization that receives grants and fees from various state and municipal governments, as well as grants from several federal government agencies. The auditors' reports are to be submitted by CCC to the granting government agencies, which make the reports available for public inspection. Charles asked a staff accountant to draft a combined report on compliance and internal control over compliance reporting. This combined report, which contained the statements included in the table below, was submitted to the engagement partner for review. The partner reviewed matters thoroughly and properly concluded no material instances of noncompliance were identified and an unmodified opinion would be rendered. For each of the statements listed below, identify whether it is appropriate or inappropriate by double-clicking on the shaded cell and selecting the appropriate response.

Step by Step Solution

There are 3 Steps involved in it

Step: 1

Get Instant Access to Expert-Tailored Solutions

See step-by-step solutions with expert insights and AI powered tools for academic success

Step: 2

Step: 3

Ace Your Homework with AI

Get the answers you need in no time with our AI-driven, step-by-step assistance

Get Started